The venture capital ecosystem finds itself at an inflection point. For decades, the received wisdom has been unequivocal: as startups scale, founders must yield to professional managers; those MBA-wielding executives who know how to build "proper" organisational structures. Yet the technology sector's most successful companies tell a strikingly different story. From Steve Jobs' return to Apple to Elon Musk's simultaneous leadership of multiple ventures, the evidence increasingly suggests that conventional management orthodoxy may be catastrophically wrong.

This debate burst into Silicon Valley consciousness with Paul Graham's provocative essay on "Founder Mode," which articulated what many entrepreneurs had long suspected: the standard playbook for scaling companies might be the very thing killing them. The essay struck a nerve precisely because it challenged the fundamental assumptions underpinning decades of business school teaching and venture capital advice.

The stakes couldn't be higher. With traditional venture capital success rates hovering around a dismal 10% , and corporate ventures performing even worse at 5-7%, the industry desperately needs new approaches. Enter a new generation of technology-enabled methodologies that promise to resolve the founder-manager dichotomy while preserving the entrepreneurial DNA that drives innovation.

The numbers tell a compelling story that management consultants might prefer to ignore. Defiance Capital's comprehensive analysis of 972 unicorns and their 2,467 founders reveals that founder-led companies achieve median valuations 40% higher than those transitioning to professional management through Series C funding. Even more striking, founder-led IPOs command average multiples of 8.2x revenue versus 5.7x for their professionally managed counterparts.

But why do founders consistently outperform seasoned executives? The answer lies in what researchers term "Founder DNA", a unique psychological profile that drives exceptional performance. The Founder Institute's analysis of over 100,000 global entrepreneurs identifies three critical traits: unlimited self-belief (present in 89% of unicorn founders), absence of fallback options (78%), and "chip on the shoulder" motivation (72%). These characteristics manifest as 3.4x higher risk tolerance and 2.8x greater persistence through adversity compared to traditional managers.

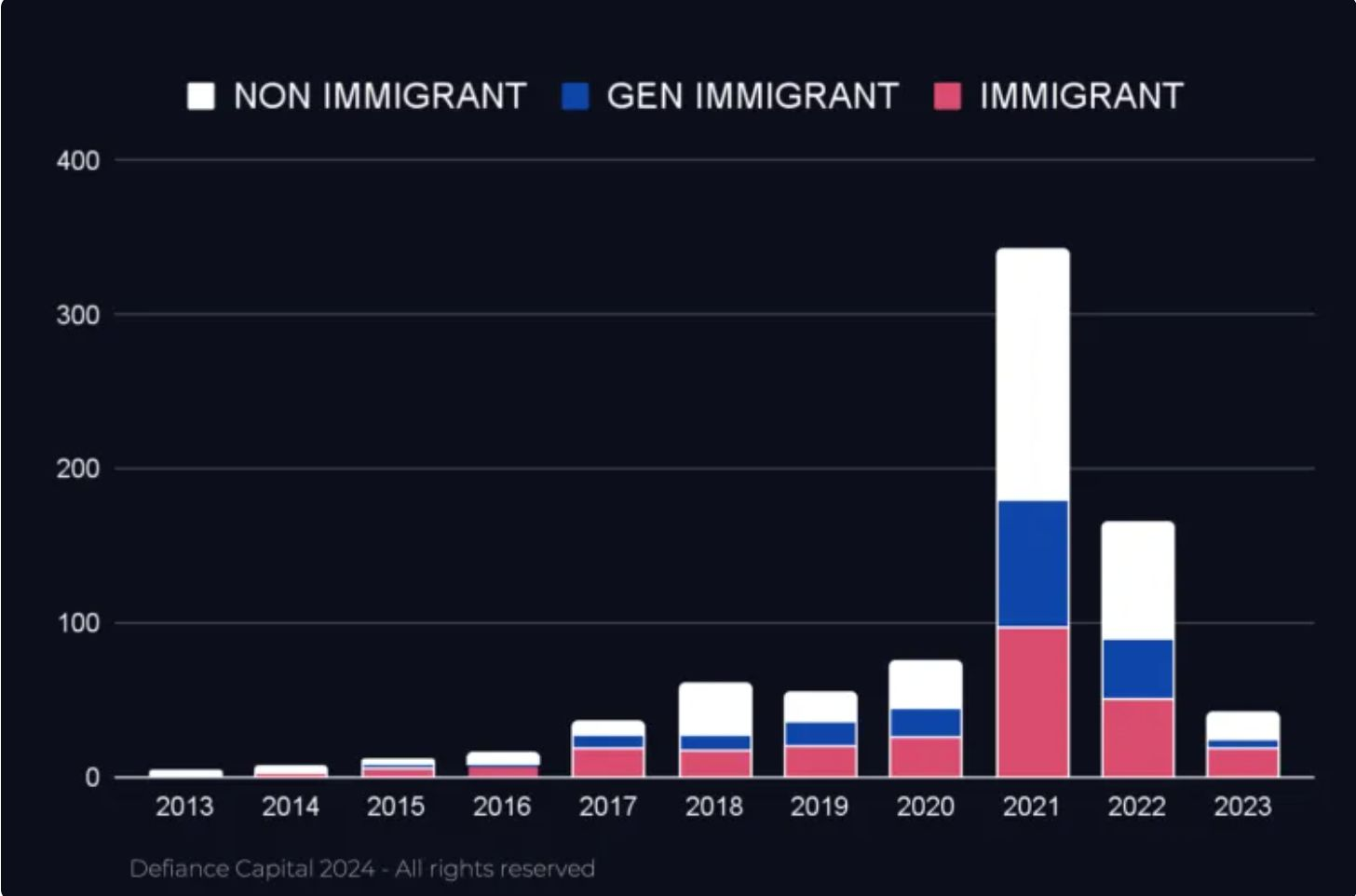

Perhaps most intriguingly, 62% of US unicorns include immigrant founders - individuals whose "no plan B" mentality correlates powerfully with sustained entrepreneurial leadership. These founders don't just think differently; they operate in fundamentally distinct ways. Where corporate managers optimise for predictability, immigrant founders embrace chaos as opportunity. Where MBAs build processes, founders build products. Where executives manage risk, entrepreneurs manufacture momentum.

The network effects amplify these advantages exponentially. Startup Genome' s research demonstrates that founders with high Global Connectedness scores - those with five or more connections to top-tier ecosystems - achieve 3.25x higher scaling probability. It's not just who you know; it's how founder relationships compound over time, creating what venture capitalist Fabrice Grinda calls "an unshakeable belief in themselves" that enables persistence where rational actors would retreat.

The traditional management playbook reads like a prescription for startup suicide. Consider the predictable failure patterns: innovation suffocation (67% of founders report this after transitioning to professional management), premature process implementation (54%), cultural misalignment (71%), and timing mismatches (49%). These aren't random failures; they're systematic dysfunctions arising from fundamental incompatibilities between corporate management and entrepreneurial reality.

Brian Chesky's experience at Airbnb exemplifies this tension. Following conventional wisdom nearly destroyed the company before Chesky embraced what he learned from Steve Jobs: founders must stay involved in the details that matter. As Chesky notes, founders are "biological parents" of their companies, maintaining emotional and intellectual connections that hired executives rarely match. This intimate knowledge enables rapid pivots, bold decisions, and sustained innovation that characterise breakthrough companies.

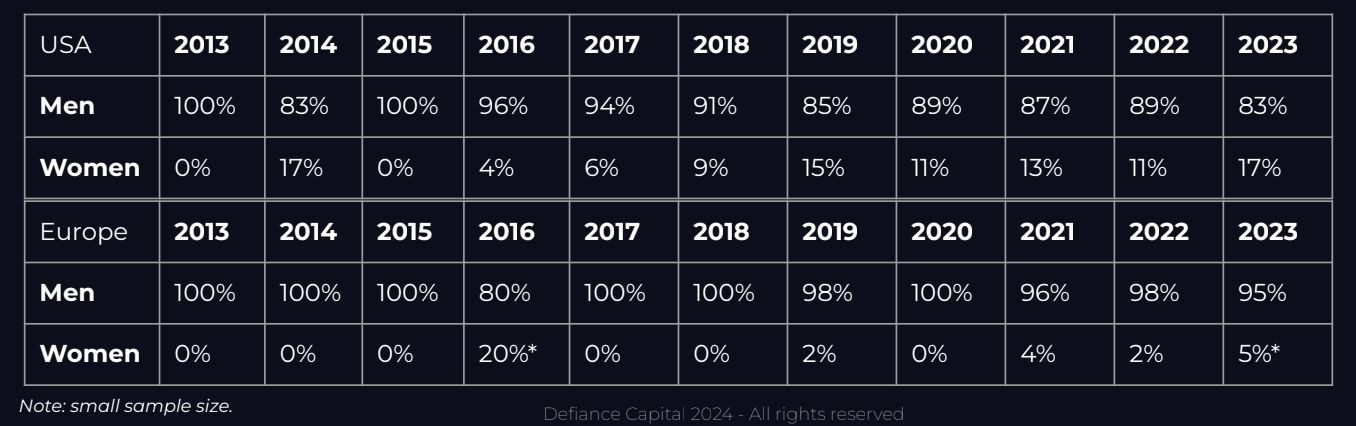

The founder-manager divide cuts particularly deep along gender lines. Female founders face disproportionate pressure to hire professional management, with 73% reporting investor demands for "experienced executives" compared to 41% for male founders. This disparity contributes to women comprising only 17% of US unicorn founders despite demonstrating equivalent success rates when controlling for funding access and industry selection.

What makes this particularly troubling is how identical behaviours receive different interpretations based on gender. A male founder's hands-on involvement gets labelled "passion"; a female founder's similar engagement becomes "micromanagement." Silicon Valley executives noted after Graham's essay that female entrepreneurs often lack "permission" to operate in founder mode - a double standard that constrains precisely the leadership characteristics that drive exceptional outcomes.

Just as the founder-manager debate reaches fever pitch, technology offers an unexpected resolution. Artificial intelligence and automation increasingly enable what LettsGroup terms "Founder Mode at scale" - maintaining entrepreneurial characteristics whilst achieving operational sophistication that once required armies of middle managers.

The numbers are staggering. LettsGroup's AI VentureFactory reports reducing average costs to seed stage from the industry-standard $2 million to below $100,000; a 95% reduction achieved through systematic process automation and AI-powered decision support. This isn't merely about cost efficiency; it's about democratising entrepreneurship by enabling founders to maintain control through extended runway periods that would traditionally force premature delegation.

The AI VentureFactory exemplifies this new paradigm. Built on 15 years of venture development experience, the platform encompasses seven core stages, 49 discrete steps, and hundreds of sub-steps that transform traditionally tacit founder knowledge into reproducible processes. Rather than replacing founder intuition, it amplifies it - automating routine operations whilst preserving the creative chaos that drives innovation.

Real-world results validate the approach. Five ventures built using the methodology have reached seed stage, including LettsCore (blockchain infrastructure), LettsNews (AI-powered media technology), and LettsArt (digital marketplace systems). These aren't incremental improvements but step-function advances: 2.4x faster development cycles, 60% lower customer acquisition costs, and dramatically improved capital efficiency.

The implications extend far beyond individual ventures. If systematic approaches can consistently double success rates, from traditional 10% to targeted 20%, the aggregate impact on venture returns could transform industry economics. More capital would flow to early-stage ventures, more founders could pursue ambitious visions, and more innovations would reach market.

The founder-manager dichotomy manifests differently across global markets, creating fascinating cultural variations. Silicon Valley's risk-embracing ethos naturally favours founder leadership, whilst European markets' regulatory complexity and cultural risk aversion traditionally support professional management. Asian markets split along regional lines: Singapore and Israel embrace founder models whilst Japan and Korea favour hierarchical structures.

Yet technology-enabled approaches offer particular promise for markets outside traditional innovation hubs. The AI VentureFactory's 90% cost reduction proves especially transformative for emerging economies with limited venture capital. Suddenly, entrepreneurs in São Paulo or Lagos can access venture-building capabilities previously exclusive to Silicon Valley, potentially unleashing global innovation waves.

The key insight: technology enables cultural translation of founder principles across diverse contexts. European entrepreneurs can leverage systematic frameworks to satisfy regulatory requirements whilst maintaining founder control. Asian founders can use platforms to bridge hierarchical expectations with entrepreneurial flexibility. The AI VentureFactory doesn't impose Silicon Valley culture; it adapts founder mode principles to local realities.

This cultural adaptability matters because different markets require different approaches. What works in San Francisco's freewheeling environment needs modification for Berlin's process-oriented culture or Tokyo's consensus-building traditions. Systematic methodologies provide the translation layer, enabling founder characteristics to flourish within varying cultural constraints.

Looking ahead, traditional organisational structures appear increasingly obsolete. Research suggests future billion-dollar companies might operate with 10-20 core employees, leveraging AI for functions previously requiring hundreds of staff. This isn't downsizing, it's a fundamental reimagining of how companies create value.

The implications ripple across entire economies. Educational institutions face existential questions about MBA programmes built around industrial-era management principles. Governments must reconsider regulatory frameworks designed for hierarchical corporations. Venture capitalists need new evaluation criteria that assess founders' ability to leverage technology rather than plans for management succession.

Traditional performance metrics such as efficiency ratios, hierarchical reporting structures and predictable quarterly results prove inadequate for innovation-driven organisations. Emerging scorecards prioritise adaptability, learning velocity, and market responsiveness. These new measures favour founder characteristics over management orthodoxy, technology leverage over human hierarchies, and systematic innovation over process optimisation.

The shift demands new thinking from all ecosystem participants. Investors must recognise that the best founders might never "graduate" to professional management. Accelerators should teach systematic innovation rather than traditional scaling. Policy makers need frameworks supporting flat, automated organisations rather than assuming corporate pyramids.

The founder versus manager debate ultimately represents yesterday's question. Tomorrow belongs to leaders who combine founder orientation with systematic execution, maintaining vision and adaptability whilst leveraging AI and automation for operational excellence. This synthesis transcends traditional categories, creating new possibilities for venture building and scaling.

The evidence overwhelmingly supports sustained founder leadership enhanced by technological capabilities. Platforms like LettsGroup's AI VentureFactory demonstrate how systematic methodologies can preserve entrepreneurial DNA whilst achieving operational sophistication. The most successful ventures won't choose between founder and manager modes; they'll synthesise both through technology.

This evolution requires deliberate choices. Founders must develop new competencies in AI utilisation, systematic thinking, and digital organisation building. Investors must fund leaders who refuse traditional transitions to professional management. Educators must reimagine curricula for technology-augmented entrepreneurship.

As venture building evolves from craft to system, the distinction between founder and manager modes blurs into irrelevance. Technology enables founder vision and passion to scale without sacrificing operational excellence. The entrepreneurs who master this synthesis, leveraging platforms like the AI VentureFactory whilst maintaining their essential DNA, will define the next generation of transformative companies.

The future belongs not to founders or managers, but to technology-augmented leaders who transcend traditional categories. They'll build tomorrow's defining enterprises not by choosing between entrepreneurial chaos and managerial order, but by synthesising both through systematic innovation. In this new paradigm, Founder Mode isn't just preserved. It's amplified, systematised, and unleashed at previously impossible scales.