In the competitive arena of global innovation, the UK has established itself as Europe's venture capital powerhouse, attracting £8 billion in investment in 2023 alone. Yet beneath this headline figure lies a troubling reality: the venture building process remains fundamentally broken. With 60% of UK startups failing within their first three years and a five-year survival rate hovering at just 42.4%, we must confront an uncomfortable truth – the traditional approach to building and scaling ventures is profoundly inefficient.

This analysis examines two critical systemic failures in the venture ecosystem: unacceptably high failure rates and the persistence of artisanal, ad hoc venture building methods in an era of unprecedented technological capability. Against this backdrop, we assess whether LettsGroup's AI VentureFactory represents a genuine paradigm shift or merely an incremental improvement to a fundamentally flawed model.

The venture capital model has long operated on a portfolio theory approach – invest in ten companies expecting seven or eight to fail, two to return capital, and one to deliver outsized returns that justify the entire portfolio. This approach, while accepted as standard practice, represents a staggering market inefficiency when examined objectively.

Research from Harvard Business School senior lecturer Shikhar Ghosh underscores the severity of this issue. His study of more than 2,000 venture-backed companies that raised at least $1 million from 2004 to 2010 found that:

This aligns with UK-specific data that reveals:

These statistics represent more than just failed businesses – they signify billions in misallocated capital, thousands of unrealised innovations, and profound opportunity costs for the UK economy. Each failure represents knowledge, talent, and resources that could have been deployed more effectively with proper systems and methodologies.

These statistics highlight an extraordinary level of failure that has become normalised in the venture building industry. Such failure rates would be considered unacceptable in most other sectors of the economy and represent a significant opportunity for improvement through more systematic approaches.

The second critical challenge lies in the persistently artisanal, ad hoc nature of venture building. Despite technological advancement transforming nearly every industry, the process of building startups remains largely unchanged from decades past – reliant on founder intuition, trial-and-error methodology, and highly variable approaches to market development.

This artisanal model creates fundamental limitations that perpetuate high failure rates:

Each founding team essentially "reinvents the wheel," learning venture-building lessons through costly firsthand experience rather than systematic knowledge transfer. The typical entrepreneur must personally discover optimal approaches to product development, go-to-market strategy, team building, and capital raising - often through expensive trial and error. This creates an inefficient knowledge ecosystem where lessons learned are rarely codified or transferred between ventures.

As noted in industry analyses, the venture capital industry "still places the greatest emphasis on financial analysis versus operational capabilities." While financial details are crucial, they "do not contain enough forward-looking information to understand, track, and govern the venture performance of today's ever-changing market brought on by operational challenges and swings." This myopic focus on financial metrics over operational excellence exacerbates the knowledge gaps in venture building.

Without standardised frameworks for venture development, quality control becomes highly variable. Investors must evaluate each startup using bespoke assessment metrics, creating information asymmetries and increasing due diligence costs. This inconsistency extends to operational practices, governance structures, and reporting standards – all contributing to market inefficiencies.

The absence of systematic approaches leads to suboptimal resource allocation. Founding teams typically over-invest in areas of founder expertise while neglecting critical business functions outside their experience. This creates imbalanced organisations that excel in certain dimensions while remaining dangerously underdeveloped in others.

Perhaps most critically, the artisanal model inherently limits scaling potential. With venture knowledge primarily housed in individual founders rather than systems and processes, organisations struggle to scale beyond the direct oversight capabilities of the founding team. This creates growth bottlenecks and governance challenges as ventures attempt to expand.

The UK venture capital market, while sophisticated by global standards, exhibits structural characteristics that exacerbate these challenges. Total venture capital investment in UK startups reached £8 billion in 2023, placing it as Europe's leading venture market with approximately 30% market share. However, this capital remains inefficiently deployed, with several structural factors constraining optimisation:

Investment remains heavily concentrated in London, which accounts for 51% of all venture deals. The concentration of VC firms is even more pronounced, with approximately 80% based in London. This geographic concentration creates resource asymmetries that limit innovation development in other regions while contributing to overheated valuations in prime markets.

The UK venture market shows particular strength in early-stage funding but demonstrates comparative weakness in growth and scale-up capital. This "missing middle" in the funding ecosystem contributes directly to the valley of death phenomenon, where promising ventures secure initial funding but struggle to access follow-on capital required for scale.

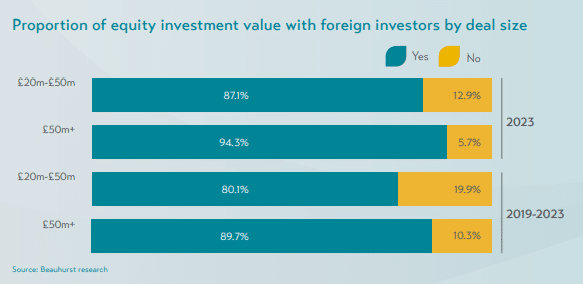

This scale-up gap is evidenced by the growing dominance of foreign investors in larger funding rounds:

This reliance on foreign capital creates vulnerability in the UK innovation ecosystem, with intellectual property, strategic decision-making, and ultimately economic benefits frequently flowing overseas rather than remaining in the UK economy.

Investment flows disproportionately to certain sectors – particularly application software (16%), SaaS (8%), cleantech (7%), and data provision (7%) - while other potentially profitable domains remain comparatively underfunded. This creates market inefficiencies where competition drives up valuations in favoured sectors while leaving potential opportunities underdeveloped in others.

Traditional venture capital typically provides financial capital but limited operational expertise. While the UK VC landscape has evolved to include more "value-add" investors, the artisanal nature of venture building means that operational support remains highly variable and often dependent on individual partner bandwidth rather than systematic methodologies.

Against this backdrop of persistent challenges and market inefficiencies, LettsGroup's AI VentureFactory represents a potential paradigm shift in venture development methodology. Rather than accepting the traditional artisanal model of startup building, the AI VentureFactory applies systematic methodology, technology automation, and standardised processes to fundamentally reshape venture creation and scaling.

The core innovation lies in the systematic application of the Innov@te methodology - a comprehensive seven-stage venture-building framework encompassing 49 distinct steps and hundreds of sub-steps. This methodology essentially codifies the venture-building process, transforming what has historically been tacit, founder-dependent knowledge into explicit, transferable systems.

LettsGroup claims that this systematic approach can double conventional success rates, achieving one successful venture (defined as worth $100M+) from every five companies, compared to the industry standard of one in ten and the corporate venture standard of one in fifteen or twenty.

Analysing this approach against the two systemic challenges identified:

LettsGroup's AI VentureFactory tackles the high failure rate problem through several mechanisms:

More fundamentally, the AI VentureFactory represents a shift from artisanal to systematic venture building:

LettsGroup's tiered subscription approach – offering Startup Lite (£1,599/month), Startup Ultra (£3,999/month), and Scale-up (£7,999/month) services - demonstrates a clear commercialisation strategy that aligns with different stages of the venture life cycle. This tiered approach provides accessibility for early-stage ventures while offering enhanced capabilities as ventures mature and their needs become more complex.

The AI VentureFactory also addresses a clear market need for systematic approaches to venture building. With increasing competition for venture funding and growing pressure on capital efficiency, ventures that can demonstrate systematic approaches to growth and risk mitigation are likely to gain advantages in fundraising and execution.

While the AI VentureFactory offers compelling advantages, several considerations warrant examination:

The standardised methodology must maintain sufficient flexibility to accommodate diverse business models and market conditions. Overly rigid frameworks risk constraining innovation or forcing ventures into suboptimal structures for their specific market contexts.

Industry experts have identified several critical operational difficulties that any systematic venture-building approach must address:

Successful implementation requires founder buy-in and discipline. The methodology's effectiveness depends on ventures faithfully executing prescribed processes rather than selectively implementing components while ignoring others. The cultural shift from entrepreneurial intuition to systematic methodology represents a significant adoption barrier.

If LettsGroup's claims of doubling venture success rates prove accurate, the aggregate impact on the UK innovation economy could be substantial:

The persistent challenges of high failure rates and artisanal venture-building approaches represent significant inefficiencies in the UK innovation economy. LettsGroup's AI VentureFactory offers a promising systematic alternative that directly addresses these fundamental limitations through structured methodology, technology enablement, and process standardisation.

While not without implementation challenges and requiring further validation at scale, the approach represents a potential step-change in how ventures are built and scaled. By transforming venture creation from an art to a science, the AI VentureFactory may contribute to a more efficient, productive innovation ecosystem with far-reaching economic implications.

For entrepreneurs navigating the challenging startup landscape, particularly those building technology ventures in capital-constrained environments, the systematic approach offers compelling advantages. By reducing unnecessary risks, optimising resource deployment, and providing structured pathways to growth, the AI VentureFactory addresses precisely the factors that cause most ventures to fail.

The true measure of this innovation will be demonstrated through longitudinal performance data. If LettsGroup can indeed double venture success rates while maintaining capital efficiency, it will represent not merely an incremental improvement but a fundamental reimagining of venture development - with implications that extend far beyond individual company outcomes to reshape the broader innovation economy.

As industry observers have noted, "saying, 'But this is how we've always done business' isn't sufficient for today's challenges. That's the old seat-of-the-pants model." In a world where up to 75% of venture-backed companies never return cash to investors, systematic approaches like the AI VentureFactory that establish specific objectives and apply reliable performance indicators may be the key to dramatically improving these dismal statistics and transforming the venture capital landscape.

This market analysis is based on data from the British Venture Capital Association (BVCA), publicly accessible market data and LettsGroup research.