We are at the cusp of a transformation in how new ventures are created and scaled. The traditional image of startups – chaotic garages, massive burn rates, and long-shot odds – is giving way to a new paradigm: startups as engineered products of a systematic process, supercharged by artificial intelligence and automation. We distil some key insights and recommendations for new style venture building for both entrepreneurs and investors:

AI-Driven Venture Building is a Paradigm Shift: It’s not just incremental improvement but a fundamental change. By treating venture creation as a repeatable process and leveraging AI at every step, we can dramatically improve success rates and efficiency. New style venture building differs from traditional artisanal methods as assembly lines differ from craft workshops – the potential scale and consistency are vastly greater. Entrepreneurs should embrace this systematic mindset, and investors should recognise startups that do so as potentially lower-risk, higher-reward opportunities.

Traditional vs. New – Know the Difference: The old approach often meant each startup learning by itself, reinventing the wheel. The new approach means standing on the shoulders of accumulated knowledge encoded in platforms. Traditional was manual and people-heavy; new is automated and software-heavy. We should be conscious of when we’re falling into old patterns (“We need to hire lots of X to do Y”) versus asking “Is there a tool or process that can do this better?”. In practice: Founders, audit your operations for anything repetitive or standardisable – that’s a candidate for automation. Investors, ask startups not just what they will do, but how they will do it with technology – the how might be the difference between needing $5M or $50M to achieve the same result.

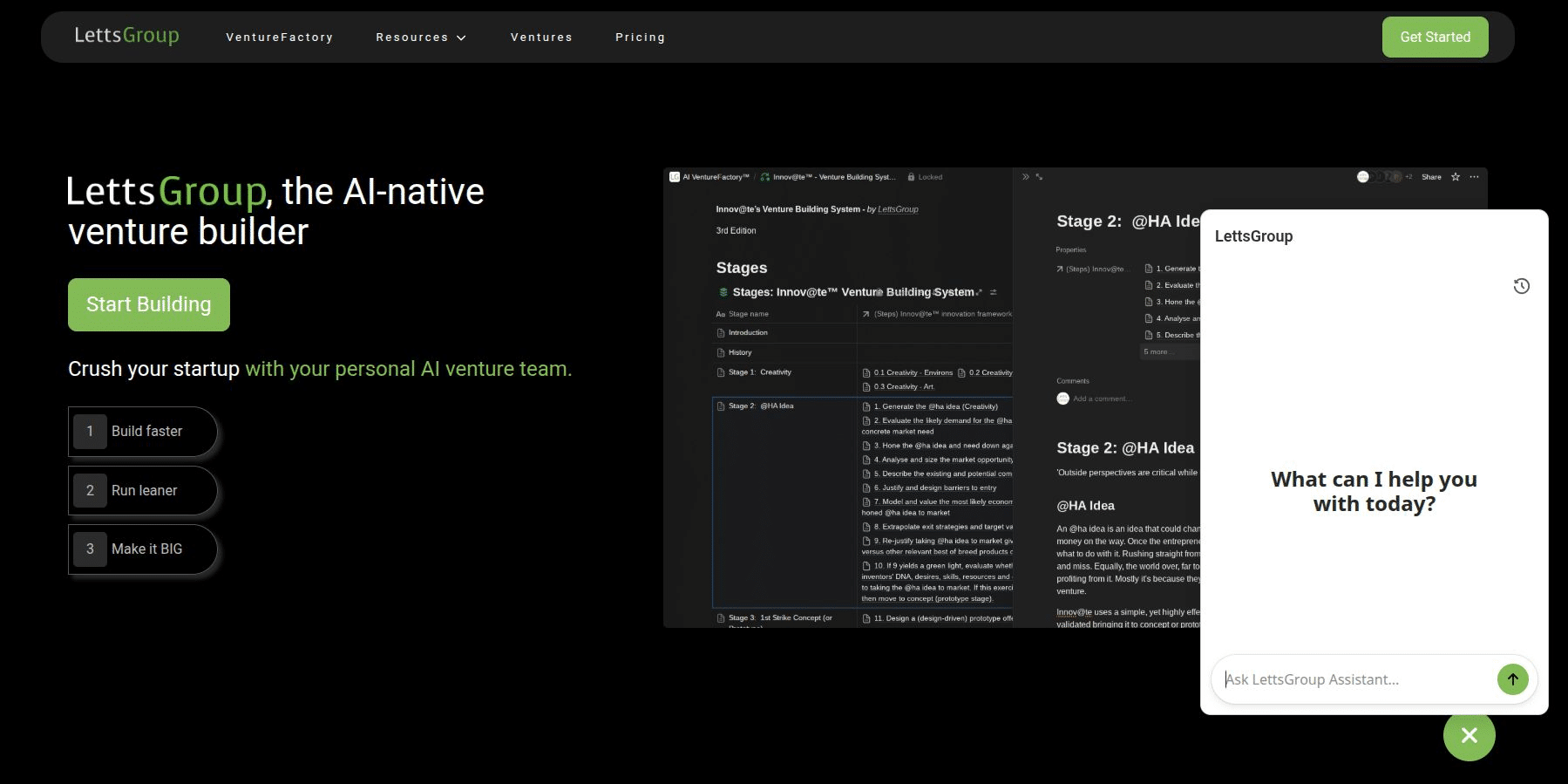

LettsGroup’s VentureFactory Example – a Glimpse of the Future: By implementing their venture building methodology and its AI-native platform , LettsGroup showed it’s possible to institutionalise innovation. Their claims of doubling startup success rates and dramatically reducing costs may seem bold, but they are backed by logic – address known failure points systematically and you will get better outcomes. The takeaway is that methodology matters . Startups should adopt a structured framework (whether the VentureFactory's Innov@te methodology or others) to ensure they aren’t missing critical steps. Investors might encourage or require portfolio companies to follow such frameworks or even provide access to them. Even if you don’t use a formal venture factory, having a checklist of venture-building steps and actively managing against it can be invaluable.

Economics Favour the Lean and Automated: We saw how small teams can reach massive scale with automation – the high revenue-per-employee case studies. The economics of startups are shifting to favour those who invest in automation early. A rule of thumb for founders: before hiring for a function, exhaust the automation options. Use humans for creativity, strategy, and nuanced relationship-building; use AI/automation for process, analysis, and scale. This will not only save money but also often produce faster outcomes (machines operate at high speed and 24/7). For investors, the “burn rate” conversation changes – it’s not just cutting burn, but smart burn. A company spending $100k on cloud services to automate may be far more efficient than one spending $100k on salaries for the same output. So dig into how the startup plans to use your capital – on building tools and scalable systems or on brute-force execution.

Scaling Challenges Can be Anticipated and Engineered Away: One of the most actionable insights is that startups fail in scaling often due to lack of planning for it. But now we know how to plan – build operational platforms in parallel with product development. Founders: don’t wait for a crisis to implement proper infrastructure and process. Use “growth hacks” but also build “growth infrastructure.” Implement at least rudimentary systems for customer management, deployment, analytics, CRM, content management, business planning etc., early – these will carry you through growth spurts. It’s the concept of building the aeroplane while flying, but given the new tools, you can at least have blueprints ready from the start. For investors: when doing due diligence, assess whether the startup has thought about scale beyond just acquiring customers – do they have an architecture that won’t crumble? If they’re using a venture building platform or methodology, that’s a positive signal of foresight.

The Right Tools Make a Difference: The landscape of startup tools and AI is rich. We identified categories from AI coding assistants to automated marketing and beyond. Founders should continuously scout for tools that can give them leverage. Adopting the right CRM or analytics platform or devops tool can save dozens of hires worth of effort later. However, integrate them well – disconnected tools can cause chaos; integration and automation between tools yield the real productivity gains. Both entrepreneurs and investors should view a well-curated, integrated tech stack as a sign of a mature, scale-ready startup. It’s akin to having good machinery in a factory – you can produce reliably. Don’t skimp on foundational tools due to cost; the ROI is usually high.

Leadership Must Evolve (But Don’t Kill the Founder Spirit): We saw the tension between Founder Mode and Manager Mode . The recommendation is clear: in early stages, favour Founder Mode , and let creative, flexible leadership drive innovation. As you grow, gradually layer in Manager Mode via processes or selectively hired managers, but do so carefully and in areas that need it. Founders should remain at the helm if possible, supported by systems (and people) that provide structure without suffocating creativity. Investors who back founder-led companies should help founders get resources to handle management tasks – maybe an ops advisor or connecting them to platform services – rather than reflexively pushing for a “professional CEO” too soon. Conversely, if a founder is resistant to any process even when the company is faltering under chaos, investors should counsel them on the need for some Manager Mode or bring in help in a limited scope (e.g., a fractional CFO to tidy finances rather than a whole new C-suite that displaces the founder). In AI-first startups, leverage the AI as a pseudo-manager for routine oversight, letting founders focus on vision.

Case Studies Prove It’s Possible – Emulate and Learn: The examples of WhatsApp, BuiltWith, etc., should serve as inspiration and playbooks. Founders: study how those companies operated. For instance, WhatsApp’s mantra was to do one thing exceptionally well (messaging) and not get distracted – which, combined with efficient tech, let 50 people serve half a billion users. Think about what is the “one thing” your startup must excel in, and apply extreme automation and focus there. If you’re an enterprise SaaS startup, maybe your one thing is a certain type of data processing – automate that fully. If you’re a marketplace, maybe it’s matching supply and demand – leverage AI to optimise that without manual brokers. Use AI case studies like the one-person marketing team to inform how you structure your team: perhaps you don’t need a full marketing department until much later if you use those techniques. Investors: when you see a startup taking such approaches, reward them, because they might do a lot with modest capital. Also, encourage sharing of best practices among your portfolio – each success story can teach others (e.g., one portfolio company’s success with an AI sales assistant might be implemented at another, raising overall performance).

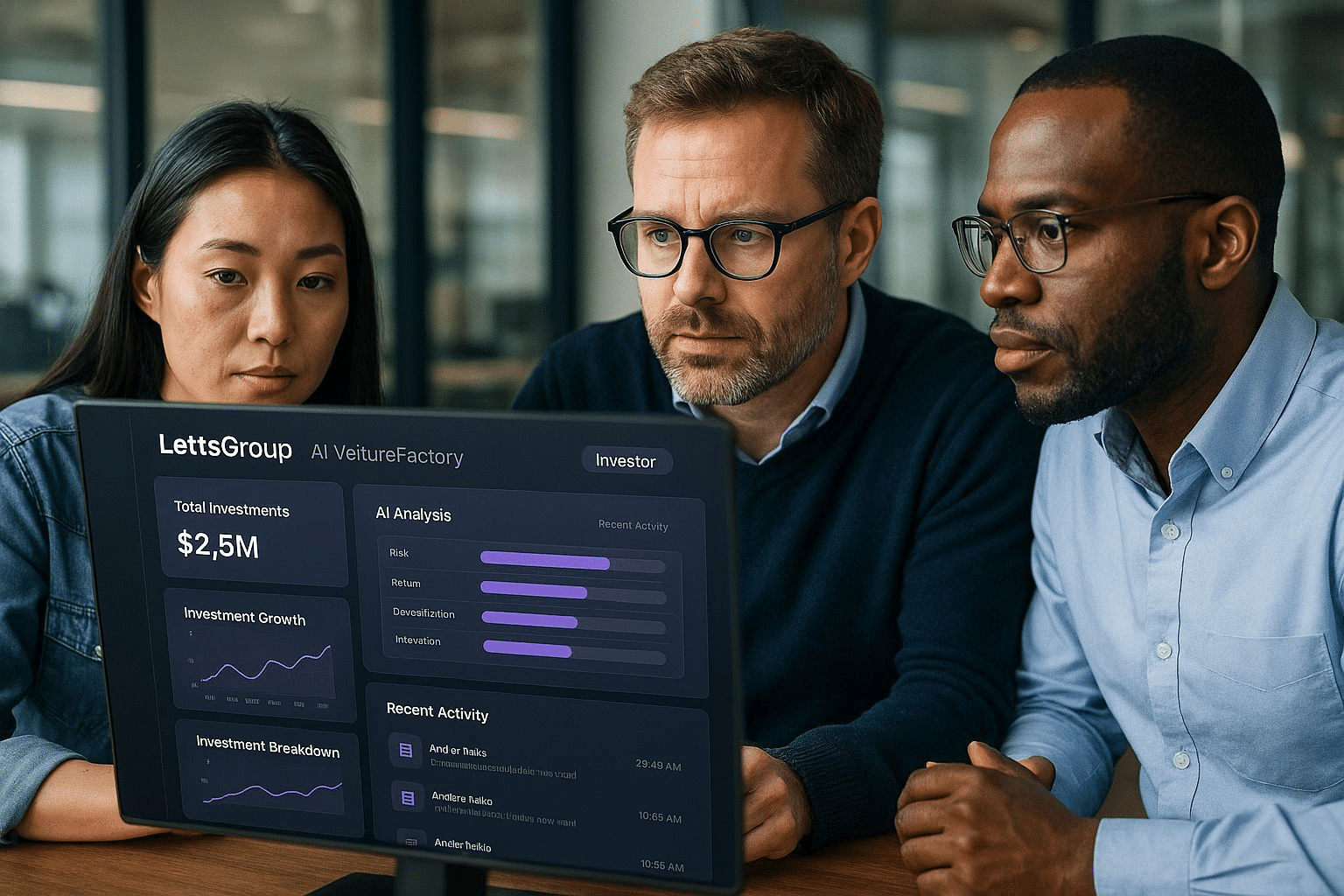

Venture Capital Itself Must Adapt: For investors reading this, the message is that the old VC model is being disrupted from within. If startups need less money and prefer platforms, you should consider how to provide a platform or partner with those who do. Building out operational teams, AI tools, or even creating your own venture studio capabilities may be critical. Consider offering portfolio services not as an informal “extra” but as a formal product (e.g., your fund gives every startup access to an AI toolkit or platforms like LettsGroup's AI VentureFactory). Embrace data in your own decision-making – maybe use AI to triage deals – but more importantly, embrace the shift to human capital and tech enablement over just capital provision . The future might see venture firms that win deals not by highest valuation offered, but by having the best platform of support. If you can help a startup succeed systematically, that’s worth more than a few extra million dollars thrown at them. LPs (the investors in VC funds) will also start to expect that VCs leverage tech to improve their outcomes – after all, if success rates can double, funds can yield better returns with fewer write-offs.

Empower Entrepreneurs Globally: A wonderful implication of the new style is that it lowers barriers. As venture building becomes more of a learned skill and service, entrepreneurs from anywhere can tap into it. This means more diverse problems get tackled and more communities benefit from innovation. Founders and investors alike should look beyond traditional hotspots. If you have a great idea in a region without a big startup scene, consider joining a venture platform or online accelerator that can provide structure and remote support. Investors, consider investing in or creating platform-based incubators in emerging markets to capture untapped talent. The tools and methods discussed don’t require being in Silicon Valley; they mostly require internet access and some training. We might see a world where a founder in Africa, plugged into an AI venture factory, builds a company that competes globally – indeed that’s already starting to happen.

Balance Structure with Innovation: A cautionary note – while we promote structure, we should guard against over-standardisation. Sometimes great innovation comes from breaking rules or taking an unconventional path. Venture methodologies must allow for pivots and creative strategies that weren’t in the original plan. As an entrepreneur, don’t become slavishly dependent on a playbook if evidence suggests a different approach is needed; use the playbook as a guide, not a prison. As an investor or platform operator, remain open to adapting the system when a unique opportunity or challenge arises that doesn’t fit the mould. The future should be flexible . Think of the venture factory like agile manufacturing – able to retool quickly for new designs if needed.

In conclusion, the convergence of AI and venture building is enabling a new era where startups are built smarter, cheaper, and faster . The key takeaways for entrepreneurs are to leverage automation early and often, follow a structured process without losing your innovative edge, and be prepared to scale not just your product but your whole company intelligently. For investors, the key takeaways are to support startups with more than just cash – offer platforms, demand efficiency, and adapt your model to these new realities.

The prize is huge: an ecosystem where far more ventures succeed, capital is used more effectively, and innovation can flourish without being bottled up by operational hurdles or lack of know-how. We could see an explosion of viable startups tackling every niche, including pressing global challenges (climate, health, education) that were previously under-invested because they didn’t fit the high-burn model. When venture building is as optimised as, say, modern manufacturing, we might consistently create companies that both generate profits and solve real problems at scale.

To borrow the manufacturing analogy one last time: the industrial revolution transformed production and prosperity. We may be at the dawn of an innovation revolution in venture building – one that could unleash a wave of entrepreneurship akin to an assembly line of world-changing ideas made real. Those who embrace these new methods early will be at the forefront of that wave, much as early industrialists leaped ahead by adopting new machines. In the world of startups, that means more founders achieving their vision and more investors seeing returns, with fewer casualties along the way.

As this guide has shown, the pieces of this puzzle – from LettsGroup’s venture factory to AI case studies – are already falling into place. The future of venture building is being written now, in code and algorithms as much as in pitch decks and term sheets. Entrepreneurs and investors should seize this moment : adopt the new style of venture building, and be part of creating the future rather than competing with it. The companies – and venture firms – that internalise these lessons will likely be the leaders of the next decade.

In the end, successful venture building – old style or new – still hinges on creating real value: a product or service that customers want and a business model that sustains it. AI and automation don’t change that fundamental truth; they simply equip us with better tools to reach that goal. So, equip yourself with those tools, combine them with vision and grit (that unique human spark), and go build the future. The assembly lines of innovation are starting up – don’t be left handcrafting in the age of industrialised venture. Embrace the AI-driven, automation-enabled approach, and you just might build the next big success story with unprecedented speed and efficiency.

If you're a tech or digital startup founder, build faster, run leaner and make it BIG with LettsGroup's AI VentureFactory .