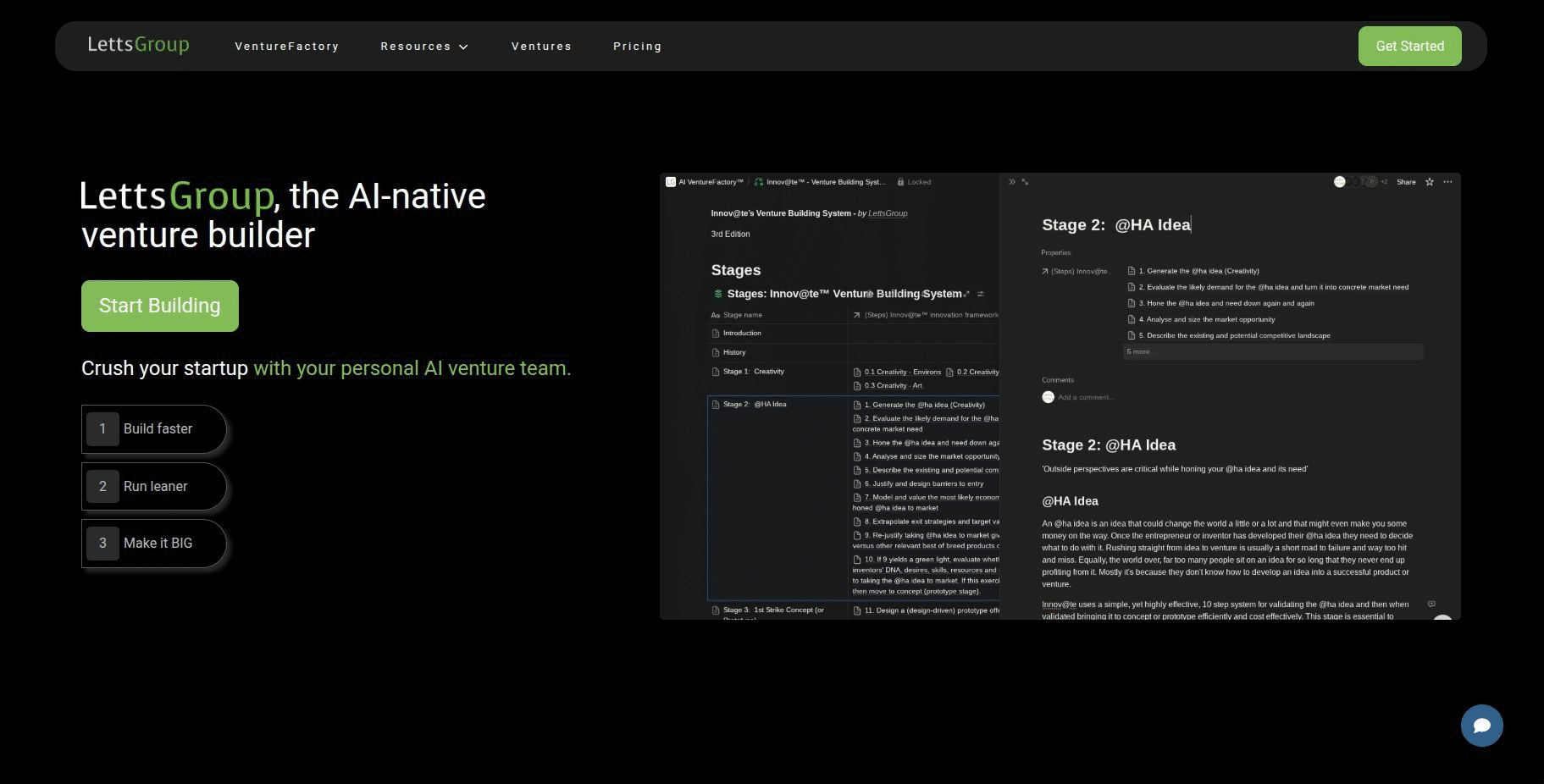

Fast forward a few years: what might the venture ecosystem look like if AI-driven venture building becomes the norm? One compelling vision is that venture capital evolves from a financial industry into a platform-enabled industry utilising platforms like LettsGroup's AI VentureFactory . Further, instead of just funds competing to invest in startups, we could see integrated venture platforms that combine funding, tools, and talent in a single unified system. In effect, venture building could itself operate like a software platform – with startups as “users” who plug in to get everything they need to build a company.

LettsGroup hints at this future. It suggests a model where the process of venture creation and the provision of capital are fused in some way - something more akin to a venture factory that has attached capital pools . Entrepreneurs might engage with this platform not by pitching in a one-off transaction, but by entering into a program or ecosystem.

Imagine a platform where an entrepreneur with an idea signs up, and the platform (through AI) helps refine the idea, provides the initial funding as credit, supplies all necessary software infrastructure (perhaps cloud credits, AI tools, etc.), helps build the startup with AI outputs for each step in the venture building process, matches the entrepreneur with mentors or team members from a network, and basically shepherds the venture from inception to growth.

Such a platform might take some equity as a blended form of payment, some might even consider a revenue share. It’s like AWS + Y Combinator + an AI advisor/team + a VC fund all rolled into one, available on-demand. This could drastically lower barriers to entry globally, as access to venture building expertise and capital would no longer be limited by personal networks or geography – anyone plugged into the platform could benefit.

From the perspective of venture capital firms, those that successfully transform to utilising platforms like LettsGroup's AI VentureFactory (which has just added a new 'Investor Dashboard') will likely have a competitive edge. For example, a founder might prefer to work with a firm that offers a proven venture-building platform with, say, a 2x higher success rate, over more traditional VC style approaches that just give money but no support. This could lead to a consolidation where a few top venture platforms attract the best founders, akin to how a few cloud computing platforms dominate their space. It’s possible we see the rise of a “Startup Operating System” provided by a private company (or consortium) that many startups use, analogous to how many businesses use cloud services today.

Another aspect of the future could be contract venture building for others . LettsGroup speculated that mature venture factories could become contract manufacturers for venture ideas from large corporations or funds, similar to Foxconn building products for Apple. Taking that further, venture capital itself could outsource some of its venture creation to such contract venture factories. For instance, a pension fund that wants exposure to tech startups could simply commission a venture factory to build and scale a set number of companies in certain domains, rather than picking existing startups to invest in. This flips the venture model: instead of investing in entrepreneurs who come to you, you as an investor decide what you want (perhaps via market analysis) and then build it with the help of a venture platform. This approach might especially appeal to corporate venture arms or large pools of capital seeking predictable innovation for their needs. It’s somewhat analogous to how the semiconductor industry evolved – initially, integrated companies did everything, but later you had fabless companies that design chips and contract foundries that manufacture them. We could see “fabless” VCs (who have ideas and capital) and “foundry” venture factories (who build the ventures).

Such a platform-driven ecosystem could also globalise venture building beyond the major hubs like Silicon Valley. If the platform is accessible anywhere, talent from around the world could create startups using it, tapping local knowledge with global support. This might unlock innovation in regions that historically lacked access to venture expertise or capital. We might see specialised venture platforms focusing on different regions or sectors, all connected in networks.

The role of people in AI venture building platforms will also evolve. We will still need visionary entrepreneurs – AI can assist, but it doesn’t replace human creativity and leadership (at least not for the foreseeable future). We will also need experienced mentors and industry experts to guide startups (though AI might handle a chunk of the advice, human judgement remains key for nuanced decisions). However, these people might be engaged in a more flexible way. The LettsGroup model mentions an “expanding network of experienced venture leaders who each contribute to multiple ventures” in their ecosystem. This hints at a gig-economy or fractional involvement model: an expert could be overseeing strategy for 3 ventures at once via the platform tools, something that’s feasible if those ventures run systematically. The platform orchestrates contributions so that expertise is shared efficiently. This collective model leverages scarce talent (like seasoned startup execs) across many companies without each startup needing to hire them full-time.

The power dynamics in such a future platform-centric ecosystem likely shifts more in favour of founders (or founding teams) and the platform operators, and a bit away from traditional VCs. If entrepreneurs have direct access to what they need, the competitive advantage of having venture connections declines. However, platform operators (which might be evolved VC firms or new entities) become extremely influential. They might even fund companies off their own balance sheet or via new mechanisms like tokens if blockchain is involved.

We may also see blurring of public and private markets . If venture creation becomes more repeatable, investors like private equity or even public market investors might want in at earlier stages through these platforms. Conversely, some startups might never need to go public if they achieve profitability quickly with a lean model – or they might get acquired by the platform itself if it makes sense.

From the founder’s perspective, the future might involve choosing which venture platform to join similar to how one chooses which accelerator or incubator to join today – but with bigger consequences. Joining a platform could commit you to certain approaches (which can be good if they work). It might also come with standardised terms (maybe less negotiation of custom equity deals since platform deals could be cookie-cutter). Ideally, if multiple platforms exist, competition among them will keep terms fair and service quality high.

It’s also plausible that big tech companies become part of this story. For instance, Amazon or Microsoft could partner with leading venture building platforms to enhance their startup programs to embrace more full-fledged venture platforms (they already give cloud credits and some support; they could in theory expand into providing funding and offering systematic guidance via LettsGroup's AI VentureFactory for example, especially if it drives usage of their ecosystem).

On the flip side, there are risks and challenges in this future. Will such heavy systematisation limit creativity? It’s important that venture platforms don’t become overly formulaic, lest they churn out cookie-cutter companies that lack true innovation. Platforms must allow flexibility and pivots – presumably the AI will learn to incorporate creative divergences when needed. LettsGroup talks about the critical; importance of AI-driven infrastructure and operations to free up time for creativity and enhance success.

Another challenge is mentorship and intuition – can AI fully replicate the mentorship a human VC or experienced entrepreneur provides? Likely not 100%, but it can augment it. The human element will remain, but possibly scaled via AI (e.g., one great mentor can impart knowledge via an AI that many startups benefit from).

In summary, the future of venture building as a platform could mean:

Ultimately, these changes aim to do what technology and process improvements always do: increase efficiency and output. In this case, the output is successful ventures, and efficiency means using less capital and time to get there. If pioneering firms like LettsGroup and Steel Perlot are indicators, we are moving toward a world where creating a startup is not a shot in the dark but a guided endeavour. Tomorrow's entrepreneur might say “I built my company on Platform X,” much like today one might say “I built my app on AWS.” And tomorrow’s investor might be as much a venture building platform user or partner as a stock picker.

As LettsGroup’s analysis puts it, this would be a fundamental restructuring of the power dynamics – shifting more control and value to innovative founders and the platforms that enable them, rather than traditional capital gatekeepers. The hope is that this democratises innovation and reduces wasted potential (all those failed startups that could have succeeded with better support). In the ideal future, venture building becomes accessible, data-driven, and successful on a scale never before seen – a true global innovation factory.

The next section of our guide to New Style Venture Building is 'Final Thoughts & Takeaways' - coming soon.

If you're a tech or digital startup founder, build faster, run leaner and make it BIG with LettsGroup's AI VentureFactory .