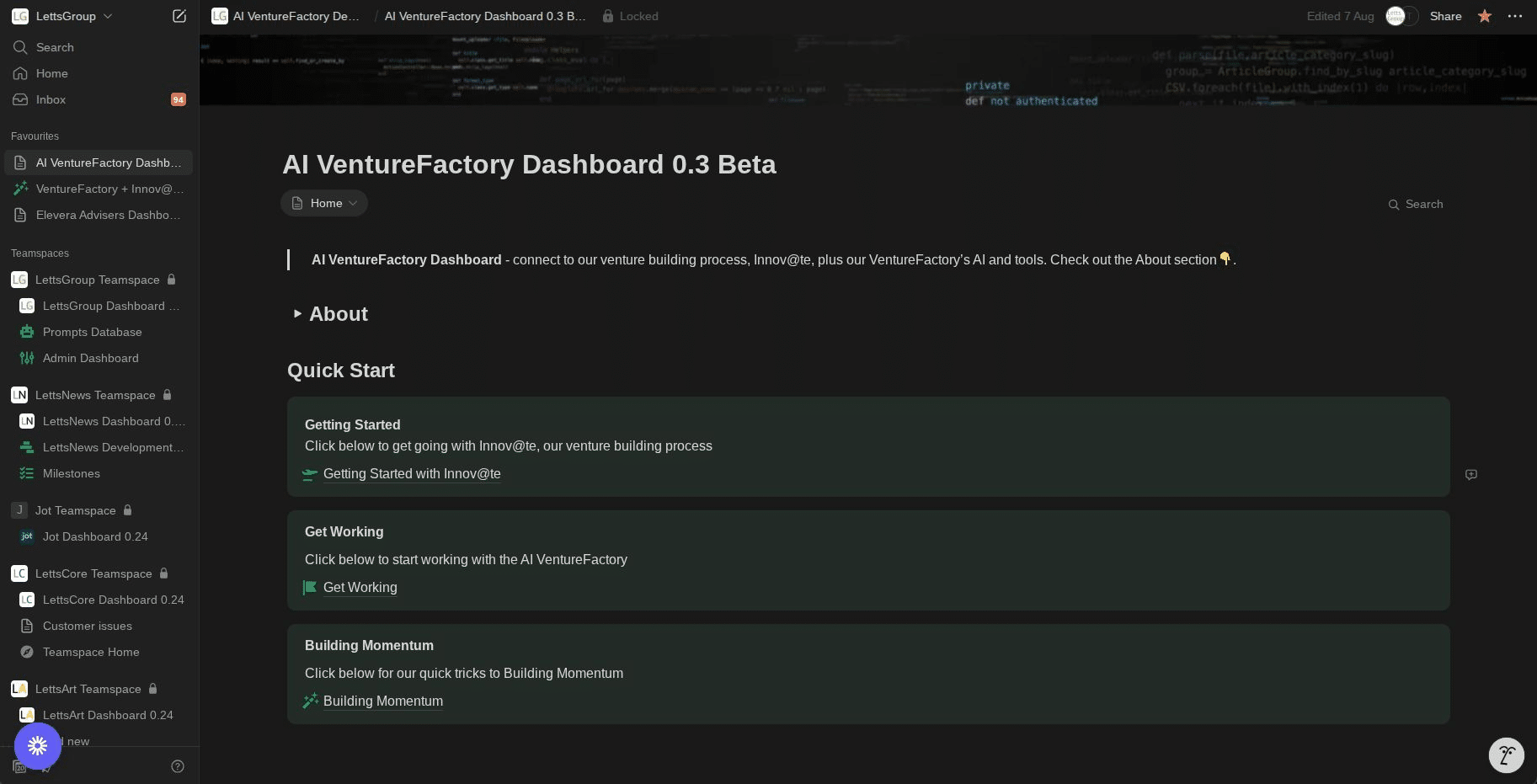

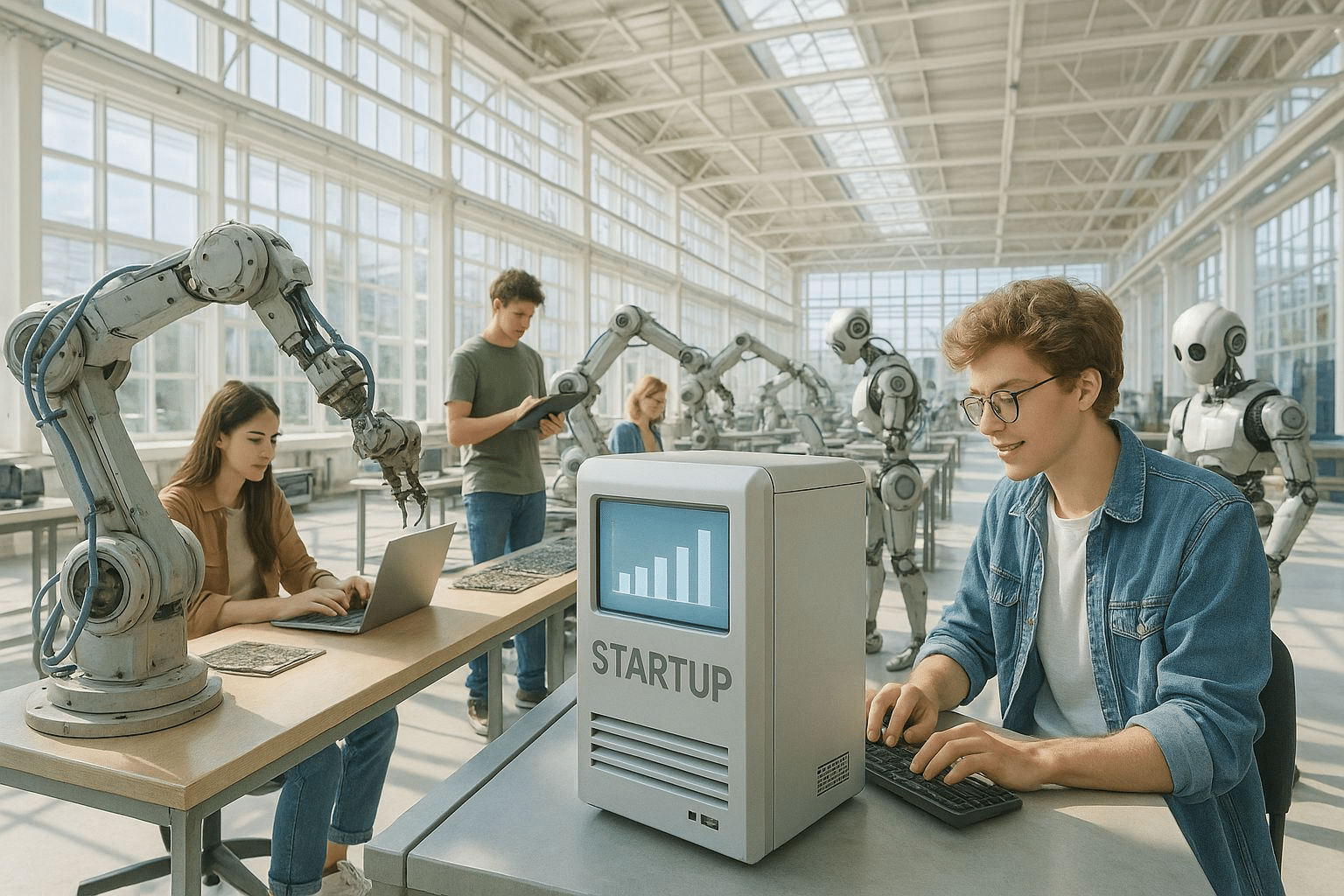

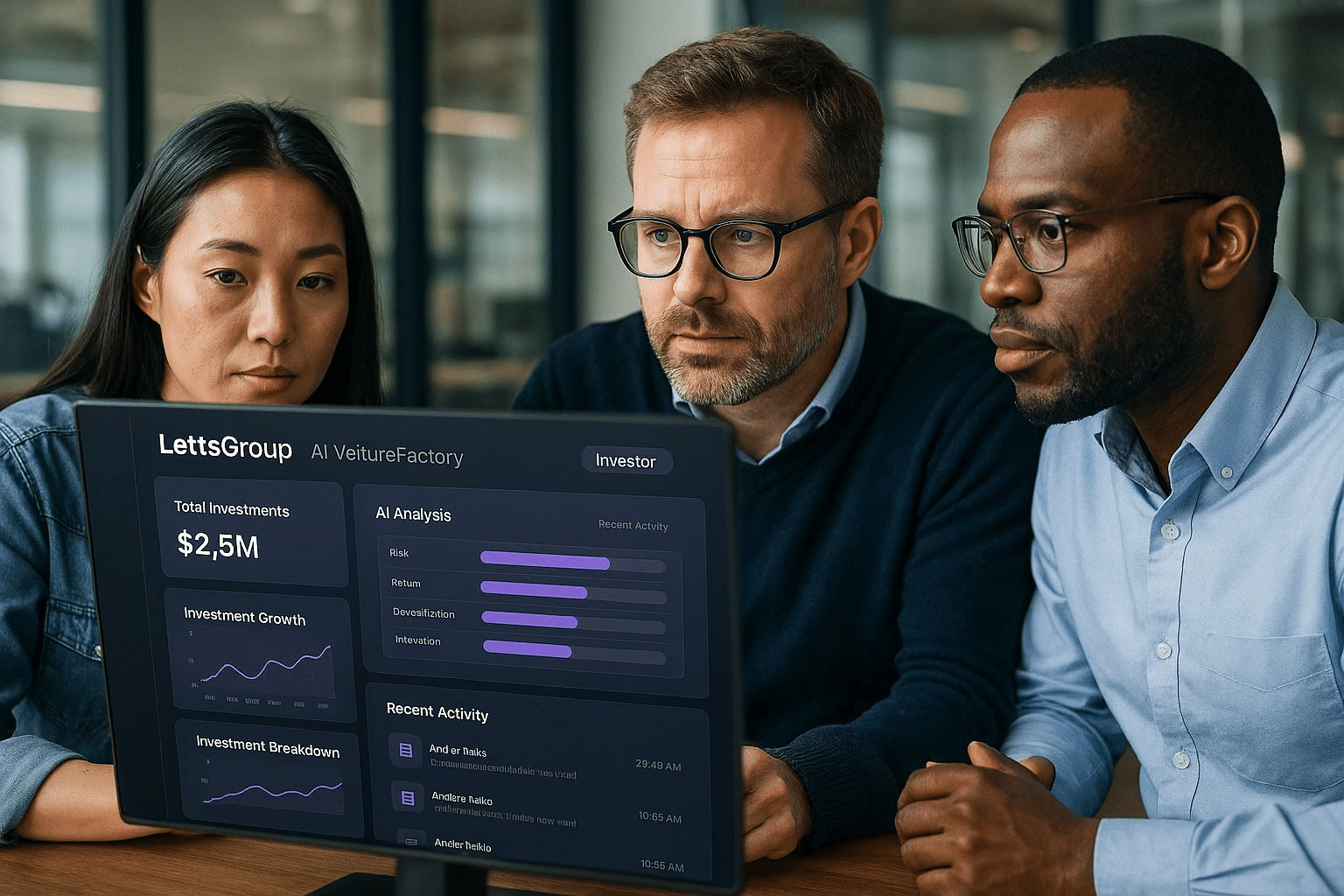

LettsGroup's AI VentureFactory is bringing a new startup each month to its AI-native venture building platform just 3 months after soft launching to external startups. Companies using it are seeing rapid gains in the 3 core KPI's it delivers - building faster, running leaner and making it bigger. The team is currently working on enhancements to its helpbot, venture building AI and native apps. Its core apps, 3rd party agents and step by step venture building AI outputs are proving to be a powerful new way to build and operate startups, and its new Investor Dashboard provides a fascinating mirrored 'pit' view into portfolio companies and prospects.

On 13 November 4pm-7pm LettsGroup will be co-hosting "LettsTalk Tech" with Brown Rudnick in central London for select tech investors and entrepreneurs. If you know one of the LettsGroup team, please contact them directly for an invite.

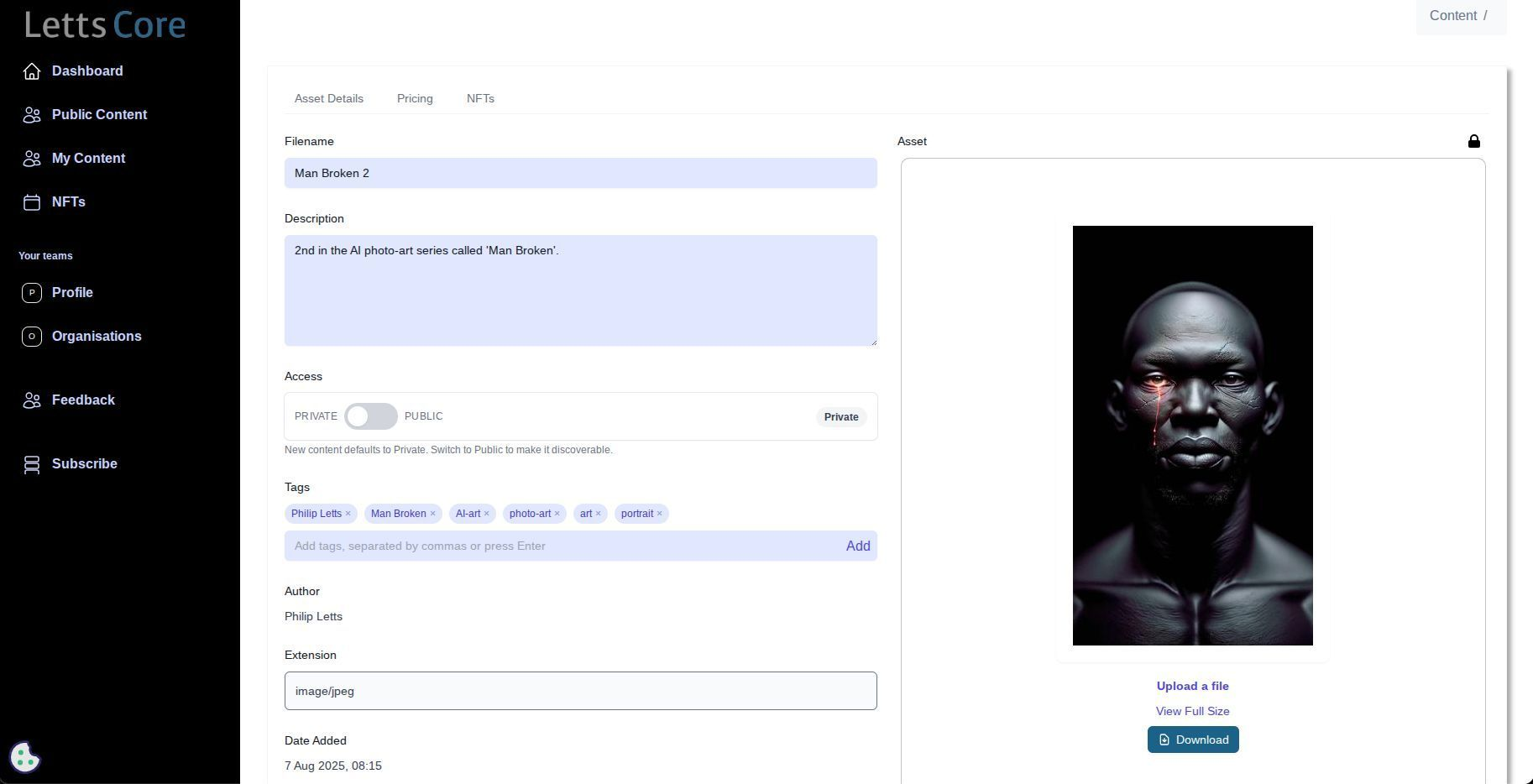

LettsCore , the Blockchain, AI CMS is live in beta and scaling quickly just a month after launching. With its first corporate customer (an AI app vendor) up and running it already boasts over 1,500 users, adding a dozen or more new users per week. Its second corporate customer has signed up and started using the platform to store, organise, protect and monetise its critical content assets. LettsCore is like a universal Googe Drive on steroids - with a raft of extra Blockchain/crypto/AI features and monetisation tools available.

The team is stretched keeping up with demand while at the same time working to add new features for its next release slated for Q1 2026. Any individual can sign up for a free trial and also upgrade to an Organisation account (if they want) at LettsCore.com/pricing .

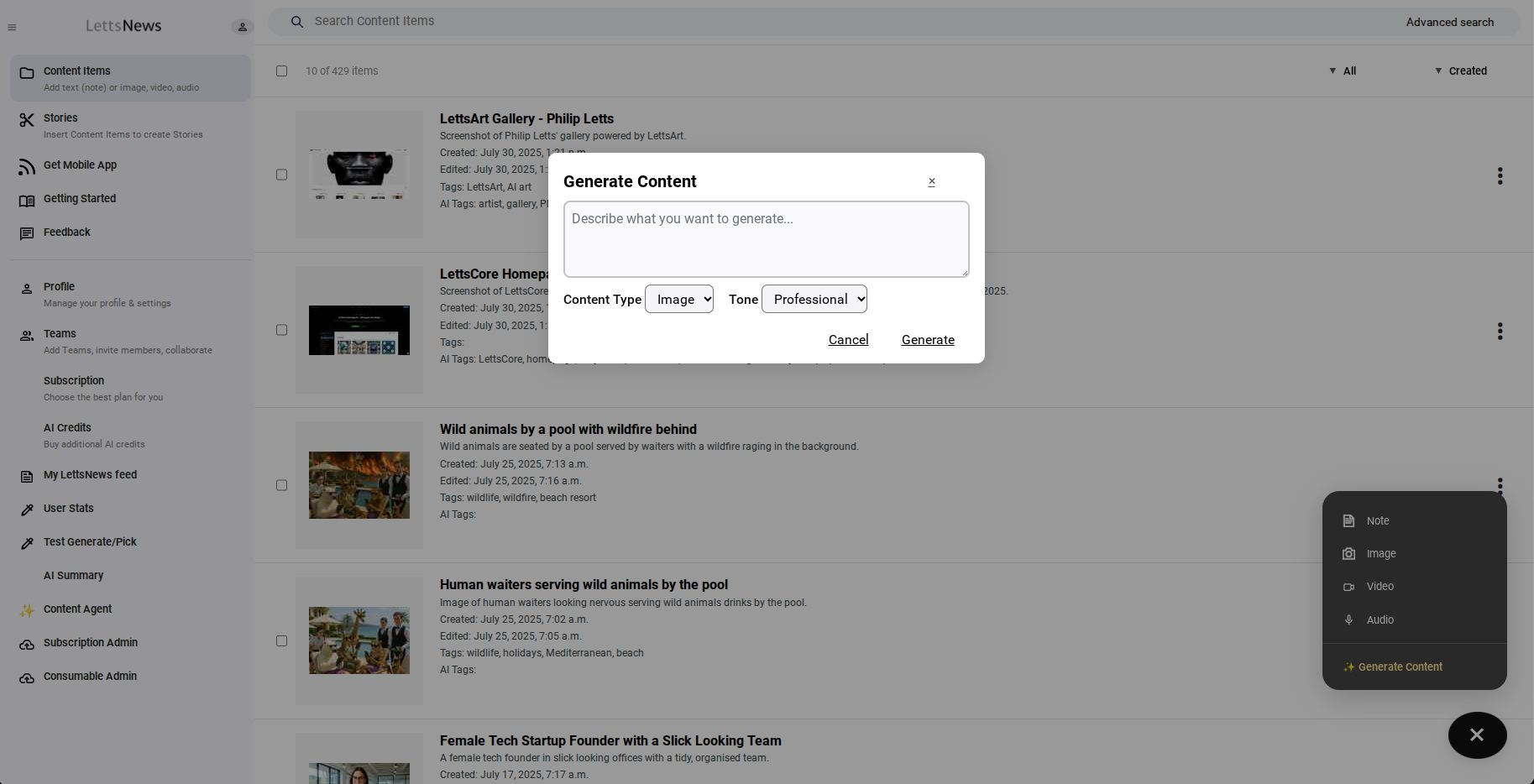

LettsNews is steadily adding new users every week. As a result the team have started working on its next release, which includes auto-embedding favourite videos and podcasts from leading 3rd party platforms into news stories, as well as its 2nd generation AI agent to take you from story to publish, distribution and promotion even faster. Following this the team will add a groundbreaking new content item store (to sell news story assets) - plus an enterprise subscription plan to extend LettsNews' AI-powered newsroom technology reach beyond small independent journalists, PRs and publishers. LettsNews is also used by small content marketing teams to speed and enhance their organic marketing process.

You can get started for FREE at LettsNews.com .

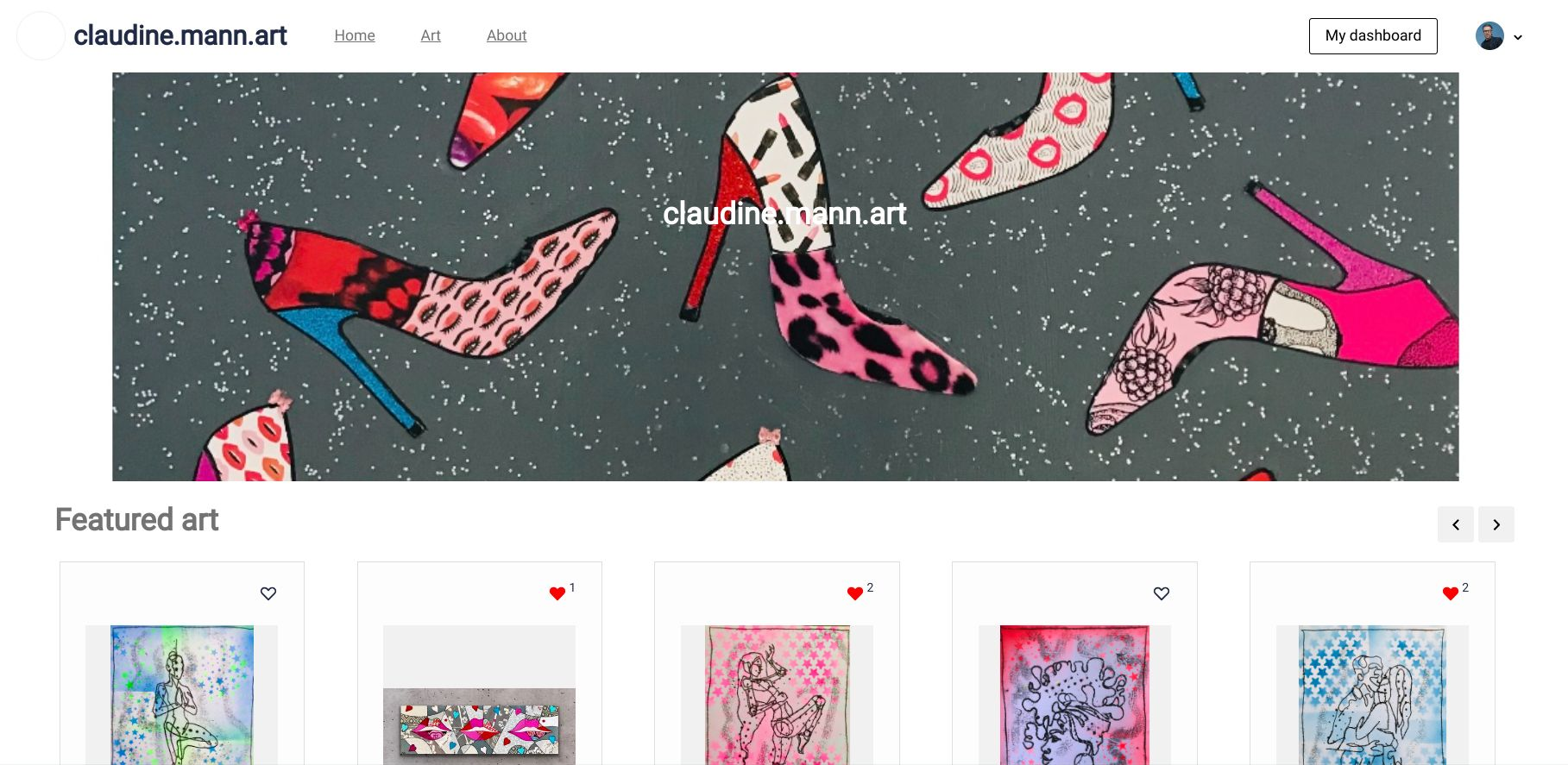

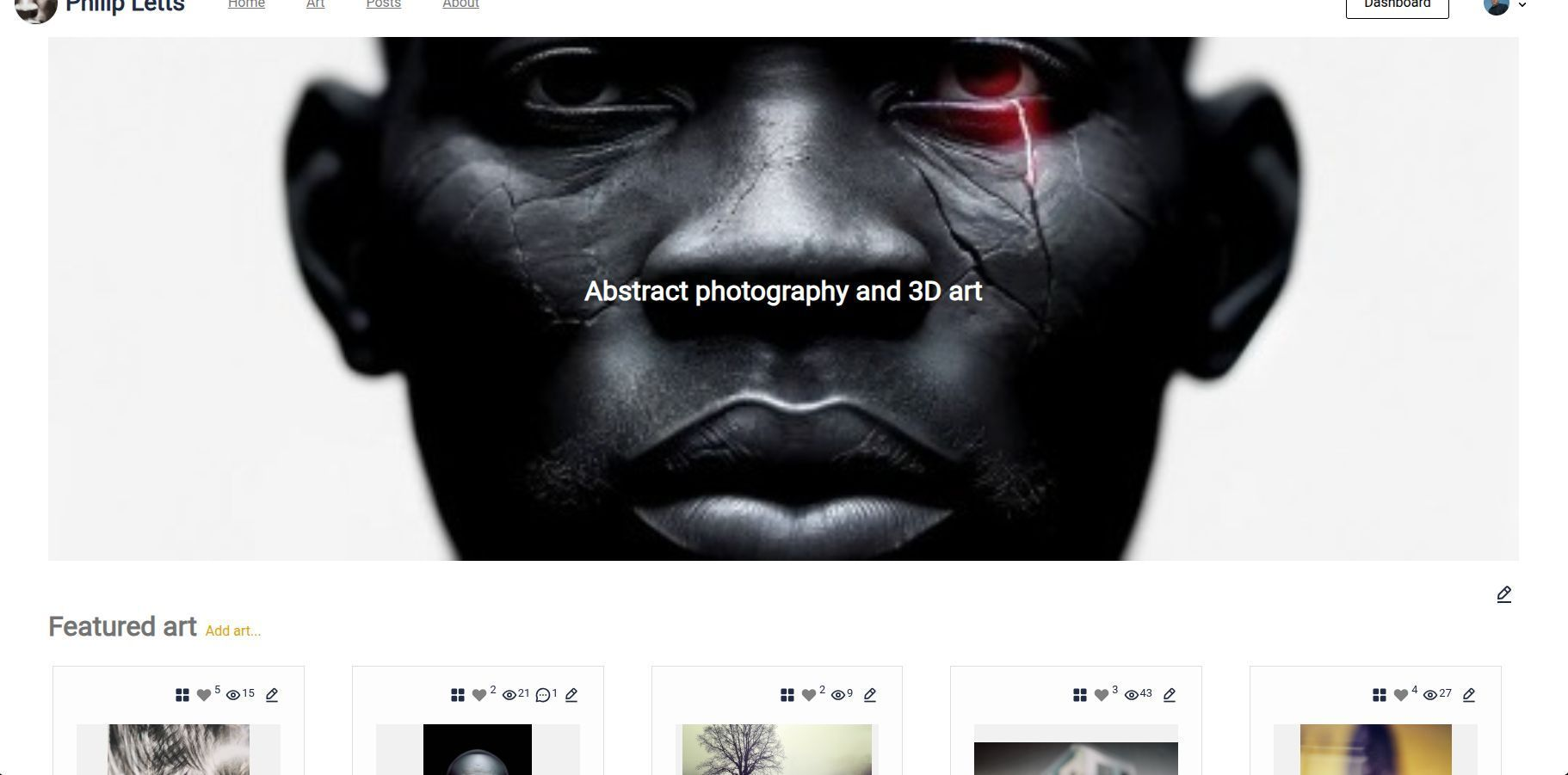

LettsArt 2.5 is now fully live across nearly 1,200 galleries and 3,700+ users. Its latest release supports artists, gallerists, curators and art collectors with one AI-powered, blockchain enabled platform that helps art sellers build advanced, branded art galleries - using AI and no-code tech to automate the curation, art selling and distribution process. Art collectors get to discover and buy directly from independent artists and gallerists.

When LettsArt 2.5 is fully rolled out the end-to-end platform will use advanced tech to show and sell art (for modern buyers) in an environment that is more immersive, connected and efficient than the current closed systems involving high street galleries, auction houses and more analogue art dealers.

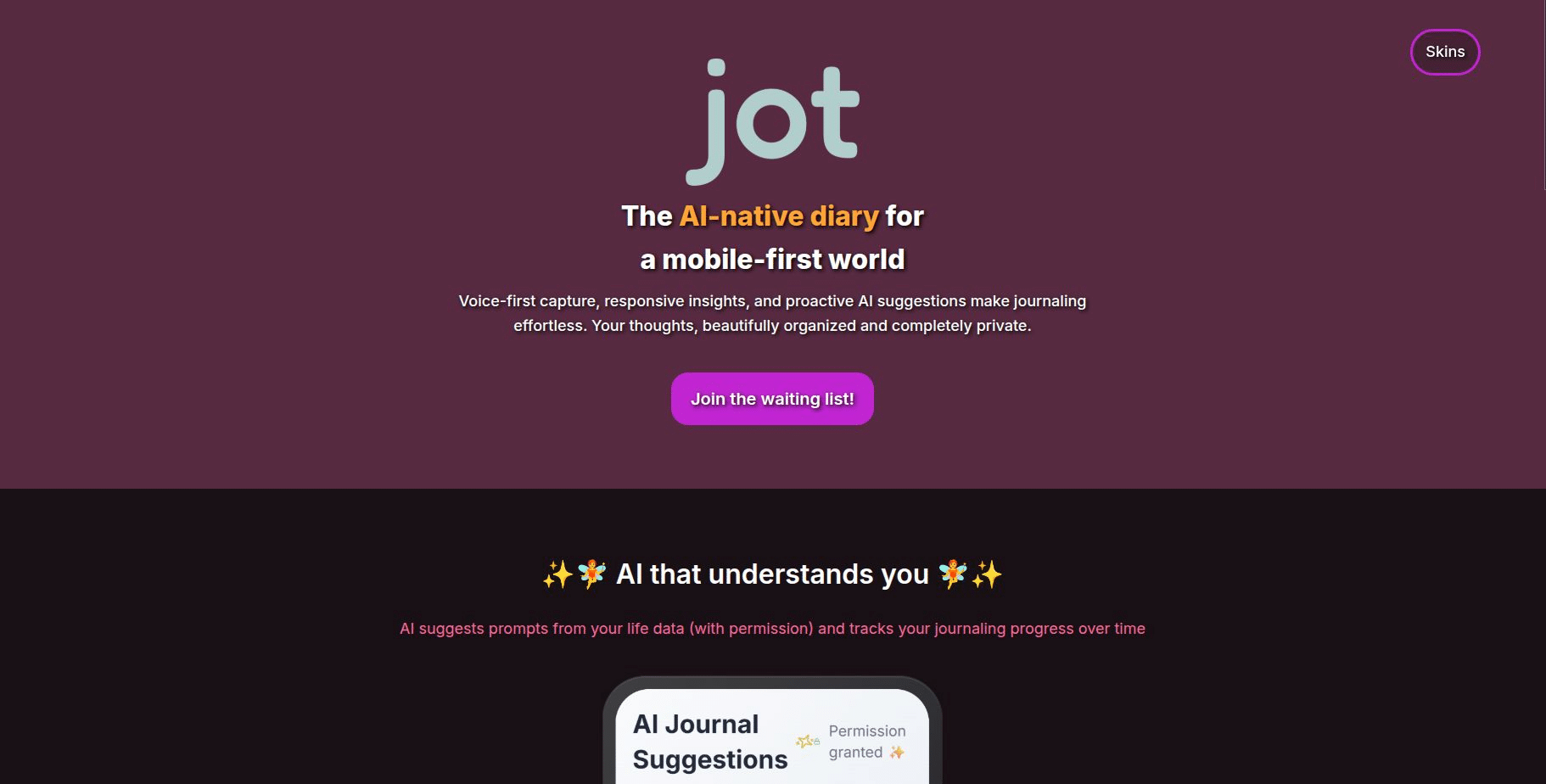

It's taken 213 years, but today we're excited to unveil Jot.

John Letts invented the original diary in 1812 thanks to the Gutenberg press. Sebastian Letts, eighth generation of the well known diary family, and Dorian Tirelli are today reinventing the diary thanks to AI. Visit Jot today and get on the hottest waiting list in town.

And mark your calendar for October...

Last week LettsSafari published one of the final sections of their comprehensive new guide to smaller-scale rewilding - it explained why LettsSafari is important to this quiet, yet developing movement:

"LettsSafari is a multi-faceted platform. First, it’s a network of rewilding parks and projects . They have on-the-ground sites where they actively practice rewilding and test models for different scales. By visiting these parks online via LettsSafari+, people can see rewilding in action - essentially living demonstrations.

Secondly, LettsSafari provides expertise and guidance distilled from 15+ years of experience. They have developed practical models for various scales - small gardens, large gardens, small parks, and more - which means if you have a particular size plot, they likely have a template or advice on how to rewild it effectively. It's like a living lab for rewilding and nature conservation at-scale.

Thirdly, LettsSafari offers a membership (LettsSafari+ and subscription) structure that makes rewilding accessible to all, even those who don’t have land to rewild themselves. For a small monthly fee (the price of a coffee, as they say), anyone can contribute to rewilding efforts - the money goes directly to creating new parks, planting trees and releasing animals."

We hope you become a member of this amazing mass-market rewilding platform - go to LettsSafari.com .

We highlight just a few startups in each monthly edition of LettsGroup's NewsFlash. To explore other companies using LettsGroup's AI VentureFactory go to LettsGroup/ventures.

LettsGroup's AI VentureFactory has been busy over the summer building routes to market, focused initially on accelerators, venture capital firms and other apps for the startup community. It already boasts a cornerstone partnership in each of these categories, to be announced soon, which should start bearing fruit this Autumn.

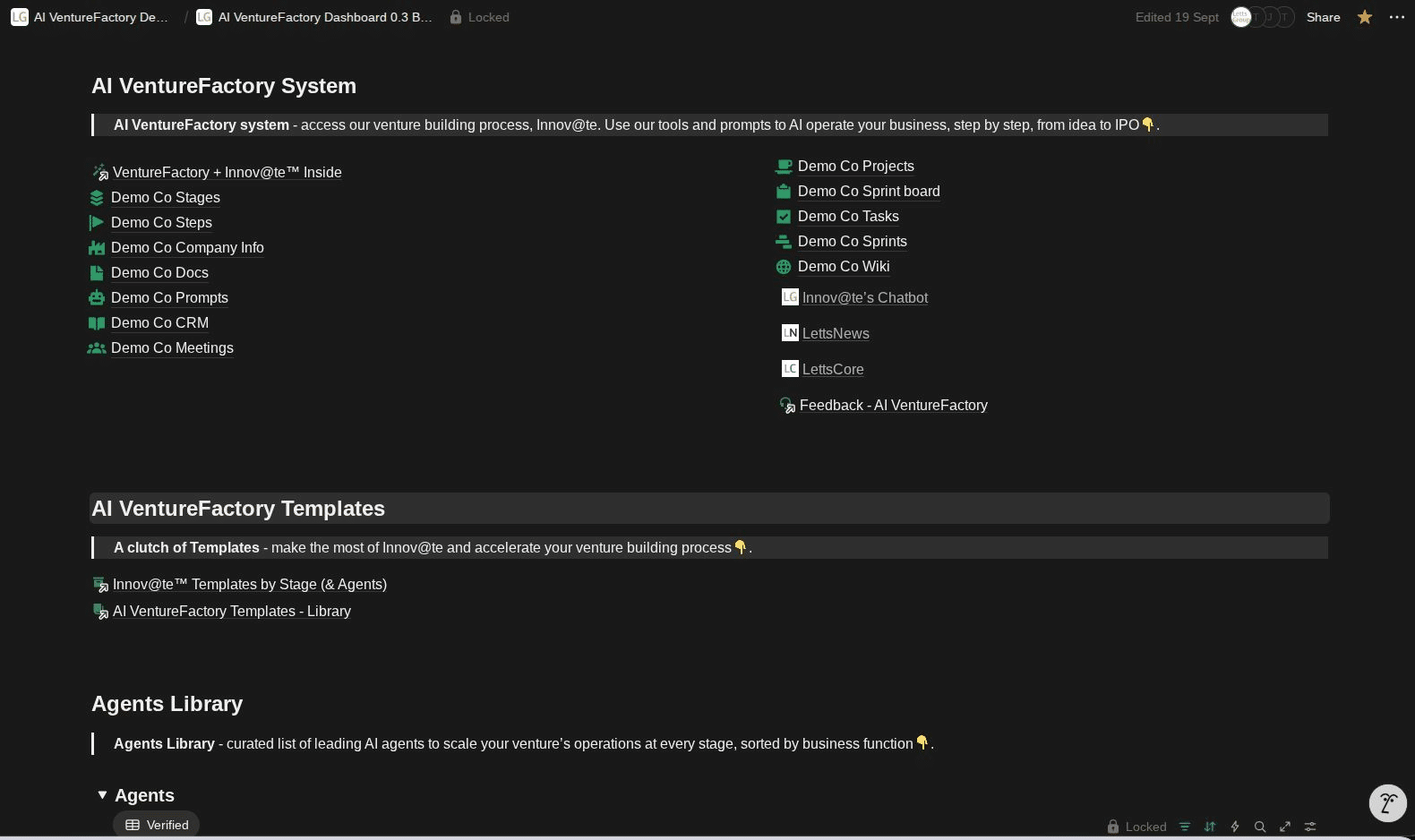

Last week the product team launched the VentureFactory's latest Dashboard 0.3 which offers more advanced features for both founders and investors and we believe fundamentally alters the cost of building tech and digital startups, enabling British and European startups to compete on a more even playing field with better funded US companies. Startups using the AI VentureFactory for more than 12 months have on average benefited from an 80% reduction in the cost of building their tech startup to Seed stage.

LettsCore is live in public beta and already adding more than 10 new users per week. The groundbreaking AI and Blockchain Content Management System (CMS) offers universal, distributed media storage, management and retrieval at scale, plus a series of intelligent content-enabling tools which include micro-monetisation, NFT minting, social sharing and auto-distribution. As a part of its launch offering, individual users can sign up to a free trial and get 2,000 credits . They can also set up an Organisation account. You can get going at LettsCore.com .

LettsNews was launched in public beta in late July, so in August it started to onboard early adopters. With dozens of users on board and a strong percentage upgrading to paid subscription plans, its unique place in the newsroom software market looks like it will be validated. This cost effective, AI-powered platform offers independent journalists, PR's and content managers tools normally reserved for enterprise-scale newsrooms and news publishers. The main newsroom dashboard is a web app, but the team have been busy readying their mobile apps, designed for work in the field with in-app subscription purchase, in both the Apple App Store and Google's Play Store. Coming soon.

LettsArt , the fast growing AI, no-code platform for artists, gallerists and new generation art collectors has launched LettsArt 2.5 (Phase 1) to its sizable user base. This latest release halves the time to sign up and start building an online art gallery thanks to its streamlined approach and innovative new use of AI. It also offers a next generation art management dashboard with fast, easy to use mobile capabilities and a multi-user model with advanced pricing to scale its core of independent visual artists while also starting to support professional art studios, independent gallerists and art dealers.

Jot , one of the more recent adopters of the AI VentureFactory, is readying its teaser website for imminent launch. Its young, new generation tech team pushes the bounds, using AI for practically everything. Most important, they are crafting a powerful reimagining of one of the oldest, most iconic consumer media products. It's a shoe-in for AI disruption and a category that has mass market consumer appeal with high customer usage rates. The space is competitive, but we believe that these young innovators have what it takes to deliver on their plans. They also offer a distinctly Brit brand in an overly US-polar environment. Watch this space!

LettsSafari is a quiet, yet powerful networked movement. It makes quite a difference to its users. This long term play is perfectly suited to the AI VentureFactory, having used it the last two years to expand its digital platform while proving its smaller-scale, mass market rewilding system. To do this it needed to build and operate its digital platform arm at a systemically lower cost base to keep re-investing in its rewilding parks and its important work on the ground. The second phase of LettsSafari's journey, stepping-up to commercial scaling, involves opening national rewilding safari parks in the West as high profile commercial attractions, starting here in the UK. Demonstrating its expertise, the team has released a serialised, definitive digital guide to smaller-scale rewilding - find it here .

We highlight just a few startups in each monthly edition of LettsGroup's NewsFlash. To explore other companies using LettsGroup's AI VentureFactory go to LettsGroup/ventures.

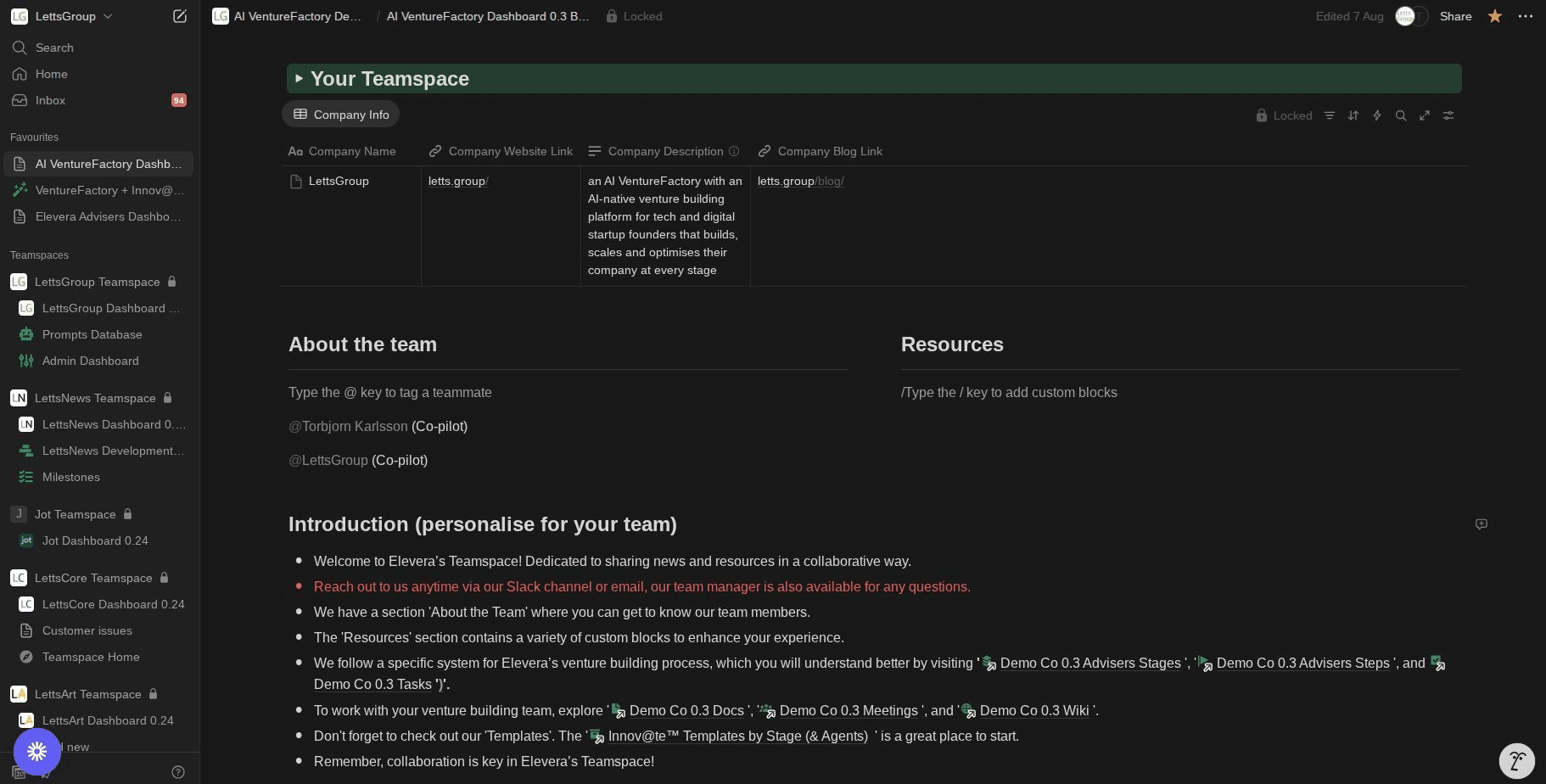

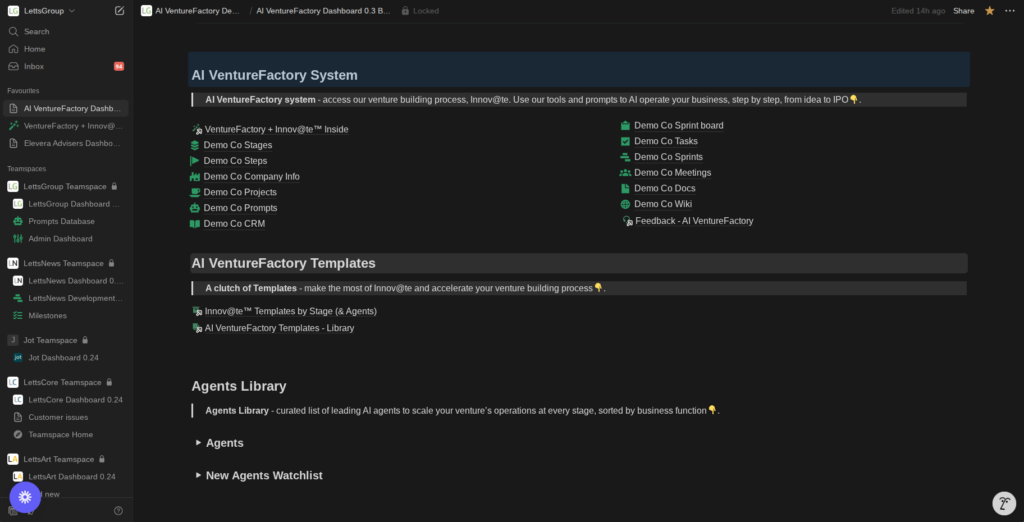

LettsGroup's groundbreaking VentureFactory is an AI-native venture building platform that builds, scales and optimises your company at every stage. Here's how to navigate its dashboard and use the system.

If you're a founder wanting to build your startup faster - go to www.Letts.Group today .

The media industry stands at an unprecedented inflection point as artificial intelligence transforms every aspect of content creation, distribution, and consumption. The global AI in media and entertainment market size was estimated at $25.98 billion in 2024 and is expected to reach $33.68 billion in 2025, representing a remarkable 30% year-over-year growth that signals the rapid acceleration of AI adoption across the sector.

This transformation extends far beyond simple automation, fundamentally reshaping how media organisations operate, create content, and engage audiences. In 2024, investment in generative AI businesses reached over US$56bn, as major players seek to harness its speed, scale, and creative potential, demonstrating unprecedented capital commitment to AI-driven media innovation. A recent survey by Stripe, the leading online payment processor, revealed that content generation is currently one of the biggest drivers of the AI economy, including data synthesis tools, moderating and verifying content, summarisation and insight tools, plus assistants and chatbots.

However, this revolution comes with significant challenges and implications for the workforce. At the top of the list of people most likely to have their job affected by the rise of generative AI are interpreters and translators, followed closely by historians, writers and authors, highlighting the particular vulnerability of traditional media roles.

The most significant shift in 2024-2025 has been the mainstream adoption of generative AI for content creation. In 2025, generative artificial intelligence will shift from a behind-the-scenes tool to a central driver of innovation in marketing, marking a fundamental change in how media companies approach content production.

This transformation is evident across multiple content formats:

Text and Editorial Content : AI-powered writing assistants and content generation tools have become standard in newsrooms and publishing houses. These systems can produce first drafts, generate headlines, create summaries, and even write entire articles on routine topics such as financial reports or sports scores.

Visual Content Creation : AI image generation and video synthesis tools have democratised high-quality visual content production, allowing smaller media organisations to compete with larger rivals in terms of visual appeal and production values.

Audio and Voice : AI voice synthesis and music generation have opened new possibilities for podcast production, audiobook creation, and personalised audio content at scale.

Fifty-three percent of surveyed executives say they are regularly using gen AI at work, compared with 44% of mid level managers, indicating that AI adoption is being driven from the top of organisations. This executive-level enthusiasm is translating into significant budgetary commitments, with 30% anticipating a significant increase of more than 10% in marketing budgets for 2025, much of which is being allocated to AI-powered initiatives.

The emergence of innovative platforms like LettsNews and LettsCore represents a new paradigm in media infrastructure. LettsNews is a simple, yet powerful AI-powered newsroom platform for independent journalists, PR's and content managers that enables quality "story idea to publish in minutes," demonstrating how AI is compressing traditional content creation timelines.

LettsCore is a blockchain platform redefining how content is managed, monetised and delivered. It is the first Web3 platform that lets creators control their content and reputation, maximising digital content revenue in the age of generative AI. This platform addresses critical challenges in the AI era, particularly around content attribution and monetisation.

The integration of blockchain technology with AI addresses several pressing concerns:

Content Provenance : LettsCore's blockchain and AI innovation for managing content, solves some of the biggest issues surrounding information - provenance, trust and verification. As AI-generated content becomes ubiquitous, the ability to verify authentic human-created content becomes increasingly valuable.

Creator Attribution : LettsNews is looking at adopting LettsCore to implement atom level author attribution to news pieces at considerable scale, enabling granular tracking of content creation and fair compensation for contributors.

Monetisation Innovation : Micro-monetisation built into content, enabling frictionless syndication and distribution represents a new economic model for content creators in an AI-dominated landscape.

The media industry faces significant workforce challenges as AI capabilities expand. According to the World Economic Forum's 2025 Future of Jobs report, 41% of employers worldwide intend to reduce their workforce in the next five years due to AI automation, with media organisations being particularly affected.

However, this disruption is creating new opportunities alongside job displacement. AI and automation could displace 85 million jobs by 2025, but also create 97 million new roles more aligned with the division of labour between humans, machines, and algorithms. In media, this means evolving roles that combine human creativity with AI capabilities rather than simple replacement.

LettsNews is solving the disinformation crisis. Its AI-powered news platform for high quality, democratised news, highlights how AI is being deployed not just to create content but to combat misinformation and improve information quality.

The challenge of maintaining trust while leveraging AI capabilities has become central to media strategy. There are still plenty of unresolved risks and unanswered questions that come with AI adoption: copyright litigation, accuracy issues, privacy and bias concerns, and other ethical dilemmas.

The current market landscape is characterised by intense competition for AI supremacy in media. Major technology companies are investing billions in generative AI capabilities, while traditional media companies are scrambling to integrate these technologies into their existing operations.

Technology Giants : Companies like Google, Microsoft, and OpenAI are developing foundational AI models that power media applications, positioning themselves as infrastructure providers to the industry.

Traditional Media Companies : Legacy players are adopting AI technologies for content creation, audience analytics, and operational efficiency, but face challenges in cultural adaptation and technical integration.

Emerging Platforms : Innovative companies like LettsCore are creating entirely new paradigms that combine AI, blockchain, and traditional media functions which redefine content storage, management and seamless integration with content-to-content interactions.

Media organisations are implementing AI across three primary dimensions:

Content Creation : From ideation to final production, AI tools are accelerating and enhancing creative processes.

Audience Engagement : Personalisation engines and recommendation systems are becoming more sophisticated, enabling hyper-targeted content delivery.

Business Operations : Backend processes including scheduling, resource allocation, and financial management are being automated through AI systems.

Based on current trends and technological trajectories, several key developments are likely to reshape the media industry over the next three years:

By 2026, we expect to see the emergence of "AI-native" media organisations that are built from the ground up to leverage artificial intelligence. These companies will:

Operate with radically different cost structures : Traditional media companies spend 60-70% of their budgets on human resources. AI-native organisations may operate with 20-30% human costs, allowing them to produce content at unprecedented scale and efficiency.

Deliver hyper-personalised content : Rather than broadcasting the same content to mass audiences, these organisations will create individualised content streams for each user, adjusting tone, format, and subject matter in real-time.

Implement continuous content optimisation : Using real-time feedback loops, content will be continuously refined and adapted based on audience response, engagement metrics, and emerging trends.

The traditional separation between content creation and distribution will dissolve as AI enables:

Dynamic Content Assembly : Stories will be assembled from modular components (text blocks, images, video clips, audio segments) that can be recombined for different audiences and platforms simultaneously.

Platform-Optimised Delivery : The same core content will be automatically adapted for different platforms – from long-form articles for web to short-form videos for social media – without human intervention.

Audience-Responsive Narratives : Content will adapt its structure, length, and complexity based on real-time audience feedback and engagement patterns.

By 2028, we anticipate the development of comprehensive synthetic media ecosystems where:

Virtual Personalities Drive Content : AI-generated personalities will become major media figures, hosting shows, conducting interviews, and building audiences comparable to human celebrities.

Immersive Experience Integration : The boundary between traditional media consumption and interactive experiences will blur, with audiences participating in content creation through AI-mediated interfaces.

Real-Time Event Synthesis : Major events will be covered by AI systems that can generate multiple perspectives, languages, and formats simultaneously, providing comprehensive coverage within minutes of occurrence.

The next three years will see the establishment of comprehensive regulatory frameworks addressing:

Content Attribution Standards : Mandatory disclosure of AI involvement in content creation, potentially through blockchain-based verification systems similar to LettsCore's approach.

Creator Rights Protection : New legal frameworks protecting human creators from unauthorised AI training on their work, with compensation mechanisms for licensed use.

Quality and Accuracy Standards : Industry-wide standards for AI-generated content accuracy, with liability frameworks for misinformation and errors.

Immediate Actions (2025) :

Medium-term Strategy (2026-2027) :

Long-term Positioning (2028) :

Platform Strategy : Focus on building AI-native platforms that solve specific industry pain points, similar to LettsNews's approach to democratising newsroom technology.

Technology Integration : Leverage existing AI infrastructure while developing specialised applications for media use cases, rather than attempting to build foundational AI models.

Regulatory Compliance : Build compliance and ethical AI practices into core systems from the beginning, anticipating future regulatory requirements.

Skill Development : Invest in AI literacy and learn to work collaboratively with AI systems rather than viewing them as replacement threats.

Specialisation : Focus on uniquely human skills – investigative journalism, emotional storytelling, cultural commentary – that are difficult for AI to replicate.

Platform Diversification : Utilise platforms like LettsCore that provide attribution and monetisation for human-created content in an AI-dominated landscape.

Copyright infringement is looming front and centre as the new battleground for the 21st century as these massive machine bots trawl carefree over our painstakingly created content and media. The industry must address:

As AI-generated content becomes ubiquitous, maintaining information quality and combating misinformation becomes increasingly challenging. Solutions include:

The rapid transformation of media economics will have significant social implications:

The media industry is experiencing its most significant transformation since the advent of the internet. The convergence of generative AI, blockchain technology, and new platform models is creating unprecedented opportunities for innovation while fundamentally challenging traditional business models and workforce structures.

Success in this new landscape will require organisations to balance technological adoption with human creativity, efficiency with quality, and innovation with responsibility. The companies that thrive will be those that view AI not as a replacement for human creativity but as an amplifier of human potential.

The emergence of platforms like LettsNews and LettsCore demonstrates that the future of media lies not just in adopting AI tools but in reimagining the entire content ecosystem. These platforms address critical challenges around attribution, monetisation, and trust that will become increasingly important as AI-generated content becomes mainstream.

LettsNews users can write once and distribute to multiple different places, including their blog, at the push of a button, doing what used to take many hours in just a few minutes. This efficiency gain, multiplied across the entire media ecosystem, represents a fundamental shift in how information is created, distributed, and consumed.

The next three years will be critical in determining whether this transformation leads to a more diverse, accessible, and creative media landscape or one dominated by a few AI-powered giants. The choices made by media organisations, policymakers, and technology developers today will shape the information ecosystem for decades to come.

Organisations that start their AI transformation now, with careful attention to ethical considerations and workforce development, will be best positioned to thrive in the AI-native media landscape of 2028. Those that delay risk being left behind by competitors who have successfully integrated AI into their core operations and value propositions.

The revolution is already underway. The question is not whether AI will transform media, but how quickly and effectively organisations can adapt to harness its potential while preserving the human elements that make media compelling, trustworthy, and valuable to society.

This analysis is based on current market data, industry trends, and emerging platform developments as of August 2025. The predictions and recommendations should be regularly updated as the rapidly evolving AI landscape continues to develop.

To implement an AI-driven, automation-first approach, startups need to assemble a tech stack and toolset that can handle as much of the work as possible with minimal human intervention. Essentially, you’re building a “startup operating platform.” Let’s break down the essential tools and systems that enable scalable venture building, often used in combination as part of platforms like LettsGroup’s AI VentureFactory :

Centralised Venture Management Platform: At the core, it’s important to have a single platform or dashboard where you can manage the venture’s process . This includes tracking the venture’s progress through stages (as per a methodology like Innov@te) and keeping all team tasks and data in one place. For example, the AI VentureFactory itself serves this role - it provides a structured approach to venture building, guiding the team on what to do next. Even if not using that specific product, a startup can set up an equivalent by integrating project management (like Jira or Trello), documentation (like Notion or Confluence), and communication (Slack, etc.) and enforcing their use for all tasks. The key is visibility and structure : everyone knows the current goals, tasks, and status. Modern platforms often have AI features to summarise project status or remind the team of overlooked tasks.

Integrated Software Apps Suite: A scalable venture should avoid a patchwork of disconnected tools. Instead, use an integrated suite for core functions . LettsGroup’s platform, for instance, bundles apps for marketing automation, CRM, productivity, project management, tasks, issue tracking, investor management and more. A startup might achieve a similar setup by choosing a main hub (say, an enterprise SaaS like Zoho One, or a combination of Slack + Monday + HubSpot + etc. that are connected). The rationale is that when these systems talk to each other, you can automate workflows between them. For example, when a new lead comes in via a web form (marketing system), it automatically creates a deal entry in the CRM and alerts someone on Slack. Or when developers push new code (tracked in issue tracker), it updates the project timeline. Seamless data flow between functions means less manual handoff and fewer things falling through cracks. It also enables unified analytics (seeing the whole funnel from marketing to sales to support).

AI and Automation Tools: This is the special sauce. You want AI tools embedded in various parts of your operations:

Modern venture building platforms like LettsGroup's AI VentureFactory integrate a suite of software apps (marketing, CRM, project management, etc.) along with a library of leading AI tools and templates. This provides startups with an out-of-the-box tech stack where every essential function is ready to be automated and scaled.

Venture Resource Planning (VRP) System: Borrowing the analogy from ERP in large companies, a startup should implement its own version of an integrated resource planning system early. This means having a clear handle on resources - not just financial, but human resources, timelines, and milestones. Tools like Asana or Monday can serve as lightweight ERP for startups when configured well. LettsGroup's AI VentureFactory essentially acts as a full-scale VRP, coordinating all aspects of the venture. The benefit is that founders can see, for example, how a delay in product feature X might impact the marketing launch, or how hiring one more engineer might speed up a timeline – all in one place. It treats the venture holistically.

Scalable Infrastructure (Cloud and DevOps): On the technical side, using a cloud infrastructure that can scale on demand is foundational. This avoids the scenario where your product becomes a hit but the servers crash under load. Platforms like AWS, Azure, or Google Cloud with auto-scaling and managed services ensure you can handle growth without needing a big IT team. Coupled with this, DevOps automation (CI/CD pipelines, infrastructure as code) means new software releases and infrastructure changes can be rolled out rapidly and repeatedly. Many startups fail to implement good DevOps early and suffer when their engineering velocity slows or a deployment goes wrong at scale. A venture builder will set up things like automated testing, continuous integration, and one-click deployment from the start, so the tech backbone is solid. This also ties into security - automated security scans, backups, and monitoring should be in place to protect the venture as it grows (a breach or major outage can be fatal to a young company).

Data Analytics and Feedback Systems: A key to scaling is listening to data. Implement analytics in your product (e.g., Mixpanel, Google Analytics, custom dashboards) to track user behaviour and business metrics. Then use AI to interpret that data. For example, AI can segment users and find patterns (“users who do X are 30% more likely to convert to paid”). Having a good data pipeline (even something simple like daily reports) that is set from the beginning means by the time you have lots of users, you already have historical data and insights. Newer AI analytics tools can even automatically run experiments or optimisations - for instance, an AI pricing tool that adjusts your prices based on demand to maximise revenue.

Collaboration and Knowledge Management: As the team grows (even if it’s from 3 to 10), having a centralised knowledge base is important so that information scales and isn’t lost. Tools like a wiki or even an AI Q&A bot trained on your company’s docs can be invaluable. LettsGroup incorporated a wiki-style system with AI into its platform to ensure knowledge is organised and accessible. This means when a new team member joins, or when an investor asks for documentation, everything is there. It also means less reliance on any one person’s memory.

Investor & Stakeholder Management Tools: If the venture will interface with investors, having a system to manage investor updates, cap tables, and due diligence documents is helpful. There are tools that automate the creation of update reports (pulling metrics into a nice template) and manage the cap table for you (e.g., Carta). These reduce the headache of financing so founders can focus on the business. The venture factory approach typically ensures startups are “funding-ready” at each stage by prepping these materials systematically. Even if not raising money, having your key metrics and board materials always up-to-date is good discipline and saves scrambling later.

In essence, the toolkit for an automation-first startup spans every function of the business . A useful way to think of it is: list out all the roles a large company would have (engineer, product manager, sales rep, marketer, finance, HR, customer support, etc.) and then pick a tool or process that covers each of those roles in a minimal way initially. Many of those “roles” can be partly filled by AI or software in an early startup. For example:

The goal is minimal human overhead, maximal output. Each tool should ideally reduce the need to add a person. When the time does come to add team members, they step into a structured environment where tools handle repetitive tasks and they can focus on higher-level contributions.

A potential pitfall is tool overload - it’s easy to adopt a ton of SaaS tools and create complexity. That’s why integration and centralisation are stressed. It’s better to have a cohesive framework (even if composed of multiple tools) than dozens of disconnected apps. This is why something like LettsGroup’s all-in-one platform is attractive: it provides a curated stack that already works together. But even without that, a startup should invest time in selecting tools that play well together and setting them up properly. Consider using open APIs and webhooks to connect any tools that aren’t natively integrated.

Security and privacy considerations also come with using many tools and AI services. Startups need to ensure they protect customer data when using third-party AI APIs, for example, and that they comply with regulations (like GDPR) even when automating processes. Automation doesn’t remove the need for oversight; it changes the type of oversight needed (from supervising people to auditing systems). So establishing good data governance early is wise.

To summarise, the essential stack for scalable venture building includes:

By putting this toolkit in place, even a very small team can project the capabilities of a much larger organisation. The mantra is: Automate early, automate often. Every hour saved by automation is an hour that can be spent on strategy, customers or innovation - the things humans do best. This tool-enabled efficiency is exactly how a startup with 5 people can compete with a company of 50. It’s the engine that powers the new style of venture building. With the right systems, a startup essentially gains “digital employees” in the form of AI and software routines, which work 24/7, don’t make mistakes (if set up correctly), and scale effortlessly.

Equipping a startup with these tools is arguably now as important as hiring the right people. In fact, part of “hiring” in the future might be “hiring” AI services - choosing which AI will handle your customer support or your code reviews, for example. Entrepreneurs and investors should view a solid automation tech stack not as a luxury but as core infrastructure for success in modern venture building. Those who leverage it will have a strong advantage in cost and agility over those who don’t.

The next section of our guide to 'New Style Venture Building' is 'Implications for Venture Capital' - coming soon.

If you're a tech or digital startup founder, build faster and better with LettsGroup's AI VentureFactory .

Last month LettsGroup's AI VentureFactory, launched to external startup founders and investors. Already gaining traction with new startups subscribing, the team is developing channels with VC's, accelerators and other startup focussed apps. In late June, the VentureFactory's new 'Investor' plan launched - providing previously unattainable investor intelligence with a unique mirror 'pit' of portfolio or prospect companies. This month, the team has been extending the platform's innovation agent with more advanced AI models for one-click plans, strategies, tools and stage by stage deliverables tailored to the business.

LettsNews launched in public beta last week. The next-generation newsroom platform is designed to enhance the future of independent media - it offers freelance journalists, independent content creators, and small media teams a powerful suite of AI-powered publishing, distribution and promotional tools. It delivers leading newsroom tech for the our information environment:

Users can sign up for free, and upgrade to more advanced plans at LettsNews.com .

LettsArt is rolling out LettsArt 2.5 (Phase 1) to its growing user base in the coming days. It includes:

Following the initial Phase 1 roll-out, LettsArt 2.5 is extending further to include additional social features and auto-distribution of digital art to leading 3rd party online art marketplaces. The team is excited to bring the benefits of LettsArt 2.5 to the 1,100 galleries and 3,500 users that rely on its AI no-code software for the art world.

LettsCore will be fully live in public beta in August. The three year deeptech R&D project is delivering a groundbreaking new AI and blockchain content management system that gives creators and content-rich companies total control over ownership, monetisation and intelligent distribution. It turns every piece of content into an autonomous asset. Beyond this, it is an exciting, next generation content operating system that's built to scale globally with lower compute costs, while transforming content at the atomic level into intelligent, secure, revenue generating assets. With its successful private beta LettsCore will, post launch, already have thousands of users on its platform.

Find out more at LettsCore.com .

LettsSafari is busy extending its community capabilities and reach, and planning a series of social campaigns designed to give it a wider reach in the UK and abroad. This UK based, mass market rewilding platform has nearly completed the first phase of its build, offering a network of private rewilding safari parks which use its pioneering smaller-scale rewilding system, blended with a unique digital, subscription based mediatech model. With phase 1 soon completed, the team will start work on the next phase of its development, planning to build and operate national safari parks, starting in the UK, that are fully open to the public. With its next phase of growth, LettsSafari's rewilding platform can make a considerable, system-level impact on nature restoration and conservation in the UK and abroad.

We are excited that Jot has adopted LettsGroup's AI VentureFactory, aiming to become one of the first startups to build 100% with AI. The new consumer tech startup is going after a sizable category with an innovative AI-native offering. The VentureFactory provides Jot with full-scale AI venture building, while its team is using AI heavily to build its product and tech. They are also working on an innovative go-to-market launch campaign that is both AI designed and created. They will use LettsNews for AI-powered news/story generation and distribution.

We highlight just a few ventures in each monthly edition of LettsGroup's NewsFlash. To explore other companies using LettsGroup's AI VentureFactory go to LettsGroup/ventures.

A frequent downfall of startups is hitting a wall when it’s time to scale operations . In the early days, a startup often focuses intensely on developing a product and acquiring a handful of early customers (the MVP stage and initial traction). Founders pour their energy into refining the product-market fit and pleasing those first users or clients. This focus is necessary, but it can become a trap: startups often neglect building the operational platform and systems that will be needed to support growth beyond the early adopters. The result is that when demand starts to increase, the startup’s internal processes, technology infrastructure, or team organisation can’t keep up - leading to breakdowns, unhappy customers, or a growth plateau.

This scaling challenge has been observed time and again. As one industry veteran noted, “After achieving product-market fit, an early-stage company’s next step is scaling its operations... Around 80% of startups fail at this stage as they struggle to transition from emergent (early niche market) to mainstream” . In other words, even many startups that clear the initial hurdles fall apart when trying to grow. Why? Common issues include: accumulation of technical debt (the product wasn’t built with scalability in mind), lack of processes leading to chaos as team grows, inability to consistently onboard and service a larger customer base, and the founding team’s struggle to delegate or shift from “building the product” to “building the company.”

One specific mistake is focusing on short-term custom solutions to please initial customers while ignoring the bigger picture architecture. For instance, a startup might hastily add features or hacks to land a few big clients. It “fulfils immediate needs” and onboards customers first, planning to fix the foundation later - but later never comes. As a tech consultancy described, “Startups often focus on customising features for a product to acquire a customer. However, they neglect generic design and product capability. They don’t go beyond the initial needs and end up with a product not fit for a larger audience… Often when startups add features, they ignore the foundation. The product might not look like it has problems at first… But those issues can haunt the engineering team later.” . This encapsulates the problem: neglecting scalability architecture early on leads to painful reckonings down the road. Many startups realise too late that their codebase can’t handle 100x users, or their manual processes don’t scale, forcing a costly re-engineering (sometimes referred to as “scaling the tech debt cliff”).

The new style venture building directly tackles this scaling challenge by building the operational platform in tandem with the product . This is a key difference in philosophy. Instead of deferring thinking about scale until after some milestone, the venture factory approach embeds scalability considerations from day one. For example, recall LettsGroup’s “Size Zero” philosophy, which is about designing a startup’s model to be scalable and efficient from the start. Practically, this means making early decisions that might slightly slow initial development but hugely pay off later: choosing a robust tech stack that can handle growth, implementing automation for onboarding and support even when the user count is small, establishing basic processes and documentation early, and so forth. It’s analogous to writing clean, modular code vs. quick-and-dirty code - the latter is faster to prototype, but the former is easier to scale and maintain.

Lean Startup methodology, popular in the last decade, taught founders to experiment quickly and focus on the core value (to avoid building stuff people don’t want). That was useful for avoiding premature scaling of the product . However, it also often led to minimalistic operations - which is fine until the startup needs to accelerate. The new approach doesn’t reject lean principles; rather, it augments them by ensuring that once there is a viable product and some customers, the startup has an execution platform ready to ramp up . Think of it as laying a stronger foundation under that MVP so that adding more floors (users, revenue) won’t cause a collapse.

A telling symptom of neglecting the operational platform is when startups try to scale, they respond by just hiring more bodies to plug holes. For example, if support tickets spike, they hire a bunch of support reps without addressing why support volume is high or how to automate parts of it. This can lead to ballooning costs and complexity without truly fixing underlying issues. An automation-first venture would instead ask: can we deploy a better knowledge base or AI chatbot to handle common questions? If so, the startup can grow support capacity without linear headcount growth. Similarly, instead of handling sales leads manually one-by-one, an operationally savvy startup will set up a CRM with automated nurture campaigns early, so when lead volume increases, the system scales rather than just the sales team. It’s these kinds of scalable systems that many startups lack when they need them.

The venture factory methodology enforces platform-building as part of scaling. In the Innov@te framework, as a venture moves from Market Entry to Market Development and Dominance, there are steps explicitly about strengthening infrastructure and processes. For instance, implementing a solid DevOps pipeline, establishing customer success processes, building partnerships for distribution, etc., are all tackled in a structured way rather than ad hoc afterthoughts. LettsGroup even extended their venture factory model to include a concept of universal, scaled distribution systems - for example, they built a proprietary Web3 content management and syndication system to support content-heavy ventures at scale. That kind of forward thinking - creating a “warehouse and distribution platform” for ventures - exemplifies how venture builders aim to solve the scale problem upfront. In simpler terms, they don’t just ask “How do we build this product?” but also “How will we deliver this efficiently when we have 10x or 100x more customers?”

Another aspect of overcoming the scaling challenge is leadership adaptation (discussed more in the next section). Often, the founding team that was great at invention and early hustle isn’t experienced in scaling operations. Traditionally, this is when investors push to hire “professional” managers (sometimes even replacing founders with a seasoned CEO). But that approach can backfire if done too early or without alignment. The new style suggests an alternative: augment the founding team with systems and targeted expertise rather than wholesale managerial takeover . For example, keep the founder at the helm (maintaining the startup culture and urgency) but support them with an AI-driven management cockpit (the venture platform that keeps operations organised) and perhaps a few strategic hires or advisers for specific scale functions. This avoids the common pitfall of a corporate manager coming in and slowing things down with bureaucracy ( the 'Manager Mode' problem ). Instead, the founder can remain in “Founder Mode” while supported by automation that provides some of the benefits of structure without the stifling rigidity.

In practical terms, a startup overcoming scaling challenges will focus on a few key areas:

The net effect of addressing these areas early is that the startup experiences a smoother growth curve. Instead of hitting a hard ceiling and panicking to re-architect under pressure (which can kill momentum and morale), the company can glide through inflection points. It’s worth noting that even large companies can fall into scaling traps if they outgrow their systems - but startups are more vulnerable because they have less buffer. The venture building platforms try to lend startups some of the maturity and robustness that larger firms have, without requiring the startup to become slow or overly bureaucratic.

One more insight: Scaling is not just about technology; it’s holistic. Sometimes a startup fails at scaling not due to tech but due to organisational issues - communication breakdown, losing the innovative culture, etc. The founder vs manager mode discussion (coming soon) touches on how the team must evolve their mindset. The venture factory approach, by maintaining a structured yet entrepreneurial environment, aims to keep the team cohesive through growth. Everyone uses the same platform, sees the same dashboard of progress, and follows the same playbook, which can reduce confusion as more people join. This way, scaling doesn't mean losing the startup’s original spirit, but rather amplifying it with new resources.

In conclusion, overcoming the scaling challenge requires planning for scale from the start . New style venture building embeds this philosophy: scaling is not an afterthought, it’s stepwise preparation. By developing the startup’s “operating system” (processes, systems, team capabilities) alongside the product and early customer acquisition, a venture can avoid the common traps of rapid expansion. When done right, scaling up becomes a more predictable, controlled process - more evolution than explosion. The use of AI and automation is a crucial enabler here, as it allows a tiny startup to punch above its weight class in operational excellence. As the saying goes, “Don’t wait to dig the well until you’re thirsty.” The venture factory digs the well early, so when the thirst of success comes (i.e. demand surges), the startup is ready to drink deeply and grow rather than choke.

Next section of our guide to 'New Style Venture Building' - Essential Tools & Systems for Scalable Venture Building.

If you're a tech or digital startup founder, build faster with LettsGroup's AI VentureFactory .

One of the most game-changing aspects of AI-driven venture building is how it alters the economics of starting and scaling a business . Traditionally, to build a startup into a multi-million revenue company, you needed a significant team and a lot of capital. Think of a typical successful startup that reaches, say, $10M in annual revenue - it often has dozens if not hundreds of employees and has raised several rounds of venture capital (tens of millions of dollars) to get there. The new style of venture building turns that formula on its head, showing that a small team - sometimes just 2-5 people - can operate a multi-million dollar venture by leveraging AI and automation. This dramatically lowers the capital requirements and increases the potential return on human effort.

In an AI-enabled environment, human capital (talent and knowledge) becomes more valuable than financial capital , because technology magnifies what a small team can do with a given amount of money. As one analysis put it, “What previously demanded years of development and millions in funding may now be accomplished in months at a fraction of the cost” . This phenomenon might be called “venture building deflation” – the cost (in time and money) to reach certain milestones is dropping rapidly thanks to AI. For example, tasks that would have required hiring a team of engineers for months can now be done in weeks with generative AI coding assistants; customer support that would have required a 10-person support team can be largely handled by AI chatbots, and so on. The result is that a startup can reach product launch, and even initial scale, with far fewer people and dollars than ever before.

Breaking it down, here are several ways AI and automation are changing startup economics:

From Labour-Intensive to Software-Intensive: In a traditional startup, as the business grows, headcount grows almost linearly to handle the work (developers to build features, sales reps to acquire customers, support staff to service users, etc.). In an AI-first startup, growth can be decoupled from headcount. AI can handle many tasks that humans would otherwise do . For instance, modern AI can transform a concept into preliminary designs and even functional code. Website and app front-ends can be generated automatically. Marketing emails and social media content can be drafted by AI. One or two engineers equipped with AI coding tools can build what a larger team might have in the past. The net effect is that the marginal cost of serving each new customer is much lower when software (which replicates cheaply) does the work instead of new hires. This is why we see companies like WhatsApp achieve staggering ratios of value to employees – WhatsApp had only 55 employees when acquired for $19 billion (which works out to about $345 million in value per employee ). That was in 2014, even before the latest AI advances - it was achieved by extreme focus on automation and a highly scalable product architecture. Today’s AI tools push this leverage further. It’s plausible now for two or three entrepreneurs with AI “assistants” to run a company reaching multi-million revenues , something essentially impossible a decade ago.

Capital Efficiency and Reduced Burn: Because an automation-first startup needs fewer employees, its operational burn rate (monthly expenses) can be much lower for a given level of progress. Payroll is often the highest cost for startups , so cutting that down through AI assistance means capital lasts longer. Additionally, AI can optimise other costs - for example, dynamically manage cloud resources to keep infrastructure spend efficient, or optimise marketing spend by quickly finding what works. All this means a startup might only need hundreds of thousands of dollars, not millions, to reach a critical milestone (like positive revenue or a large user base). This is exactly what we see with some “indie” startup successes: a single founder or tiny team reaches $1M+ annual revenue without any external funding, by heavily automating and staying lean. A cited example is BuiltWith , a web technology tracking service that reportedly generates around $14 million per year with essentially one full-time employee. That kind of one-person multimillion-dollar business simply wouldn’t be feasible without modern software doing most of the heavy lifting – BuiltWith continuously crawls websites and compiles data, work that would require an army of analysts if done manually. We can expect more such cases as AI further automates knowledge work.

Faster Time-to-Market and Pivoting: AI-driven development not only saves money, it saves time. And in startups, time is money (or survival). Getting from idea to product-market fit quickly is crucial before competitors or market changes intervene. Automation accelerates development cycles - code generation, rapid prototyping, instant customer feedback analysis, all can happen faster. This means startups can reach revenue in months instead of years . A faster time-to-market reduces the total capital needed (because you’re spending for fewer months before revenue starts coming in). It also means if something isn’t working, a pivot can be made sooner with less wasted effort. The new venture building ethos emphasises being systematic but also fast . For example, LettsGroup's Innov@te system has structured steps, but those steps can be executed in rapid sprints with AI tools, potentially cutting down the overall timeline to scale. By compressing development and iteration cycles, AI-driven startups can do in 6 months what might take others 18. This speed advantage can translate to lower costs (less overhead burn) and a better shot at capturing market opportunities.

Different Cost Structure (Opex to Capex shift): In a traditional startup, increasing scale means increasing operating expenses (mainly salaries). In an AI-driven startup, a larger portion of costs will be in software, cloud computing, and AI services (which are more like variable costs or fixed subscriptions). As noted in one analysis, the core expenses shift towards “software subscriptions, hardware, and computational resources” plus a few experienced leaders, instead of dozens of mid-level staff. This is more akin to a capital expenditure upfront to build and configure automation, and then very low marginal cost afterwards. It’s the classic technology business dynamic (high fixed cost, low variable cost) taken to the internal operations of the company itself. The positive side of this is that once those systems are set up, scaling revenue further becomes extremely profitable (since you don’t need to hire proportionally). An AI-powered venture can thus achieve profitability much earlier in its life because its costs don’t balloon at the same rate as its revenues. Reaching breakeven or profitability faster also reduces reliance on external capital.

Human Talent as a Multiplier: The role of the human team in an automation-enabled startup shifts to higher-level tasks: strategy, creative decisions, complex problem-solving, and relationships (partners, key customers). Freed from drudgery, a small team of high-skilled individuals can focus on big-picture moves . This makes those individuals incredibly leveraged. It also means that having the right people (who are adept at using AI tools) is vital – a concept sometimes called the rise of the “AI-native entrepreneur.” In fact, prompt engineering (the skill of instructing AI systems effectively) may become a core competency of startup teams. The economics here is that a couple of talented people with AI can outperform a large traditional team, so the value concentrates in those key people. Investors and venture builders will likely start placing even more premium on founding teams that are technically proficient and adaptable to AI tools. In other words, talent that knows how to drive the AI “supercar” will be far more valuable than a larger crew that doesn’t . This could also affect hiring – startups may hire fewer but more “unicorn” employees (those who can wear many hats with AI augmentation).

To illustrate the new economics, consider a hypothetical scenario: A decade ago, a SaaS startup aiming for $5M ARR (annual recurring revenue) might have needed ~50 employees and maybe $10M+ in venture funding to reach that goal over a few years. In the new model, one could imagine reaching the same $5M run-rate with perhaps 5-10 employees and maybe $1-2M of funding (or even none, if revenue is reinvested), by leveraging AI to handle tasks like customer onboarding, support, product updates, etc. The return on investment for both founders and investors in the new model could be significantly higher. A small team owning a $5M revenue business is a great outcome for those founders (with far less dilution of ownership since they didn’t need big VC rounds). For investors who do fund such companies, they might spread smaller checks across more startups, expecting each to be more capital efficient.

It’s important to note that this isn’t just theory - we already see trends supporting it. The cost of starting a startup had already dropped due to cloud computing and open-source software (as compared to the 1990s when you needed to buy servers, etc.). AI acceleration is the next step. A recent commentary argued that a small founding team with AI support could effectively run a tech company generating multi-millions in revenue , since “entrepreneurs primarily need to provide strategic direction while AI handles execution” of many tasks. We’ve seen extreme examples like a one-person company relying entirely on AI “employees” for marketing – doing everything from market research to content creation solo, which drastically cuts costs while still allowing growth. When that one person can generate output equivalent to a 10-person team, the economics (and lifestyle) of startups change: more entrepreneurs can sustain companies without seeking huge investment or incurring crippling burnout.

Another economic shift is in risk profile . If building a startup is cheaper and faster, it becomes less financially risky to try new ideas. This could lead to a greater number of experiments (since each one requires less funding), which in turn can increase innovation. It also means investors might tolerate lower exit values per startup since they invested less - but if more startups succeed overall (even at moderate levels), the total returns can still be attractive. This suggests a possible move away from the “unicorn or bust” mindset. Indeed, LettsGroup explicitly states that they're AI-native venture building platform (AI VentureFactory) is designed to help develop profitable, sustainable enterprises rather than expecting every tech company to be a billion-dollar valuation . If the cost to build a solid $50M company is small, that can be a great outcome for all involved, whereas in the old model only a $1B+ exit would return the large VC investment. In that sense, AI-driven venture building could produce an “army of centaurs” (i.e., $100M companies) rather than a few unicorns, but done systematically and efficiently.

In summary, the new economics of venture building are defined by high leverage and high efficiency . A small team can do what a large team did before, meaning labour is no longer the limiting factor. Capital requirements drop, timelines shorten, and the focus shifts to making maximal use of technology. This bodes well for founders (who can retain more equity and control by not needing as much outside money) and for the startup ecosystem at large (as more ideas can be tried with the same amount of resources). It does, however, challenge existing players like venture capital firms to adapt - a topic we will explore later.

Next section of our guide to 'New Style Venture Building' - Overcoming the Scaling Challenge.

If you're a founder with a tech or digital startup, get going with LettsGroup's AI VentureFactory today.

FOR IMMEDIATE RELEASE

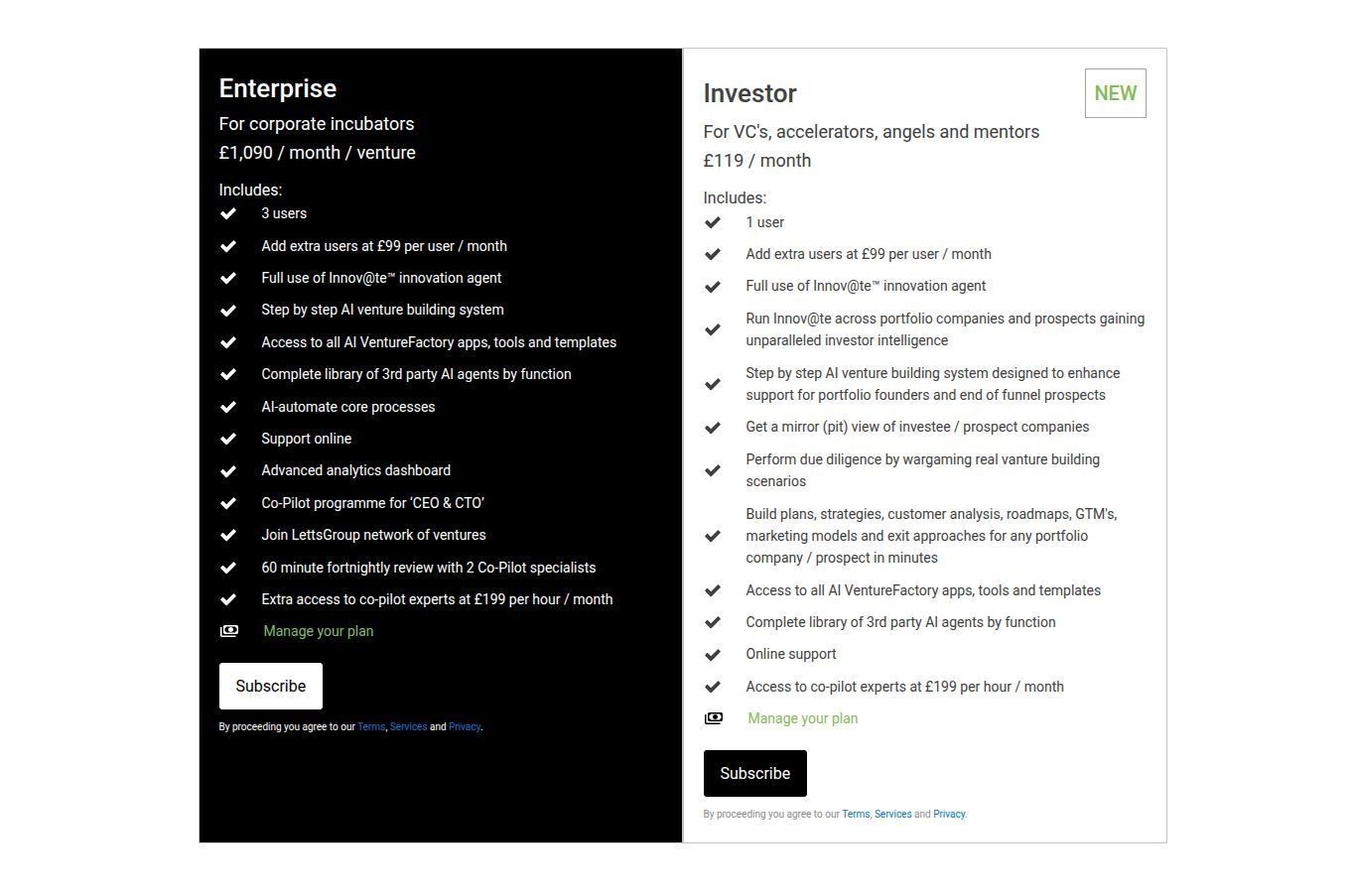

London, 19 June 2025 – LettsGroup today unveiled its powerful new Investor plan for AI VentureFactory, a next-generation AI dashboard designed to give investors unprecedented intelligence and control across their portfolios. Available now at letts.group/pricing, the Investor Dashboard offers a radical rethinking of venture management - transforming how capital identifies, shapes, and scales early-stage and growth businesses

For the first time, investors gain what LettsGroup calls a “pit view” into portfolio and pipeline operations: a live, dynamic workspace to develop venture plans, go-to-market strategies, customer blueprints, marketing models, and exit frameworks - not in months, but minutes.

Built by investors, for investors, the dashboard enables institutional-grade venture building with zero-code ease. It includes full access to LettsGroup’s entire VentureFactory suite, plus a curated marketplace of third-party AI agents organised by function - from product to finance to GTM.

Whether refining product-market fit or pressure-testing an exit thesis, the Investor dashboard empowers investors to run scenario simulations, craft strategic interventions, and support founders at speed.

“Investor is not just a dashboard - it’s a cockpit,” said Philip Letts, LettsGroup's CEO. “It turns passive capital into a builder of strategic value.”

Innov@te™ Agent Access: LettsGroup’s flagship AI venture strategist, now deployed across your portfolio and pipeline.

Real-Time Strategy Lab: Build venture plans, growth models, and GTM frameworks in under 10 minutes.

Live ‘Pit View’: A mirror into your startups’ operational layers - and a tool to shape them.

Third-Party AI Agent Library: Curated agents for marketing, sales, finance, ops, and more.

Collaboration & Support: Online AI assistance and team-based workflows.

Priced at £119/month for single users, with £99/month for additional team seats, the Investor plan delivers boardroom-level strategy to firms of any size - making it a compelling new tool for VCs, angel syndicates, family offices, and operator-investors.

LettsGroup’s AI VentureFactory is already trusted by a growing base of startups, scale-ups, and innovation labs. With Investor , the platform now delivers on the other side of the table - where capital meets creation.

Start building smarter today at letts.group/pricing.

Peter Prince - [email protected]

—ENDS—

We are publishing this definitive guide to new-style venture building section by section, week after week, over the coming weeks - starting today. It's the ultimate guide for startup founders, investors and advisers.

Venture building is the process of taking an idea and developing it into a successful, scalable business. Traditionally, this process has been highly artisanal and ad hoc, often relying on the intuition and heroic efforts of founders. Unfortunately, the outcomes of the traditional approach are sobering: around 60% of startups in the UK fail within their first three years, with only about 42% surviving five years. Globally, the picture is similar - the conventional venture model accepts that perhaps one in ten startups will succeed on a large scale, while the rest falter. These high failure rates point to a fundamentally broken process for building and scaling new ventures. In short, too many resources are wasted and too many good ideas never reach their potential under the old model.

Why does traditional venture building struggle? One core issue is that each startup “reinvents the wheel.” Founders typically must learn how to build a company through trial and error, discovering what works in product development, go-to-market, team building, and financing largely on their own. Little of this hard-won knowledge is codified or transferred to others. This leads to massive inefficiencies and repeated mistakes across the startup ecosystem. Another issue is an excessive focus on short-term outputs (like getting a minimal product and first customers) without developing the underlying systems and operations needed for long-term scale. This myopic focus means many startups flame out when it’s time to scale up, as they lack the infrastructure to support growth.

Enter “new style” venture building - an AI-driven, automation-enabled approach that aims to fundamentally improve the venture creation process. In contrast to the ad hoc traditional method, this new software-driven approach treats venture building as a disciplined, repeatable process - more like manufacturing than alchemy. Just as Henry Ford revolutionised car production with the moving assembly line, the new style of venture building applies automation, data, and process engineering to systematically take startups from idea to scale. Advanced technology (especially artificial intelligence) is leveraged at every stage to reduce manual effort and human error. The goal is to double or even triple venture success rates by eliminating guesswork and bringing science to the art of entrepreneurship.

Crucially, AI-driven venture building isn’t just an incremental tweak - it promises a paradigm shift for how startups are built. It involves using AI tools and software platforms to guide founders through proven frameworks, automating routine tasks, and augmenting human decision-making with data-driven insights. This guide provides a comprehensive look at this new style of venture building. We will compare it to traditional methods, explore a leading example (LettsGroup’s AI VentureFactory and Innov@te™ methodology), and examine how automation-enabled scaling changes the economics of startups. We’ll discuss strategies to overcome scaling challenges, the tech stack needed for automation-first growth, and implications for venture capital investors. We’ll also look at case studies of startups that scaled rapidly with small teams thanks to AI and automation, and peer into the future where venture capital itself may operate as a platform.

The promise of AI-driven venture building is a startup ecosystem where a small, agile team can achieve what used to require an army of employees and massive capital. By the end of this guide, entrepreneurs and investors will understand how to leverage this approach to build more resilient, scalable ventures - and perhaps revolutionise the innovation economy in the process.

Traditional venture building has often been likened to navigating uncharted waters with no map - each startup finds its own way, and many sink. In the current ad hoc, artisanal approach, success depends heavily on the founder’s personal hustle, luck, and ability to learn on the fly. There is typically no repeatable blueprint; one founder might obsess over product features while another focuses on sales, and each builds their company with unique, improvised processes. This artisanal model leads to huge variability in outcomes and a low signal-to-noise ratio in terms of what works. As noted in one analysis, building startups today remains “largely unchanged from decades past - reliant on founder intuition, trial-and-error methodology, and highly variable approaches,” creating limitations that perpetuate high failure rates. In most industries, such a 90% failure rate would be unacceptable, but in startups it has long been considered the cost of doing business.

By contrast, the AI-driven, automation-first approach to venture building is about moving from craft to manufacturing discipline. Instead of every startup reinventing processes, the new style codifies the venture-building journey into defined stages, steps, and best practices. For example, LettsGroup’s Innov@te™ framework encapsulates the process from idea to exit in 7 stages, 49 steps, each with sub-steps and checklists. This provides a standardised roadmap that any startup can follow, reducing reliance on individual gut feel. Knowledge that was once tacit and founder-dependent is made explicit and shareable. In effect, the new model creates an “assembly line” for startups - with ideation, validation, product development, market entry, growth, and even exit strategy all defined as repeatable sequences. Just as an automotive factory has a predictable process to ensure quality output, an AI-driven venture factory aims to produce viable startups with far more consistency than the old artisanal approach.

In essence, the traditional method is like artisan craftsmen hand-building custom cars (beautiful when it works, but expensive and failure-prone), whereas the AI-driven method is like a well-oiled factory assembly line for ventures. The latter doesn’t eliminate creativity - entrepreneurs still come up with innovative ideas - but it provides a process infrastructure to execute those ideas more reliably. This shift is akin to moving from building one-off prototypes to a repeatable manufacturing process for startups.

Notably, the venture studio model that emerged in recent years was a precursor to this new style. Venture studios brought more systematic company creation by generating ideas in-house and providing shared resources to launch multiple startups. However, venture studios often still rely on significant human involvement and bespoke efforts for each venture. The AI-driven venture factory takes this a step further - fully tooling the process with software and AI so that much of the venture building can be automated or centrally managed. For example, a venture studio might have advisers and templates to help startups, but an AI venture factory will have an actual software platform that executes tasks (like automatically running marketing campaigns or generating financial models) and guides the team through every step. It’s the difference between offering advice and providing an integrated machine that does the heavy lifting.

Further, a new style venture building software platform is considerably more cost effective and empowering than traditional venture studio body shops.

To summarise, the new style of venture building dramatically contrasts with the old: it is systematic where the old way is haphazard, data-driven where the old is intuition-driven, and platform-based where the old is individual-based. This difference matters because it attacks the root causes of startup failure. High failure rates are not simply a law of nature – they result from the inefficiencies and knowledge gaps of the traditional approach. By addressing those with structured methods and AI assistance, new style venture building hopes to create a world where startups succeed far more often, with less waste of time and capital in the process.

One of the leading exemplars of this new venture building paradigm is LettsGroup, a UK-based venture group that has built what it calls an AI VentureFactory platform powered by its Innov@te™ methodology. LettsGroup’s approach provides a concrete case study in how to implement AI-driven, automation-first venture building.

At the heart of LettsGroup’s model is the Innov@te™ methodology, which is essentially a detailed playbook for venture building. As mentioned, it consists of 7 core stages, 49 steps and hundreds of sub-steps, covering the entire journey from ideation to exit. The seven stages are defined as: (1) Creativity, (2) @HA Idea (a validated “aha” idea), (3) Concept, (4) Market Entry, (5) Market Development, (6) Market Dominance, and (7) Exit. This sequence starts from the spark of an idea and progresses through building a product, entering the market, scaling up, achieving leadership in the market, and finally preparing an exit (such as an acquisition or IPO). Each stage has specific objectives and checkpoints. For example, Market Entry would involve launching the product to early customers and iterating the go-to-market strategy, whereas Market Development would focus on expanding customer acquisition channels and refining the business model for growth.

What makes Innov@te more than just a static manual is that LettsGroup has turned it into a dynamic software platform - the AI VentureFactory. The AI VentureFactory is a suite of integrated apps, tools, and AI assistants that together function as a co-pilot for startup teams. It guides entrepreneurs through each of the 49 steps with templates, checklists, and AI-driven recommendations. For instance, in an early step the platform might prompt the founder to conduct market research, and even provide an AI tool to perform that research (scouring data or competitor info). Later, in a product development step, the platform might include a project management module pre-loaded with agile templates or user testing protocols. Everything is tied into one system so that the venture’s progress is tracked and each step feeds into the next.

Importantly, the AI VentureFactory doesn’t just advise - it automates and executes many tasks. LettsGroup describes it as a “hybrid AI suite” providing integrated apps for things like marketing, CRM (customer relationship management), productivity, project management, issue tracking, investor relations and more. For example, the platform can automate marketing campaigns using AI content generators, manage the sales pipeline through a CRM integrated with communication tools, and keep financial records up to date - tasks that normally would require hiring multiple roles or even agencies can be handled by the platform’s tools. An integrated AI chatbot assistant is even available (LettsGroup’s “How to AI Innovate!” bot) to answer founders’ questions and provide startup intelligence drawn from the venture factory’s knowledge base. In short, LettsGroup’s platform is like having a full operations team and mentor network in software form, available on-demand. Some have even called it the AWS of venture building!

The combination of Innov@te methodology and the AI VentureFactory platform yields what LettsGroup calls a “venture manufacturing system.” In fact, they explicitly compare it to a production system akin to ERP (Enterprise Resource Planning) but for startups – humorously dubbed “Innov@te VRP (Venture Resource Planning)”. The platform manages the process flows (the 49 steps), the data, and even the work allocation akin to an assembly line for new ventures. By doing so, it aims to reduce the cost of venture building, accelerate growth, and double success rates relative to industry norms. LettsGroup has stated the goal of helping ventures go from “zero to IPO” faster, more predictably and in a capital-efficient manner.

It’s instructive to see how LettsGroup’s approach differs in practice from traditional incubation or accelerator programs. A typical accelerator might provide a 3-month program of mentorship, some template documents, and a small investment for a considerable chunk of your company. LettsGroup’s VentureFactory, on the other hand, is positioned as an ongoing subscription-based co-pilot for building a company. In fact, LettsGroup offers tiered subscription plans for startups to use its platform: e.g. a Startup Lite plan starting at just £295 per month, with further plans for more advanced startups needing more features and support. This “startup building as a service” model shows how venture support is productised in the new approach. Instead of spending (or wasting) millions in trial-and-error, a startup might pay a predictable monthly fee to get the scaffolding it needs to grow. This aligns incentives as well - the venture factory is motivated to help the startup succeed so that it remains a paying (and growing) customer through the stages.

LettsGroup has already used its AI VentureFactory internally to build and launch several of its own “branded ventures.” These include LettsCore (a content management blockchain), LettsNews (an AI-powered “newsroom tech for everyone”), LettsArt (an AI co-code platform for the art world), and LettsSafari (a nature-tech venture). Each of these was developed using the same Innov@te methodology, demonstrating its versatility. By dogfooding their platform on their own ventures, LettsGroup could refine the process. They report that previous ventures they built (even before the AI platform) - such as Beenz (an early digital currency), SurfKitchen (mobile phone-top software), and Maistro (a business services marketplace) - achieved over $1 billion in combined peak valuation. Those experiences fed into the Innov@te framework as well. Now, with the AI VentureFactory, LettsGroup not only builds its own companies but also “co-pilots” external startups and corporate ventures on the platform. Essentially, they have turned venture building into a service that others can tap into.

A few aspects of LettsGroup’s methodology stand out as particularly innovative in venture building:

Size Zero Philosophy: In parallel with Innov@te, LettsGroup developed what they call a “Size Zero” design philosophy for ventures. This philosophy emphasises designing startups to be highly efficient and automated from day one - essentially building a scaled business model in miniature . The idea is to architect the company (its processes, cost structure, and tech) such that it can scale gracefully without massive complexity or cost explosion. For example, a Size Zero approach might impose frugality and automation early: only 5 staff managing what others would delegate to 50, by relying on software and automation (AI). LettsGroup uses this philosophy to help founders embed lean, agile, and cost-controlled designs into their ventures from the start. Combined with the Innov@te process, it acts like a modern just-in-time and continuous improvement system, analogous to how manufacturing evolved with techniques like Kanban or Six Sigma - but applied to growing a business.

Integrated Toolset and Data: The venture factory platform doesn’t just outline steps; it provides the tools to execute each step. LettsGroup’s platform integrates proprietary and third-party apps for everything from marketing automation to issue tracking to fundraising. All these tools produce data that feed into a unified dashboard, allowing real-time tracking of a venture’s KPIs and progress. This addresses a common blind spot in traditional startups where different tools are siloed (spreadsheets here, Trello boards there, etc.). By operating on one platform, a venture factory can apply AI analytics across the venture - spotting risks (e.g. if user engagement metrics are trending down) or opportunities (e.g. a marketing channel shows exceptional ROI) faster than a human team could. It essentially gives a bird’s-eye view of the startup’s health, something investors and founders typically struggle to get in real time.

Systematic De-risking: The Innov@te methodology systematically addresses common failure points. For instance, it enforces rigorous market validation in the Concept stage to ensure there is genuine demand before heavy scaling. It has steps for funding readiness - essentially preparing the startup to cross the “valley of death” between initial funding and Series A by ensuring the fundamentals (traction, metrics, pitch) are strong. By baking in these checkpoints, the venture factory tries to de-risk ventures early and continuously, rather than the traditional approach of discovering a fatal flaw only when it’s too late (e.g. running out of cash unexpectedly, or discovering no product-market fit after a big launch).