Many startups start with a Friends and Family (F&F) round – the initial capital from people who personally know and believe in the founders. This is often the first outside money a startup ever gets, bridging the gap between bootstrapping and bringing in professional investors. Done right, an F&F round can provide not just money but also emotional support; done poorly, it can strain relationships. Here’s how to navigate it:

What is an F&F Round? It’s a small financing round from your personal network – literally friends, family, former classmates or colleagues, even friendly ex-bosses. People that are more likely to be on your Whatsapp and Insta than your Linkedin. Startups powered by LettsGroup's AI VentureFactory gain access to angels, early stage funds and angel networks. Typically, a friends & family round brings in anywhere from a few thousand up to around $100K–$150K (≈ £10K–£120K) total, though in some cases it can be more (especially if there’s a wealthy connection). This money is usually used to build the first prototype, conduct research, or simply keep the lights on for the first few months of operation. Often, this is considered “pre-seed” funding (or even pre-pre-seed) – getting you to a stage where angel or seed investors would consider you.

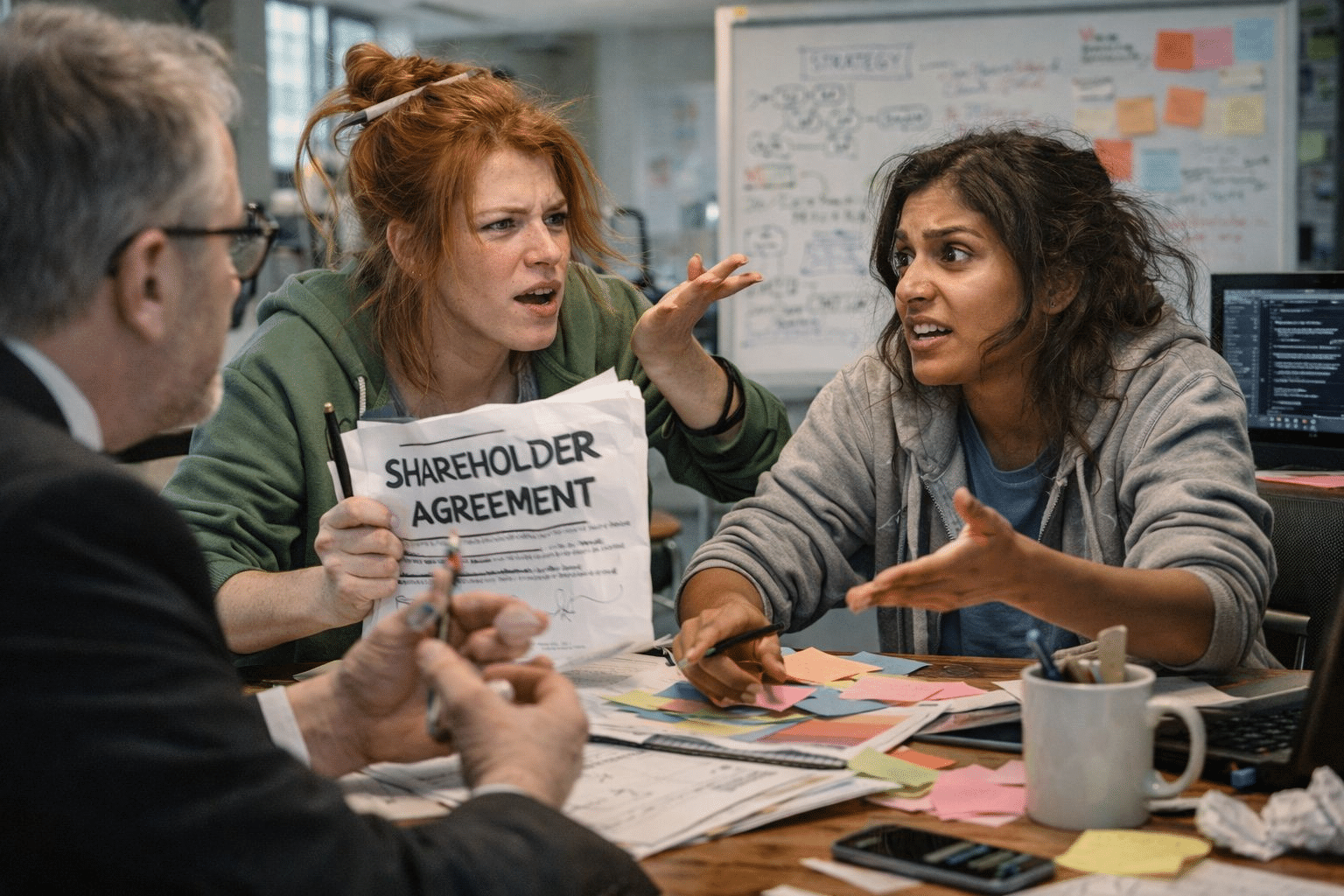

Treat It Professionally: Even though these investors are people you know informally, handle the process with full professionalism. That means paperwork, transparency, and clear communication. It may feel awkward to put family money on legal documents, but it’s for everyone’s benefit. Clearly explain that investing in a startup is highly risky – >90% of startups fail, and they could lose every penny. In fact, put that in writing and have them acknowledge it. This manages expectations and protects relationships (no one should be betting their life savings on your idea unless they fully understand the risk). As Founder Institute advises, project an aura of professionalism and educate your F&F investors about the risks, to avoid future hard feelings.

Choose a Funding Mechanism: Decide how you’ll structure the F&F money:

Gifts: Simply accepting money as a gift (no repayment, no equity). If someone insists it’s a gift and doesn’t want anything in return, still put that in writing – a simple letter saying “This £X is a gift to the company, with no expectation of ownership or repayment.” This avoids misunderstandings (e.g. a relative later claiming it was a loan).

Loans: A loan from family that you promise to pay back (with or without interest). This can be simpler than equity, but remember a loan adds debt to your company (which future investors might ask to be cleared or converted). If you do loans, use a basic promissory note template and include interest rate (if any), repayment terms (often only repay if company has cash or after certain time), etc. Some founders use convertible notes that start as a loan but convert to equity in the next round – more on that below.

Equity: Giving them a stake in your company in exchange for cash. This is tricky at the earliest stage because, as noted, valuing the company is very difficult and arguably “make-believe” at this point. If you can avoid formally setting a price (valuation) with family, do so. Selling, say, 10% of your company to Uncle Bob for £10K implies your company is only worth £100K – that could really hamstring you when later investors value you at £1M+ and Uncle Bob’s stake either dilutes heavily or your cap table looks off-balance. A common approach is to use a Convertible Note or SAFE for friends & family: this way they are effectively investing now but will get equity later once a professional round prices the company. You might include a valuation cap on the note/SAFE that’s somewhat generous (to reward them for early risk), but not a formal valuation today. For example, issue a SAFE with a £1M or £2M cap (depending on how early it is) and perhaps no discount (or a small discount) – this means if your seed round is priced at £4M, their money converts at the £2M cap (so effectively they doubled on paper), but if things go poorly and you only raise at £1M, they convert at that. This way, you avoid the “my startup is worth £X now” conversation with family while still giving them a fair deal.

Convertible instruments are highly recommended at this stage. They are simpler (no need for immediate valuation negotiation or heavy legal), and they avoid cluttering your cap table with many small shareholders early on. In the US, the Y Combinator SAFE is popular; in the UK, SeedFAST or Advanced Subscription Agreements (ASAs) are used (often via SeedLegals). These are SEIS/EIS compatible as well. If equity must be given (say an uncle really wants shares), keep the round small (<15% total) and involve a lawyer to draft a straightforward shareholders agreement. Ensure any equity given doesn’t come with special rights that could deter future investors. LettsGroup has various AI-powered tools and apps to get you investor ready and manage your cap table and rounds.

Don’t Over-Dilute or Over-Promise: A big mistake is giving away huge chunks of your company in a F&F due to feeling grateful. Yes, they are helping you, but you and your co-founders are doing the work. It’s your sweat and vision that will drive the company’s value. So it’s okay to accept money on reasonable terms. Typically, friends & family collectively might end up owning 5-10% of the company post-round (sometimes up to 15% if a bigger F&F round) – not 50%. Maintain control and the majority of equity for the team who will attract future investors. Also be very careful about promising jobs or roles to investors (e.g. your cousin gives money and expects to be “CFO”). Unless they truly are qualified and it’s part of the plan, keep investment and roles separate to avoid complications.

Keep Things Simple and Documented: Whichever route you choose, get the agreements in writing. There are plenty of templates for SAFE notes, simple loan agreements, or stock subscription agreements for F&F rounds. After receiving funds, issue a simple update to those investors every few months. They’ll appreciate being kept in the loop (and it trains you in investor communication). If things aren’t going well, don’t hide it – it’s better they know you’re pivoting or struggling than be left in the dark.

Maintain Relationships: These early believers are special, they backed you when nobody else would. Treat them with gratitude and honesty. If you succeed, they’ll not only (hopefully) make a nice return, but also share pride in your journey. If you fail, having been transparent will retain their respect. And never take money from someone who can’t afford to lose it – even if they beg. Protect your loved ones and friends: insist they invest only a small portion of their savings. As one guide says, make the risk exceedingly clear so no one is using their kid’s college fund on your seed round.

Key Takeaway: An F&F round can be a fantastic launchpad, but approach it like a professional transaction. Value the relationships above the money by being clear and fair. Use proper legal instruments (SAFE/note or simple agreements) to avoid future headaches. And once you move to pitching “real” investors, you’ll be glad you set things up cleanly at this stage.

Join some of today's hottest startups building faster with LettsGroup's AI VentureFactory - go to Letts.Group.