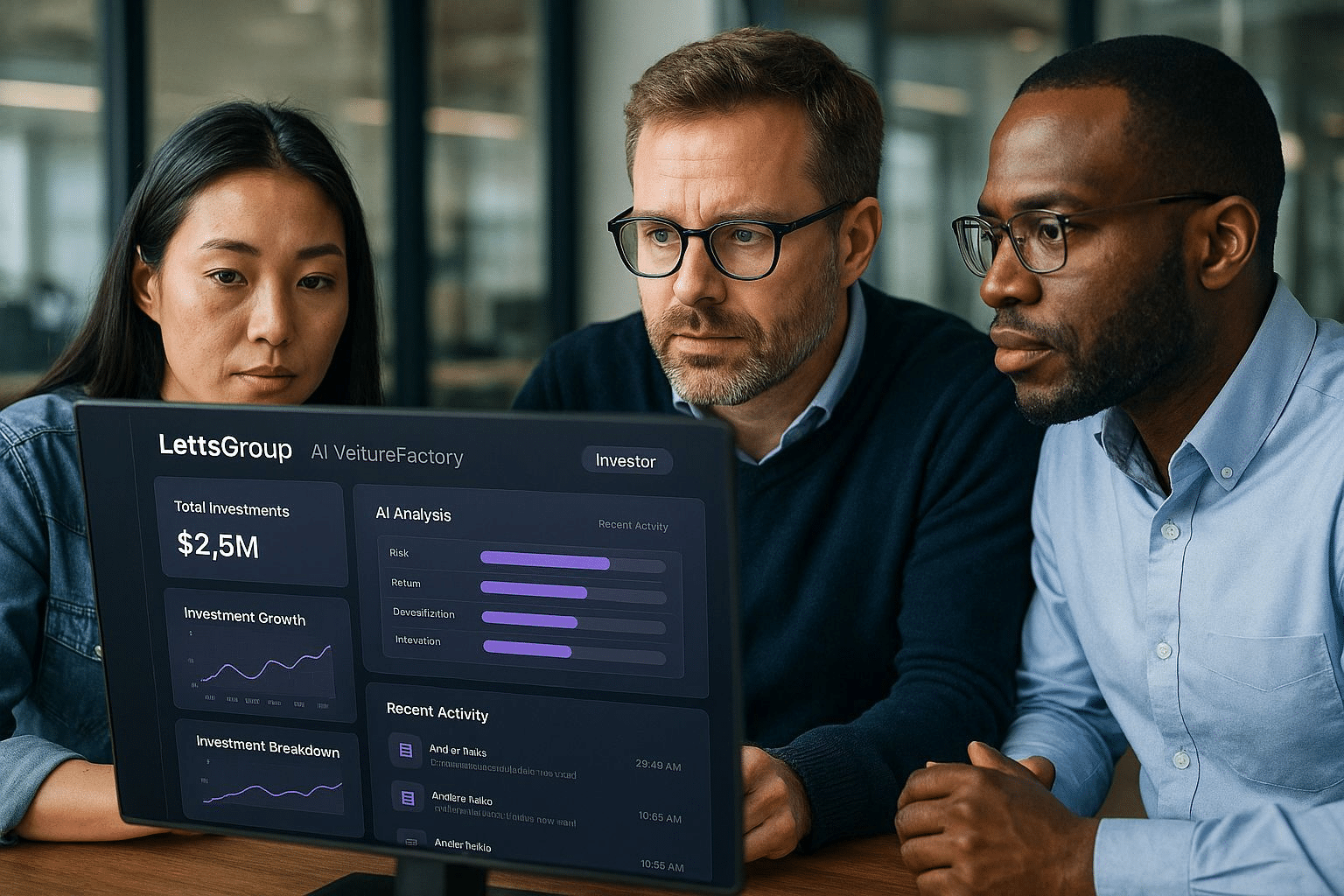

LettsGroup has continued its fast start to 2026 with a slew of new customers, partners and channels. It is also benefiting from its extensive AI-centred product development process to add AI apps, agents and product features to the VentureFactory and its Core Apps even faster and more efficiently than previously possible.

*LettsGroup is expanding its advisory board ahead of strategic developments later in 2026. If you're interested in joining our investing advisory board contact us at [email protected].

LettsGroup AI VentureFactory customer numbers (both startups and investors) grew 100% in the last 3 months over the 3 prior months - following its full launch in early December 2025. This positions LettsGroup nicely at the start of 2026, as software revenues grew 100% year-over-year from 2024 to 2025.

The product team is working on the all new VentureFactory 1 slated for release in Q2 2026 with a slew of new features, automations and an enhanced interface. It adds yet more AI capabilities, broadens its end-to-end startup agent Innov@te, adds a new AI Startup Intelligence chat-driven system, and a new Self-Driving Mode that builds websites, investor decks, analyst grade notes, and more in front of your eyes at the click of a button.

VentureFactory 1 will strengthen platform scaling and defensibility: unify the suite into a crisp system-of-record experience; add more AI Core Apps and agents; deepen the agent runtime and marketplace governance; formalise VentureFactory “venture telemetry” as data products, and expand distribution through early stage funds, angel networks, advisors, and SME channels supported by the scale of the startup economy.

LettsCore, the pioneering AI and blockchain content and media management platform is preparing to support its next content-rich customers and app vendors using its API to cyrpto-enable content assets and speed up mediatech app creation for the AI era. The team has implemented bulk content upload with AI descriptions and tags for any asset uploaded. They are currently busy completing the beta build-out of LettsCore's content market capabilities with 'bring your own' crypto wallet, buy and sell side tools and online KYC enablement. LettsCore continues to scale with between 60-100 new users a month while still in beta-stage organic growth mode.

*LettsCore is an AI VentureFactory core app.

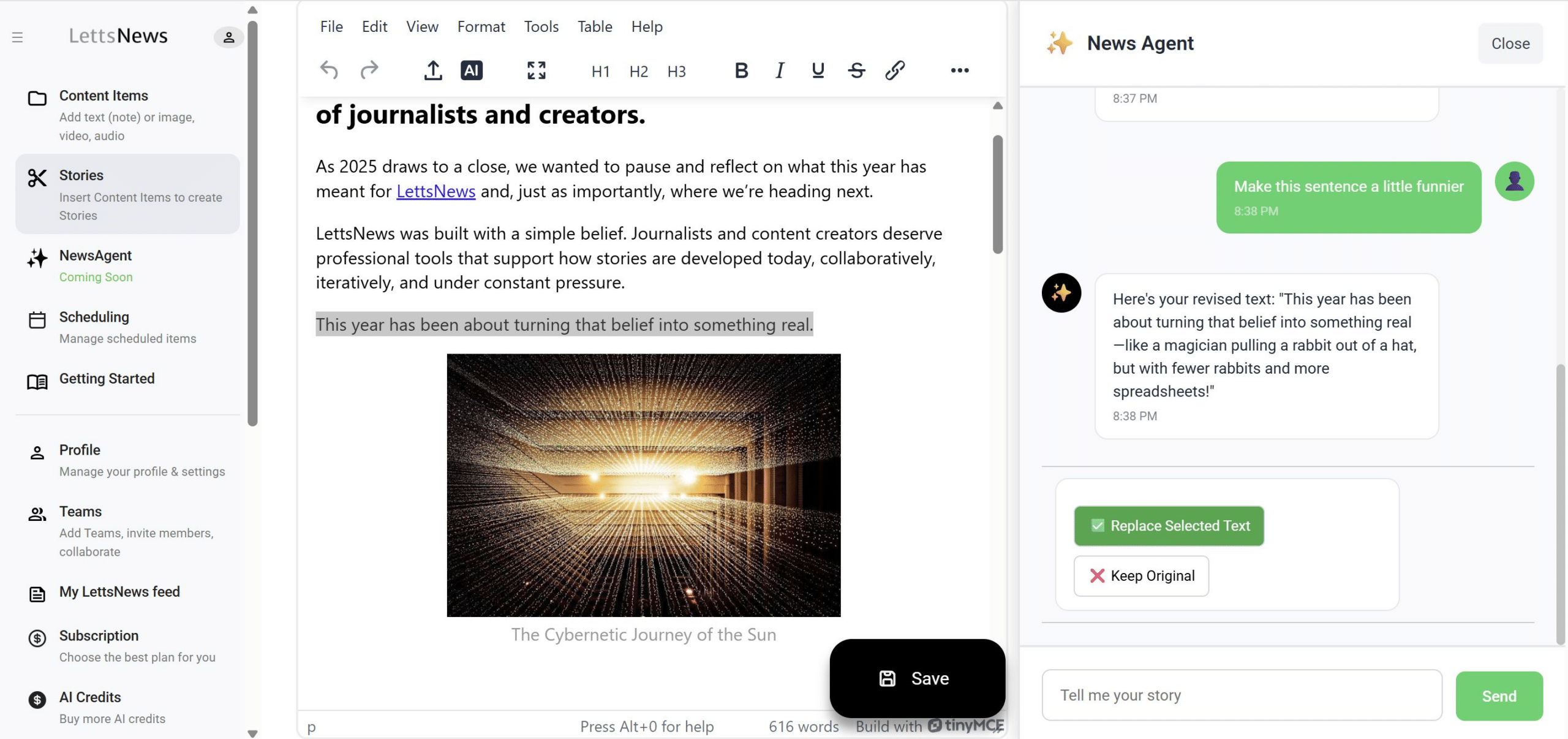

LettsNews AI NewsAgent is fully live in beta providing a genuinely disruptive platform for accelerated news creation and distribution for companies, individuals, and independent journalists and writers. Users of LettsNews can now gather, create and publish quality news faster and more autonomously than previously imaginable - providing a series of newsroom agents to start a story, assemble media elements including text, images, video and audio, fact-check the story, share with teams, and publish prior to auto-distributing and promoting news stories at-scale.

LettsNews is currently targeted at independent writers, journalists and content creators but is starting to get the attention of larger news publishers.

*LettsNews is an AI VentureFactory core app.

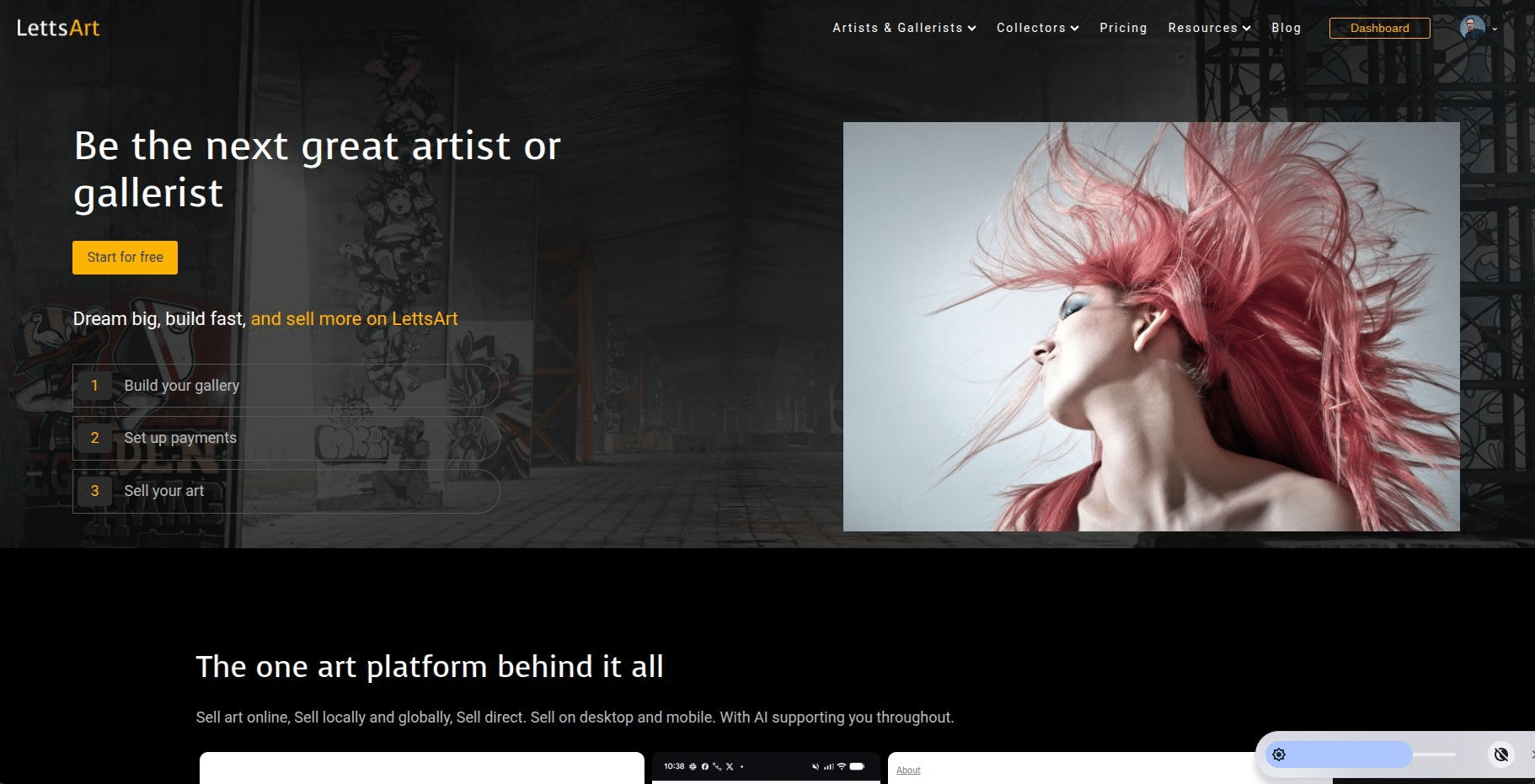

LettsArt, the leading AI no-code platform for the art world, is starting to demonstrate some valuable network economics. Its first phase growth strategy is focused on building network dynamics by attracting thousands of galleries, emerging artists and new generation art collectors. Currently LettsArt boasts over 1,400 galleries, showing and selling contemporary art and photography in AI-powered online galleries built using LettsArt, with 6,250 artworks, and over 5,000 art collectors signed up.

Customer acquisition is strong in terms of quality: 33% of registrations convert to gallery users, trending 12 new galleries signing up per week over trailing 8 weeks. 53% of galleries enable payment and pricing of art on sale which supports transaction fees, and already nearly 2% of galleries are on advanced plans opening the path to scalable subscription revenues as well. The LettsArt team has built a powerful organic marketing machine, with only limited digital ad spend at this stage. The cost of acquisition is playing out nicely.

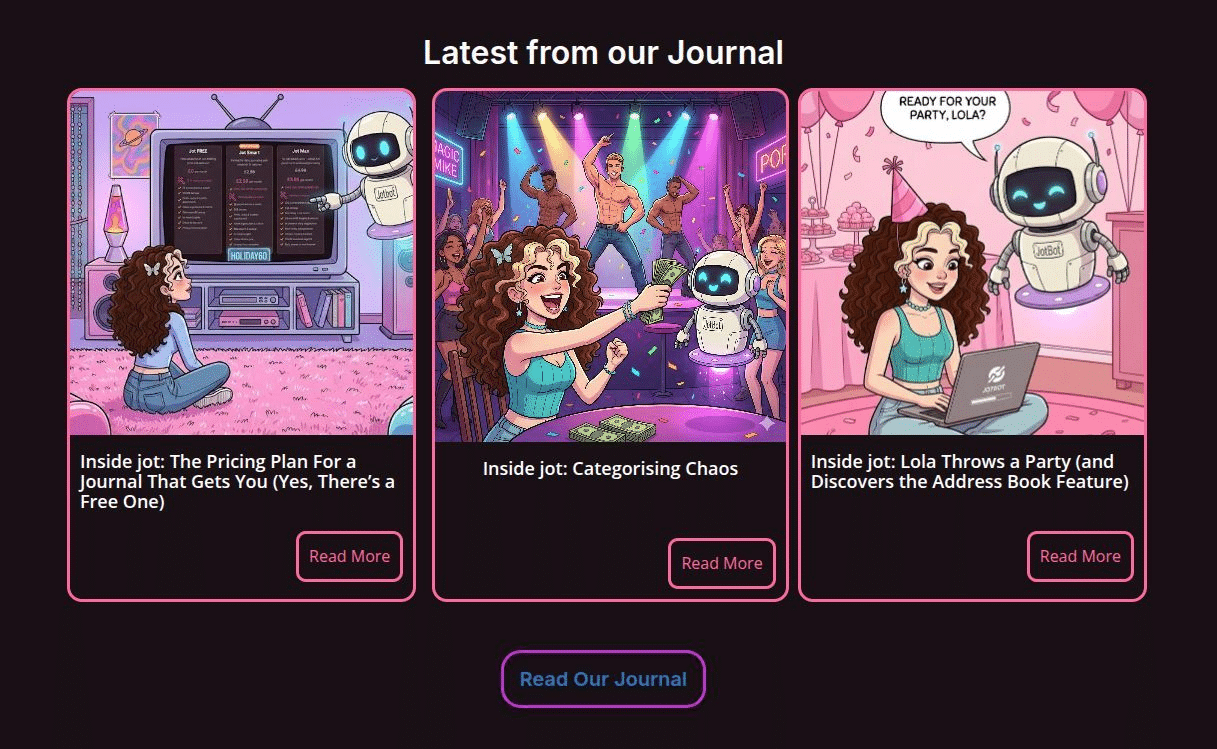

Jot, the AI-native diary and personal organiser, has been working on its next generation diary entry screen and flow to speed and simplify the user journey - whether its a blank diary entry, voice entry or AI chat entry. The team has also added a series of new AI insights feeding back and analysing user habits, lives, and suggestions for improvement. It provides tips and tools around life enhancement strategies helping users become more productive -> healthier -> and happier.

The AI insights can be run daily or weekly depending on the user's subscription plan. The more Jot is used as a personal diary / organiser / notetaker / journal, the better the insights. New Jot features are captured in snappy videos to enhance user take-up and the "Lola and JotBot" viral organic campaign on TikTok, Insta and YouTube is building nicely.

*Jot is an AI VentureFactory core app.

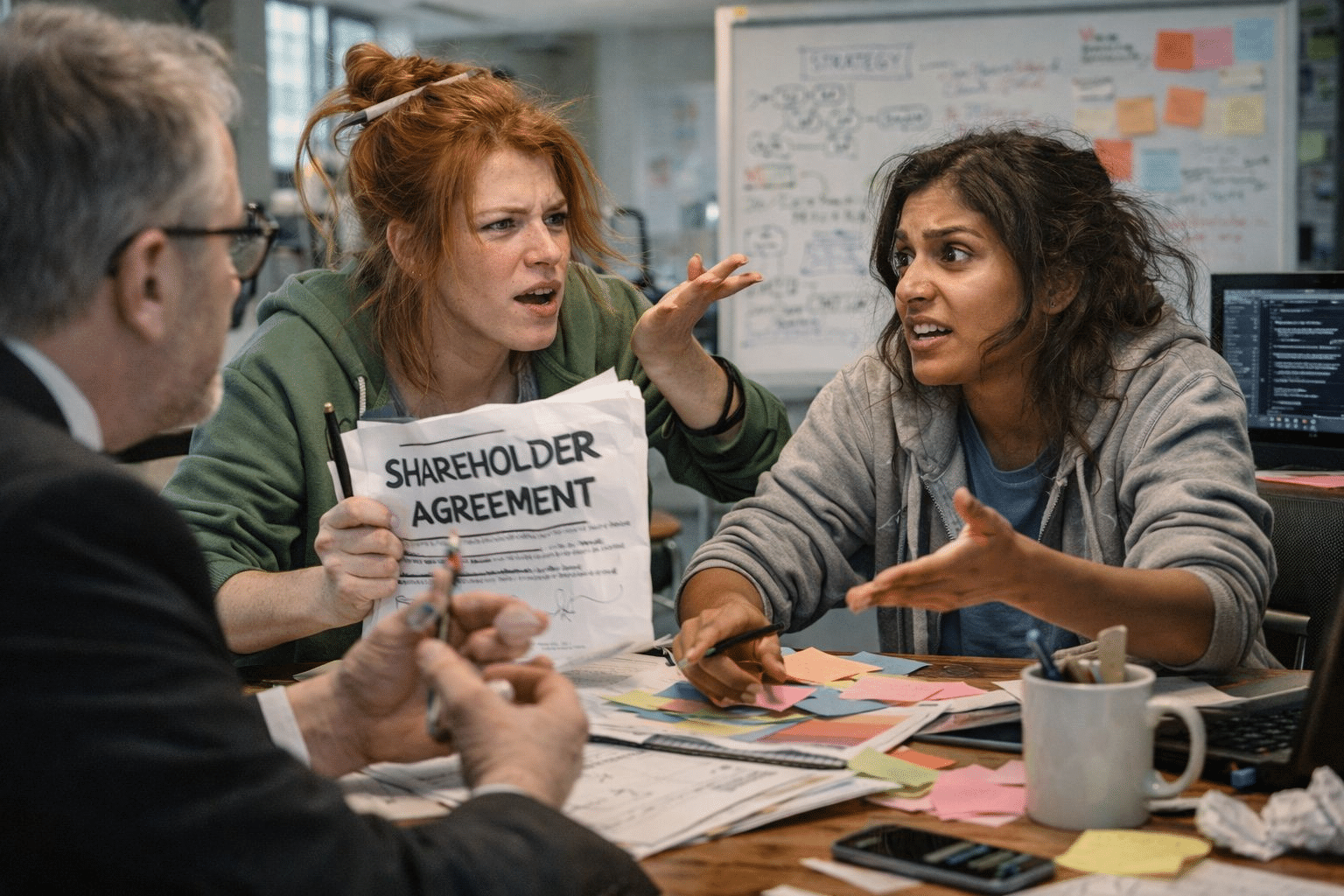

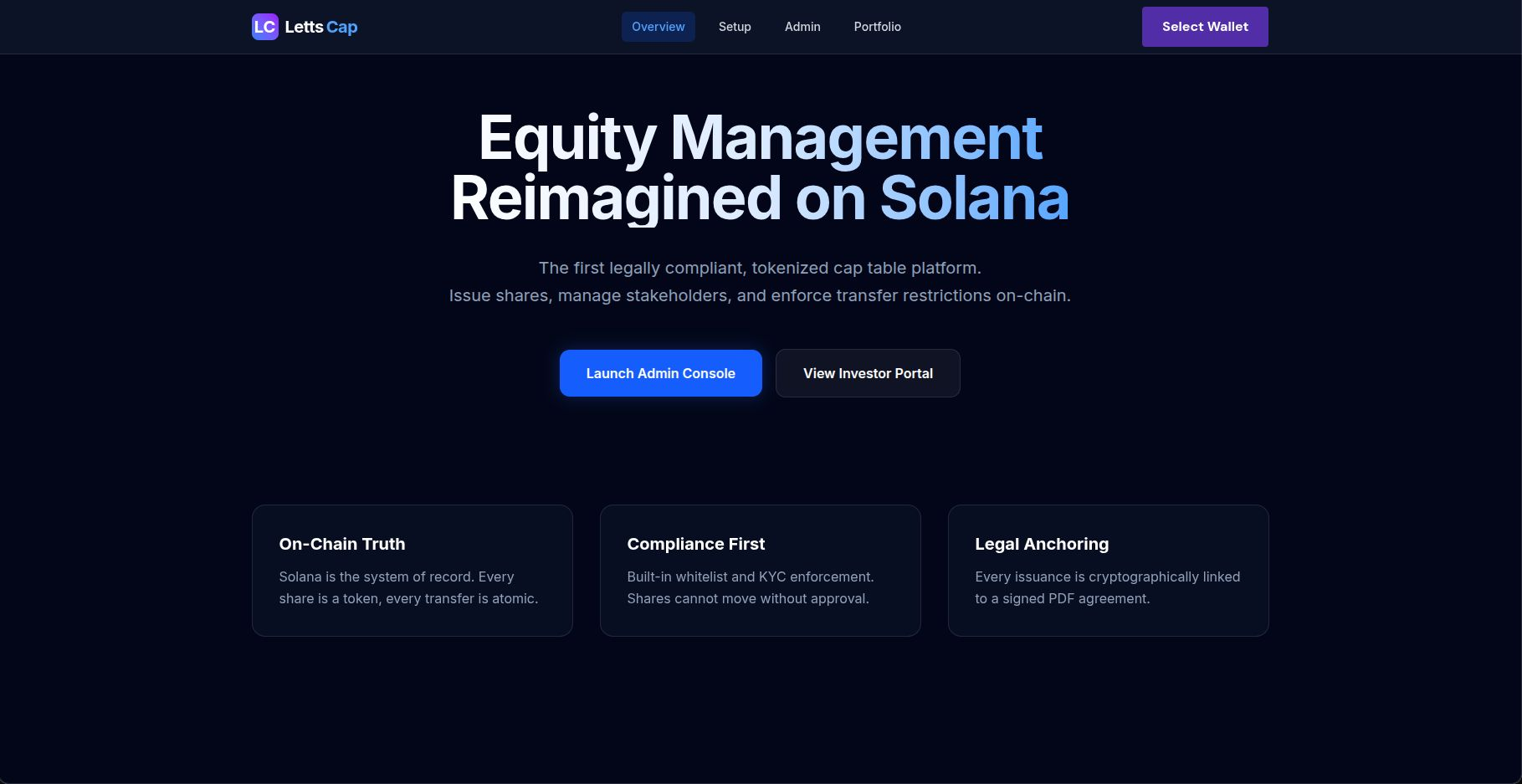

LettsCap, the newest VentureFactory Core App, which is a next-generation, blockchain/crypto equity management platform is building towards its beta launch in April. It transforms traditional, manual share registries into a dynamic, transparent and compliant ecosystem. By leveraging blockchain tokenization and secure document management, LettsCap will provide companies and investors with a single source of truth for equity ownership, streamlined fundraising workflows and liquidity potential.

The team is starting to build a private, in-company p2p equity sales capability with company controls, vetting and a blockchain-based transaction system.

*LettsCap is an AI VentureFactory core app.

VOICES is launching in Q2 2026 as a new, connected social platform for creators, innovators and entrepreneurs - and a fully integrated social network for VentureFactory Core Apps and select startup customers. Both VentureFactory 1 and LettsArt 3 will be VOICES-enabled starting Q2 2026.

*VOICES is an AI VentureFactory core app.

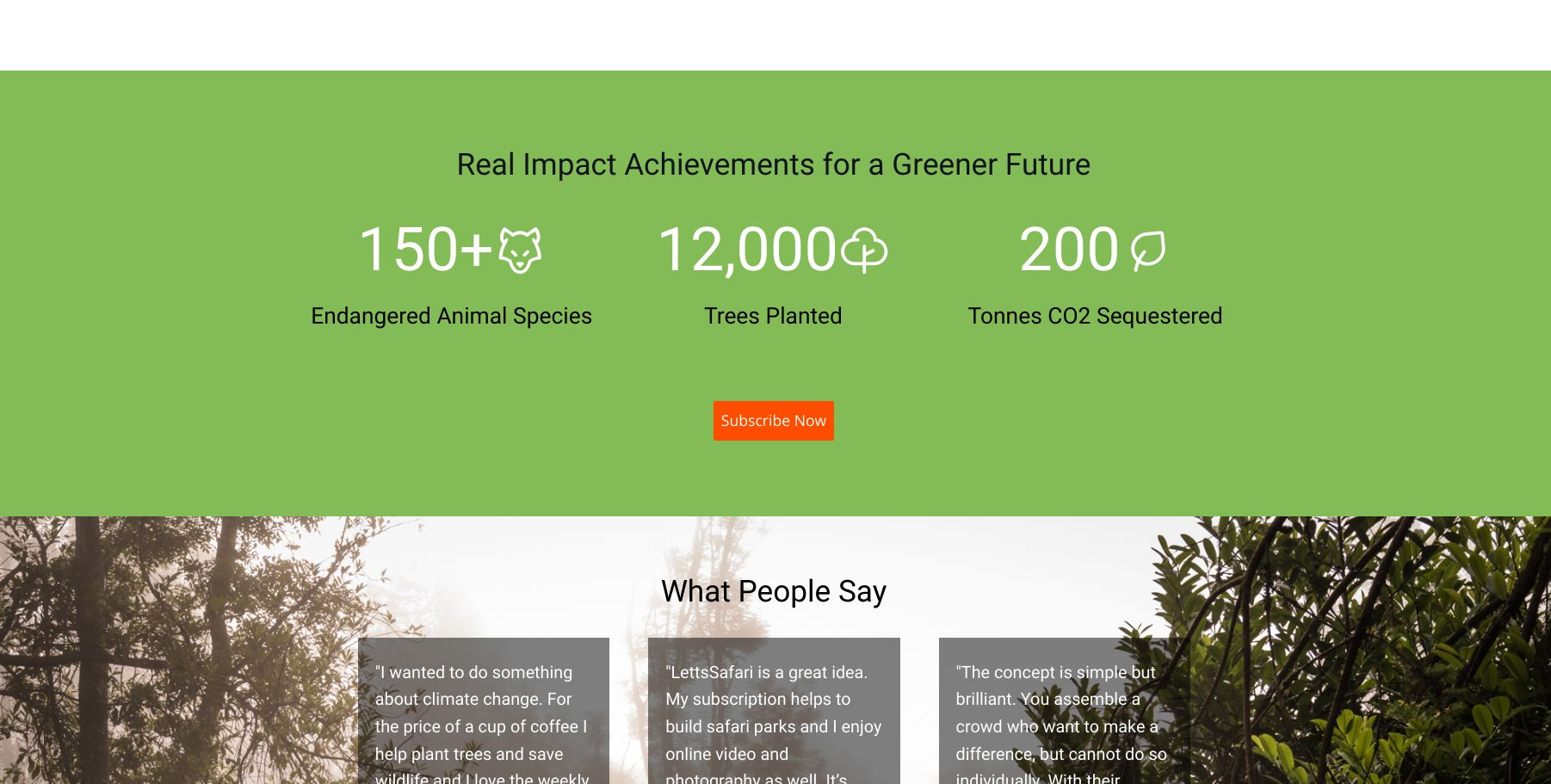

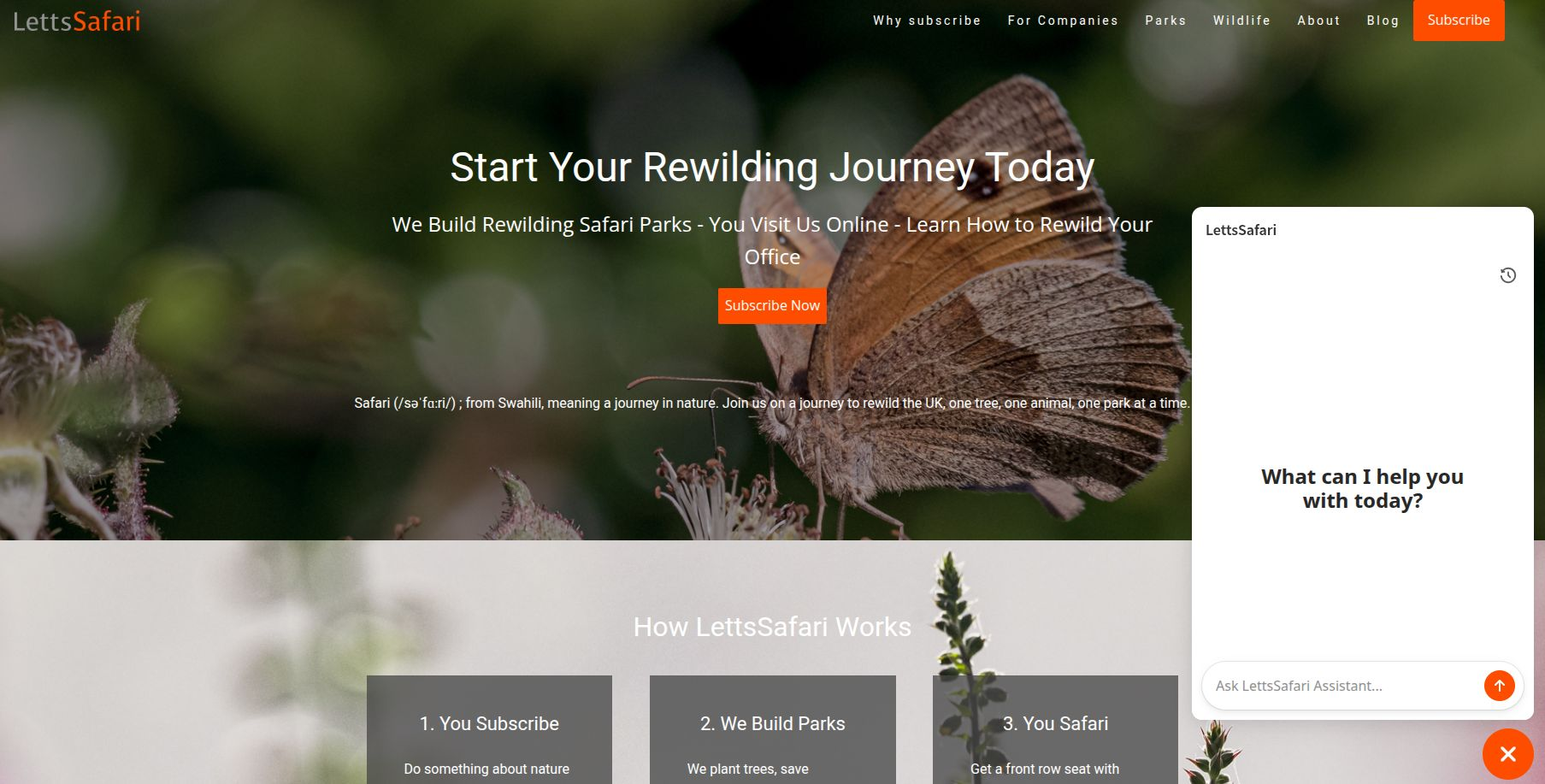

LettsSafari, the leading platform for small-scale, mass market rewilding launched the LettsSafari AI Assistant which is already proving popular. It's the first AI chatbot focused on rewilding, nature restoration and wildlife gardening. You can use it for free at LettsSafari.com - click the orange chat button at the bottom right of the page.

In the next couple of months LettsSafari will launch its definitive guide to small-scale rewilding as a digital, coffee table book - available free to paid members. Try it, gift it, wild it .

We highlight just a few LettsGroup Core Apps in each monthly edition of NewsFlash. To explore other core apps and some of the startups powered by LettsGroup's AI VentureFactory go to LettsGroup/ventures.

Many startups start with a Friends and Family (F&F) round – the initial capital from people who personally know and believe in the founders. This is often the first outside money a startup ever gets, bridging the gap between bootstrapping and bringing in professional investors. Done right, an F&F round can provide not just money but also emotional support; done poorly, it can strain relationships. Here’s how to navigate it:

What is an F&F Round? It’s a small financing round from your personal network – literally friends, family, former classmates or colleagues, even friendly ex-bosses. People that are more likely to be on your Whatsapp and Insta than your Linkedin. Startups powered by LettsGroup's AI VentureFactory gain access to angels, early stage funds and angel networks. Typically, a friends & family round brings in anywhere from a few thousand up to around $100K–$150K (≈ £10K–£120K) total, though in some cases it can be more (especially if there’s a wealthy connection). This money is usually used to build the first prototype, conduct research, or simply keep the lights on for the first few months of operation. Often, this is considered “pre-seed” funding (or even pre-pre-seed) – getting you to a stage where angel or seed investors would consider you.

Treat It Professionally: Even though these investors are people you know informally, handle the process with full professionalism. That means paperwork, transparency, and clear communication. It may feel awkward to put family money on legal documents, but it’s for everyone’s benefit. Clearly explain that investing in a startup is highly risky – >90% of startups fail, and they could lose every penny. In fact, put that in writing and have them acknowledge it. This manages expectations and protects relationships (no one should be betting their life savings on your idea unless they fully understand the risk). As Founder Institute advises, project an aura of professionalism and educate your F&F investors about the risks, to avoid future hard feelings.

Choose a Funding Mechanism: Decide how you’ll structure the F&F money:

Gifts: Simply accepting money as a gift (no repayment, no equity). If someone insists it’s a gift and doesn’t want anything in return, still put that in writing – a simple letter saying “This £X is a gift to the company, with no expectation of ownership or repayment.” This avoids misunderstandings (e.g. a relative later claiming it was a loan).

Loans: A loan from family that you promise to pay back (with or without interest). This can be simpler than equity, but remember a loan adds debt to your company (which future investors might ask to be cleared or converted). If you do loans, use a basic promissory note template and include interest rate (if any), repayment terms (often only repay if company has cash or after certain time), etc. Some founders use convertible notes that start as a loan but convert to equity in the next round – more on that below.

Equity: Giving them a stake in your company in exchange for cash. This is tricky at the earliest stage because, as noted, valuing the company is very difficult and arguably “make-believe” at this point. If you can avoid formally setting a price (valuation) with family, do so. Selling, say, 10% of your company to Uncle Bob for £10K implies your company is only worth £100K – that could really hamstring you when later investors value you at £1M+ and Uncle Bob’s stake either dilutes heavily or your cap table looks off-balance. A common approach is to use a Convertible Note or SAFE for friends & family: this way they are effectively investing now but will get equity later once a professional round prices the company. You might include a valuation cap on the note/SAFE that’s somewhat generous (to reward them for early risk), but not a formal valuation today. For example, issue a SAFE with a £1M or £2M cap (depending on how early it is) and perhaps no discount (or a small discount) – this means if your seed round is priced at £4M, their money converts at the £2M cap (so effectively they doubled on paper), but if things go poorly and you only raise at £1M, they convert at that. This way, you avoid the “my startup is worth £X now” conversation with family while still giving them a fair deal.

Convertible instruments are highly recommended at this stage. They are simpler (no need for immediate valuation negotiation or heavy legal), and they avoid cluttering your cap table with many small shareholders early on. In the US, the Y Combinator SAFE is popular; in the UK, SeedFAST or Advanced Subscription Agreements (ASAs) are used (often via SeedLegals). These are SEIS/EIS compatible as well. If equity must be given (say an uncle really wants shares), keep the round small (<15% total) and involve a lawyer to draft a straightforward shareholders agreement. Ensure any equity given doesn’t come with special rights that could deter future investors. LettsGroup has various AI-powered tools and apps to get you investor ready and manage your cap table and rounds.

Don’t Over-Dilute or Over-Promise: A big mistake is giving away huge chunks of your company in a F&F due to feeling grateful. Yes, they are helping you, but you and your co-founders are doing the work. It’s your sweat and vision that will drive the company’s value. So it’s okay to accept money on reasonable terms. Typically, friends & family collectively might end up owning 5-10% of the company post-round (sometimes up to 15% if a bigger F&F round) – not 50%. Maintain control and the majority of equity for the team who will attract future investors. Also be very careful about promising jobs or roles to investors (e.g. your cousin gives money and expects to be “CFO”). Unless they truly are qualified and it’s part of the plan, keep investment and roles separate to avoid complications.

Keep Things Simple and Documented: Whichever route you choose, get the agreements in writing. There are plenty of templates for SAFE notes, simple loan agreements, or stock subscription agreements for F&F rounds. After receiving funds, issue a simple update to those investors every few months. They’ll appreciate being kept in the loop (and it trains you in investor communication). If things aren’t going well, don’t hide it – it’s better they know you’re pivoting or struggling than be left in the dark.

Maintain Relationships: These early believers are special, they backed you when nobody else would. Treat them with gratitude and honesty. If you succeed, they’ll not only (hopefully) make a nice return, but also share pride in your journey. If you fail, having been transparent will retain their respect. And never take money from someone who can’t afford to lose it – even if they beg. Protect your loved ones and friends: insist they invest only a small portion of their savings. As one guide says, make the risk exceedingly clear so no one is using their kid’s college fund on your seed round.

Key Takeaway: An F&F round can be a fantastic launchpad, but approach it like a professional transaction. Value the relationships above the money by being clear and fair. Use proper legal instruments (SAFE/note or simple agreements) to avoid future headaches. And once you move to pitching “real” investors, you’ll be glad you set things up cleanly at this stage.

Join some of today's hottest startups building faster with LettsGroup's AI VentureFactory - go to Letts.Group.

You’ve got ambition, energy, and a backlog of things you know you should be doing: validate the market, shape the product, build the MVP, write positioning, launch a landing page, plan GTM, start content, talk to users, prep fundraising, model runway. The list is endless — and that’s before you add a cofounder, contractors, advisors, and investors asking for “just one more doc”.

This is where most early-stage startups quietly die: execution chaos.

Modern founders juggle dozens of tools, spreadsheets, docs, decks, chats, task managers, prototypes, analytics, “AI prompts”, and half-finished frameworks. Add agencies, freelancers, and advice from ten different directions, and you get a startup that’s busy… but not moving.

The result is predictable:

You ship slower than your competitors

Your roadmap changes weekly because nothing is connected

Your messaging drifts because there’s no single source of truth

You lose weeks rebuilding the same work in different formats

You hit fundraising with scattered materials and weak narrative consistency

Early-stage founders don’t need more hustle. They need a system.

Two forces are colliding:

Everything is faster now. Shipping cycles, competitor iteration, and investor expectations have accelerated. “Wait and see” is a luxury you don’t have.

AI tools multiplied the noise. Copy here, research there, slide drafts somewhere else — but still no coherent operating system to connect strategy to execution.

You can generate content faster, sure. But if your startup is still stitched together across random tools, you’ll still move like a startup with no spine.

Founders don’t need another template library. They don’t need generic “startup advice”. They need:

A single operating system that connects strategy → experiments → product → growth → fundraising → finance

Structured workflows that reduce decision fatigue

Outputs that turn into execution — not one-off documents that die in a folder

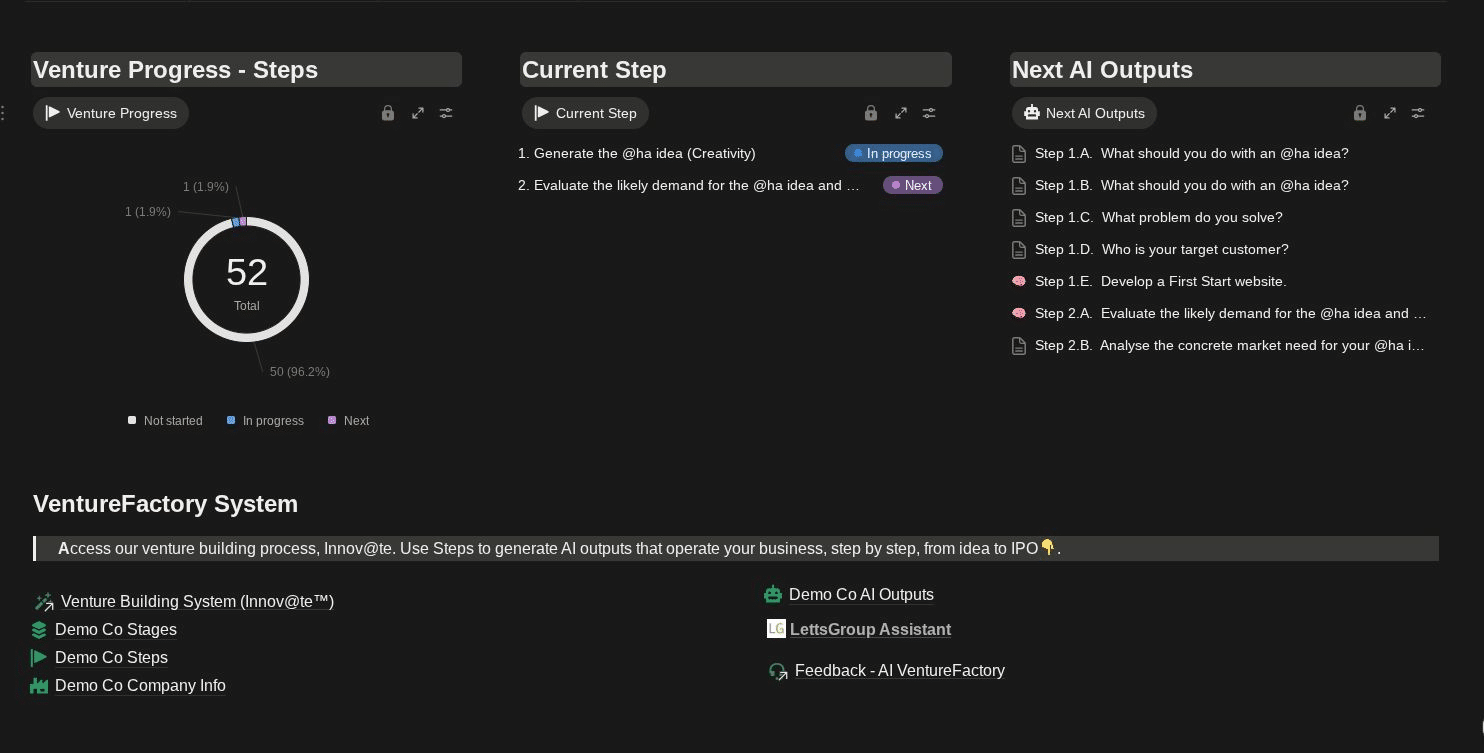

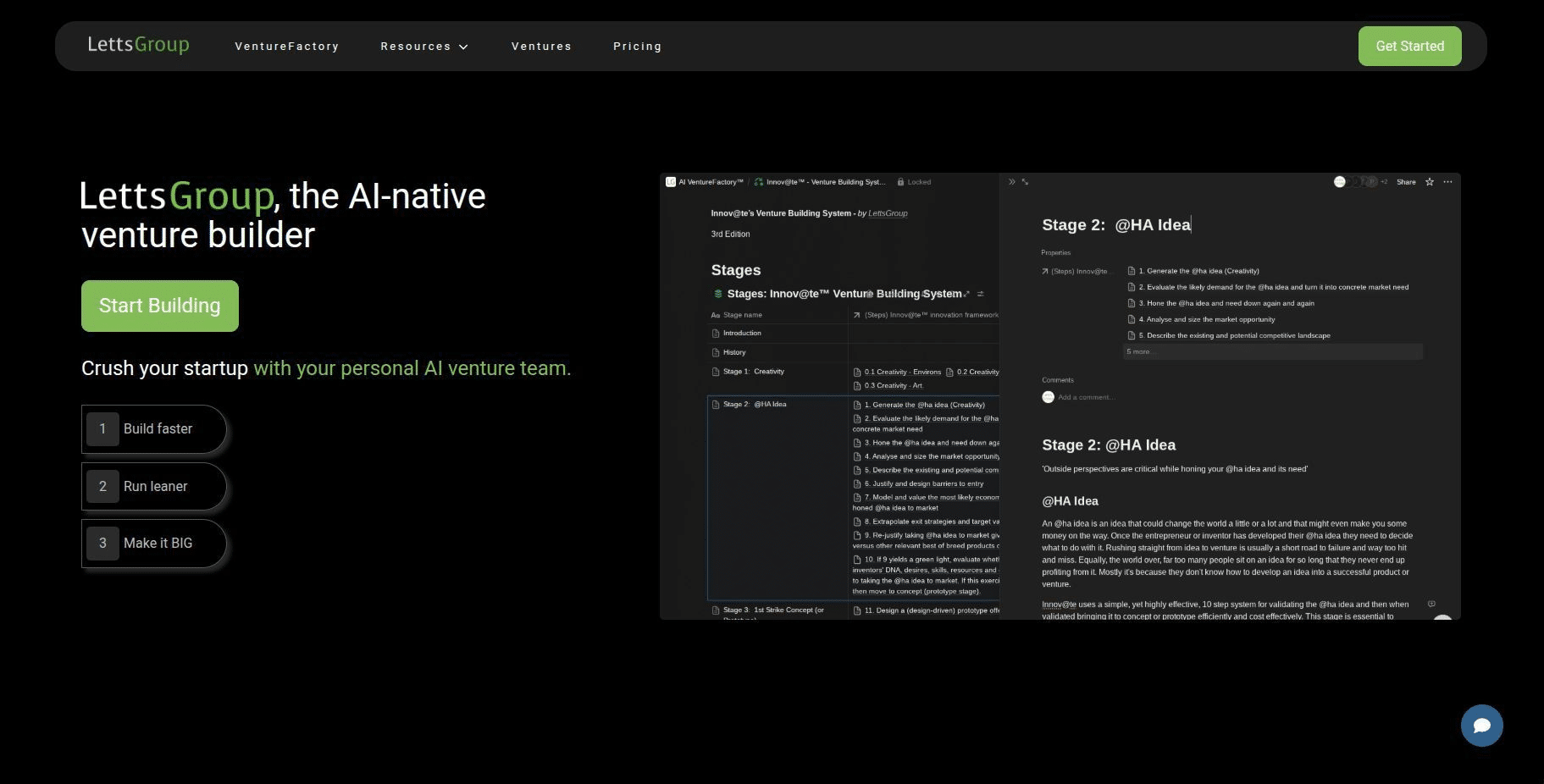

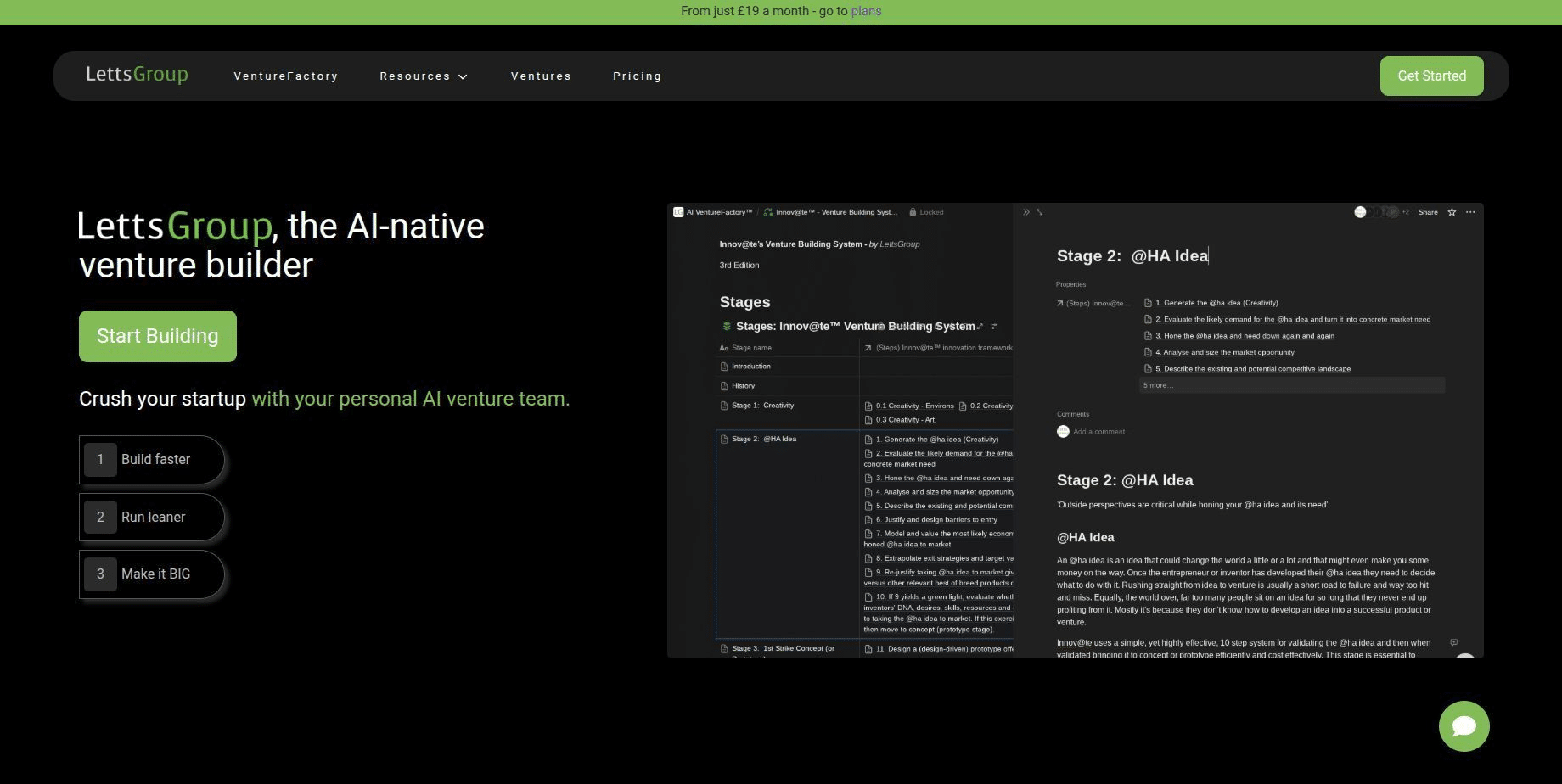

LettsGroup’s AI VentureFactory is venture building as software — an end-to-end startup operating system designed for modern founders.

Instead of giving you isolated outputs, it gives you a connected system where your startup context powers everything you do. That means less repetition, less chaos, and far more momentum.

1) One source of truth for your startup

Your strategy, market, product direction, GTM approach, and fundraising narrative live in one place, so your decisions and outputs stay aligned.

2) Outputs at the click of a button (that actually match your startup)

Founders need deliverables — fast. The AI VentureFactory helps you create what normally takes weeks:

business plans and investor narrative

product roadmaps and feature planning

landing pages and positioning

forecasts, runway planning, and key assumptions

marketing plans and organic growth execution

3) A workflow that keeps you moving forward

The problem isn’t knowing what to do. It’s knowing what to do next, and executing it with consistency. VentureFactory turns “startup chaos” into a step-by-step operating rhythm.

4) Built for lean teams

If you’re a solo founder or tiny team, you need leverage. This is your “AI venture team” — not replacing your judgement, but accelerating your output and keeping your execution connected.

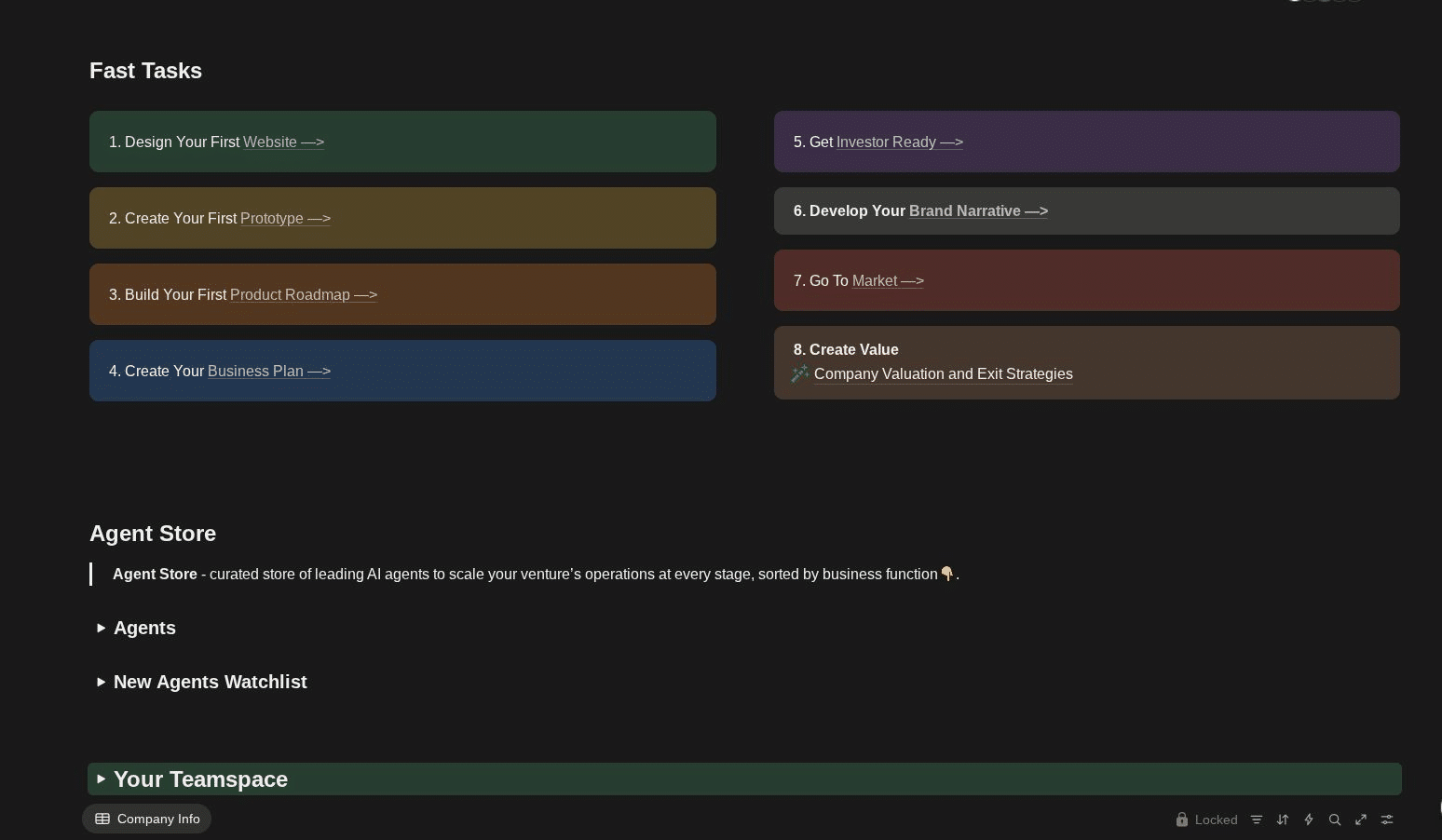

Most founders don’t need a 12-month strategy deck. They need momentum. In week one, a VentureFactory-style workflow typically gets you:

a clear startup snapshot (idea, ICP, problem, wedge)

a first roadmap and execution plan

a working landing page + positioning direction

a coherent pitch narrative and early fundraising prep

a clean set of assumptions behind growth and runway

That’s the whole game for first- and second-time founders. Not perfection. Not theory. Progress you can ship.

LettsGroup’s AI VentureFactory exists for founders who want to stop duct-taping their startup together, and start running it like a coherent system.

If that sounds like you, try it. Plans start from £19/month — and the fastest way to understand it is to see what it produces, then build your first output.

Start building: https://letts.group/

See demos: https://letts.group/videos/

Launching a startup is exhilarating, but raising that first capital can be daunting. This comprehensive guide, which we are serialising in 9 parts, is your all-in-one playbook for DIY fundraising at the pre-seed and seed stages, tailored for solo founders and small teams in the UK (and secondarily the US). We’ll cover every step - today we show you how to value your early stage startup.

One of the trickiest questions for early-stage founders is, “What is my startup worth?” At pre-seed or seed, your company likely has little or no revenue, making traditional valuation metrics (like EBITDA multiples) meaningless. Valuation in these stages is more art than science, it’s about potential, team credibility, and market size. Here’s how to approach it:

Understand the Norms: While each deal varies, there are industry benchmarks that can guide you. In the UK, recent data shows pre-seed startups often raise at valuations around £3–4 million . For instance, UK pre-seed valuations in 2024-2025 averaged about £3.2M (up 31% from 2023). Seed-stage post early-revenue startups might see valuations around £4–5M pre-money in the UK. In the US (which generally trends higher), a typical pre-seed round might be $0.5M–$1M raised on a ~$5–6M valuation . By seed stage, US companies often raise $2M–$4M on $12M–$15M valuations . These figures are not hard rules, but knowing the ballpark helps set realistic expectations. If you go significantly above these ranges without exceptional traction, investors may push back. LettsGroup's AI VentureFactory has powerful tools to ehlp you value your startups and get investor ready.

Equity Dilution: Early investors typically target 10–25% ownership in a round. At seed, it’s common for all seed investors combined to get ~15–25% of the company. Pre-seed rounds (especially friends/family or angel rounds) might be a bit less dilutive (~5–15%), but it depends. Be cautious about over-dilution, if you sell, say, 25% at pre-seed and another 25% at seed, you’ve given up half your company before Series A. On the flip side, offering too little equity for a needed sum can overprice your startup and deter investors. Striking a balance is key. Remember that valuation = amount raised ÷ equity percentage sold. If you seek £500k and feel 15% is the max you’re willing to give now, you’re proposing ~£3.3M pre-money valuation (500k/0.15). Check if that aligns with what similar startups are getting in your domain/stage.

Methodologies: Traditional methods like Discounted Cash Flow (DCF) or revenue multiples aren’t very meaningful for pre-revenue startups. Instead, investors use heuristics:

Comparable Raises: What valuation did startups at a similar stage in your industry raise at? (Hence the importance of the benchmarks above and networking with other founders and investors).

Team and Tech: A repeat founder with a prior exit might justify a higher valuation on team strength. A deep-tech AI startup might get a bit more credit for IP or technical innovation. Conversely, if it’s a crowded space or you lack experience, investors may insist on a lower valuation to compensate risk.

*The * “valuation cap” on SAFEs/notes: Many early deals use convertible instruments (SAFE or convertible note) with a valuation cap. This cap is effectively the max valuation at which the money will convert in a future priced round, thus it sets an implied valuation without formally pricing the round now. Median valuation caps for pre-seed SAFEs have been around $10M in recent times in the US (around £8M). In the UK, common SEIS/EIS SAFE equivalents often have caps in the £2M–£5M range for pre-seed. If using a SAFE, picking a reasonable cap aligned with your peers can simplify the conversation.

Be Realistic & Flexible: It’s very hard to “objectively” value a pre-revenue startup , and investors know this. Even third-party “valuation services” can only estimate. Don’t obsess over squeezing the highest valuation; optimise for getting the right partners and enough capital. Often it’s better to accept a fair valuation that brings supportive investors than to overprice and struggle to raise at all. Also consider structuring the round with a convertible note or SAFE which defers the strict valuation negotiation. In fact, roughly 80% of pre-seed rounds use SAFEs for their simplicity. These typically come with a valuation cap (e.g. £3M or £5M) and a discount (often 20%) for converting in the next round. This way, everyone agrees you’ll price the company later when there’s more data, while early investors get the upside of a cap if you grow fast.

UK SEIS/EIS Considerations: In the UK, if you qualify for the SEIS/EIS schemes , you effectively make your valuation more attractive by giving investors a big tax break. Under SEIS, investors can get 50% of their investment back in income tax relief (and other benefits on gains/losses). This means UK angels might be willing to invest at somewhat higher valuations or in riskier concepts because their downside is cushioned by tax relief. Make sure to apply for SEIS/EIS advance assurance from HMRC before fundraising – it’s a one-page form and signals to investors that if they invest, they’ll get the tax relief. The impact is huge: over 32,000 companies have been funded through SEIS/EIS totaling £24B , underscoring how vital these schemes are in UK early-stage funding.

Don’t Overthink “Percentage Owned”: Founders sometimes worry about “only owning X% after the round.” It’s better to own 30% of a £100m company than 100% of a £1m company. The goal is to get to product-market fit and scale; that will require capital and dilution. As long as you’re diluting in exchange for value (capital + investor expertise), it’s part of the game. However, do avoid giving too much to friends & family or others just because they’re close. You need enough equity on the cap table to incentivise future institutional investors and key hires. As a rule of thumb, try to keep >50% as founders through seed stage if possible, so you’re in a strong position for Series A (where another 20% dilution often occurs).

Valuation Pitfalls to Avoid: One pitfall is setting valuation based on your personal worth (“I put a year of work, it’s worth £X”), as investors only pay for future potential, not past effort. Also avoid unsubstantiated big numbers (“$1B market so we’re worth $10M now”). Justify any number you propose with logic. Finally, be mindful of down rounds: raising too high now can lead to a painful “down round” later if you don’t meet milestones, which can hurt team morale and investor confidence. It’s often wiser to raise at a moderate valuation and beat expectations, than at a sky-high valuation and struggle to justify it later.

Join some of today's hottest startups building faster with LettsGroup's AI Venture Factory - go to Letts.Group .

LettsGroup started the year with a bang. The group is tightly focused on its commercial growth - now with 5-8 new customers signing-up on a daily basis to the VentureFactory and/or its Core Apps, reflecting early network effects. LettsGroup has also started augmenting its advisory board and will be adding select new leaders to its management teams.

*LettsGroup is expanding its advisory board ahead of strategic developments later in 2026. If you are interested in joining our investing advisory board contact us at [email protected].

LettsGroup's AI VentureFactory is scaling smoothly with the new Dashboard 0.3 speeding navigation across its venture building system, its AI outputs, AI enabled core apps and AI Agent Store. Its full launch pricing, announced at the end of 2025, positions it to further accelerate take-up. The VentureFactory team have an ambitious product roadmap in place with a number of new AI apps being added, including an innovative PitchDeck Analyzer that reviews, rates and adds value to uploaded pitch decks, and LettsCap , a new blockchain / crypto platform to automate and tokenize cap tables, investors and private fundraising.

The VentureFactory team is working with early stage funds and angel networks to enhance startup screening and portfolio services using the AI VentureFactory, supplemented by LettsGroup's new investor plan available at just £39 per user per month.

LettsNews has just launched its AI NewsAgent in beta to all its users. The AI NewsAgent guides writers, journalists and marketers through its automated process building style guidelines, target readership, and creating a full or draft news story with AI-generated headline, sub-header and embedded images. It also enables in-line editing and additions, as well as fact-checking and copy editing. Following this, the completed story can be seamlessly reviewed by team members, published, auto-distributed and auto-promoted.

We believe the NewsAgent accelerates gathering, building and publishing quality news and company stories by around 5X, making original story creation faster and more sustainable by empowering writers themselves, automating much of the process and support offered by a wider newsroom to get the story published and distributed. The NewsAgent should prove an essential tool in the trend to increase organic marketing and indie news production in the AI era.

*LettsNews is an AI VentureFactory core app.

LettsCore , the pioneering AI blockchain CMS, is broadening its commercial success with new capabilities and new media applications for its fast growing user base - both end users and developers using its API. LettsGroup's Core App customers have, in the last six weeks alone, used LettsCore to build and launch a new art marketplace with thousands of artworks and hundreds of artists and gallerists, and enabled a new equity and investor management system for startups and scale-ups. LettsCore is adding nearly 100 new users a month . It also just launched an analytics dashboard for enterprises. The product team is currently building an enhanced content pricing and monetisation system, as well as adding bulk content uploading with AI generated titles, descriptions and tags.

*LettsCore is an AI VentureFactory core app.

With Jot launching fully in December 2025, the team has been busy adding users and expanding its AI capabilities - staying true to its promise of reinventing the diary with AI. It has started rolling out Jot 1 which extends AI capabilities, including 'Deep Insights' that analyse previous diary entries to provide feedback and insights into user's behaviours, patterns and wellbeing. The team are reuniting traditional diary capabilities - including journal, calendar, appointments, notes, and tasks - into one unified app, while staying true to the core promise that users only need add a diary entry and the AI (JotBot) will do the rest, automatically adding appointments, tasks, notes and more. They have priced Jot aggressively, and users get started for free at getjot.ai .

*Jot is an AI VentureFactory core app.

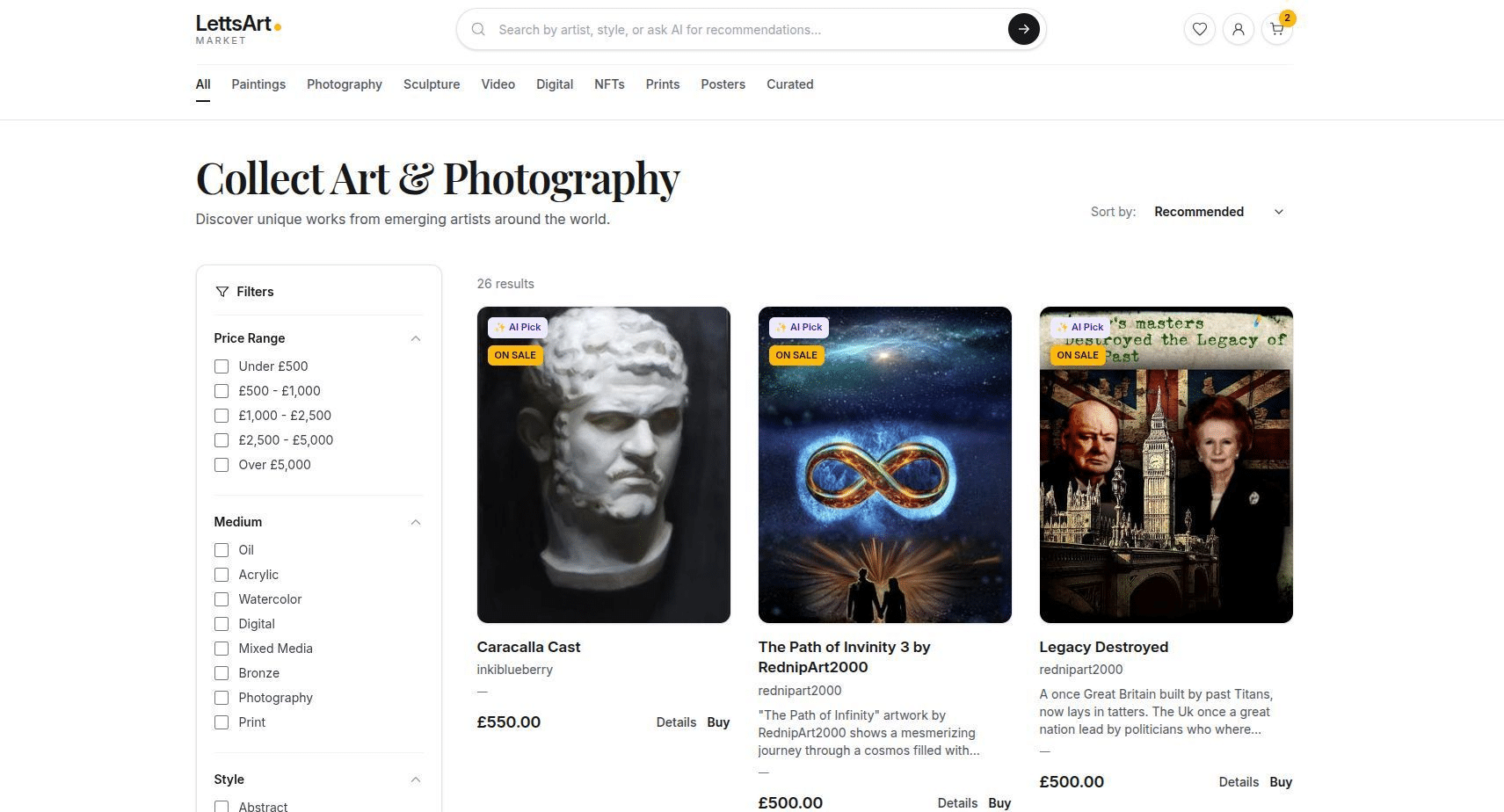

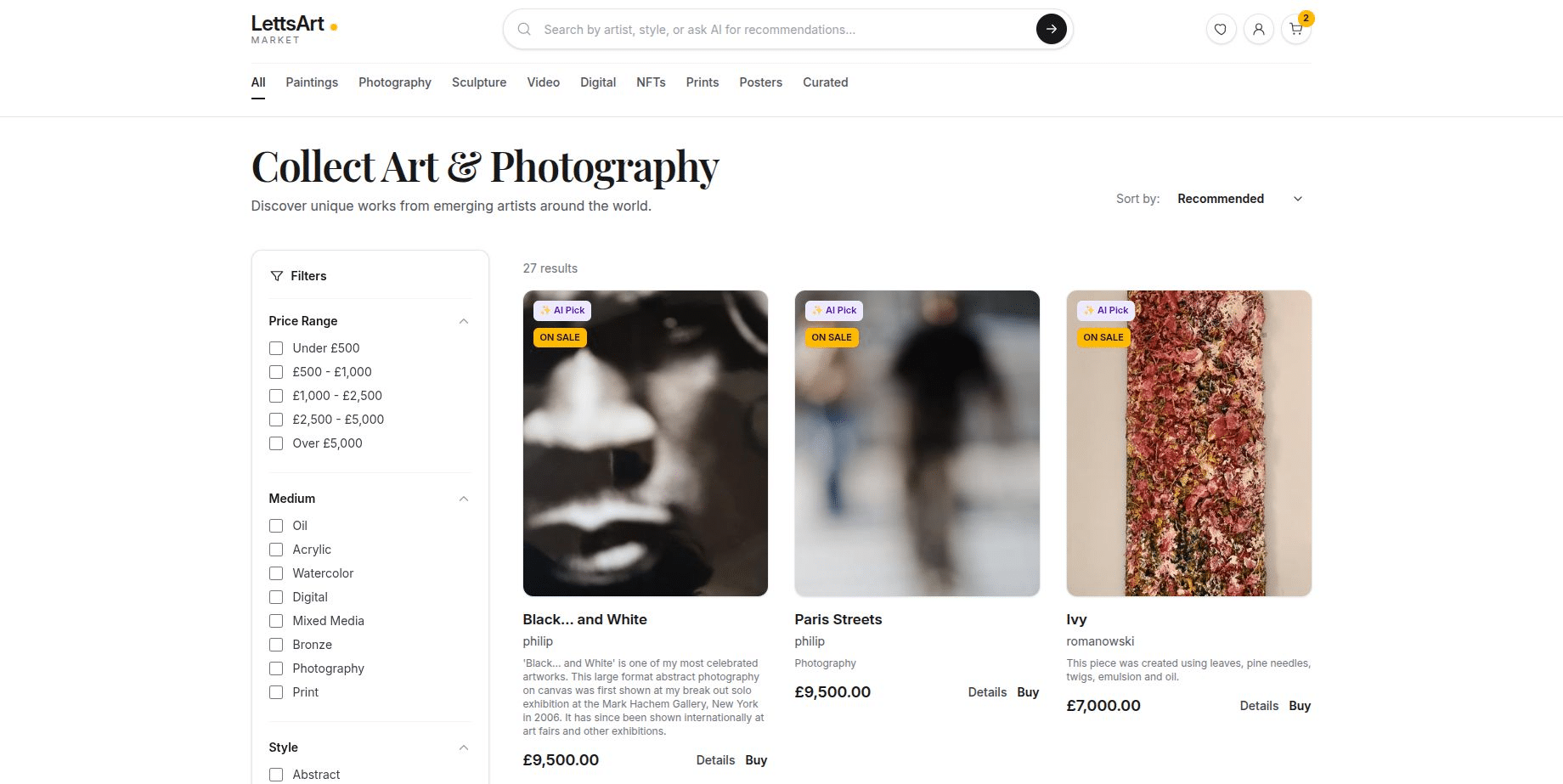

LettsArt has enjoyed a fast start in January with over 1,360 art galleries, 4,900 collectors and over 6,000 artworks using its AI no-code platform for the online art world. To cap it off, the team have launched LettsArt Market - a brand new app for art collectors signed up to LettsArt, with, at launch, hundreds of artists and art galleries and thousands of artworks available on sale. It's slick AI search, filters and format work at speed on mobile, tablet and laptop. It's a fascinating new entrant to the fast growing art-commerce market - and could become the leading online marketplace to discover and collect unique artworks from emerging artists and independent gallerists, initially in the UK. LettsArt Market enables the new trend for buying direct from artists, at-scale with just one click. Watch out Saatchi Art and Artfinder!

*LettsArt is an AI VentureFactory core app.

We are excited to announce LettsCap , the newest VentureFactory Core App, which is a next-generation, blockchain/crypto equity management platform. It transforms traditional, manual share registries into a dynamic, transparent and compliant ecosystem. By leveraging blockchain tokenization and secure document management, LettsCap provides companies and investors with a single source of truth for equity ownership, streamlined fundraising workflows and unparalleled liquidity potential. It should be commercially available toward the end of Q1 2026.

*LettsCap is an AI VentureFactory core app.

VOICES is launching later in Q1 2026 as a new, connected social platform for creators, innovators and entrepreneurs - and a fully integrated social network for VentureFactory core apps and startup customers. The team is excited about the potential for VOICES as a next-generation, Web3, filtered-network and safe space for solopreneurs, entrepreneurs, innovators and creators. People with valuable voices.

*VOICES is an AI VentureFactory core app.

This week, LettsSafari, the leading platform for small-scale, mass market rewilding launched LettsSafari's AI Assistant . It's the first AI chatbot focused on rewilding, nature restoration and wildlife gardening. Try it - go to LettsSafari.com and click the orange chat button bottom right of the page.

Later in Q1 2026 LettsSafari will launch its definitive guide to small-scale rewilding as a digital, coffee table book - available free to paid members. Try it, gift it, wild it .

We highlight just a few startups in each monthly edition of LettsGroup's NewsFlash. To explore other companies powered by LettsGroup's AI VentureFactory go to LettsGroup/ventures.

Launching a startup is exhilarating, but raising that first capital can be daunting. This guide is your all-in-one playbook for DIY fundraising at the pre-seed and seed stages, tailored for solo founders and small teams in the UK (and secondarily the US). We’ll cover every step, - from getting investor-ready with solid plans and pitch materials, to finding the right investors, to converting pitches into actual investments - all in the context of today’s AI-driven startup era. Short, actionable sections and checklists will help you raise early-stage capital methodically and avoid common pitfalls. Let’s dive in!

Before you knock on any investor’s door (or inbox), prepare your startup inside-out . Early-stage investors today expect more than a cool idea, they want evidence of a credible plan, even at pre-seed. “Investor-ready” means you have clearly articulated your venture’s vision, strategy, and execution plan. Key preparatory steps include:

Clear Business Plan & Strategy: Articulate your business model, target market, go-to-market strategy, and milestones. This doesn’t mean a 50-page old-school business plan, but you do need the fundamentals figured out. Many founders use a short business plan or extended executive summary that covers the problem, solution, market opportunity, business model, and growth plan. Modern AI tools can help draft these; for example, LettsGroup’s AI VentureFactory platform can auto-generate first drafts of key documents - from your first full business plan with financial forecasts to go-to-market campaigns - tailored to your startup. You’ll need to refine any AI-generated content, but such tools jump start the process, ensuring you don’t overlook crucial pieces.

Solid Financial Projections: Prepare 3-5 year financial projections (even if very high-level for pre-seed). Investors know forecasts are guesses, but the exercise forces you to think through revenue streams, pricing, costs, and unit economics. Be ready to discuss your cash burn and how much runway (months of operation) the raise will give you. For pre-seed startups, plan for 12–18 months of runway with the amount you raise, at least enough to hit your next major milestones. Use simple models (spreadsheets or tools) focusing on key assumptions rather than false precision. Make sure your ask (raise amount) aligns with the plan - e.g. raising £250k to £500k to build an MVP and acquire first users, or £1M to reach certain revenue targets, depending on your stage.

Market Sizing & Research: Conduct a TAM/SAM/SOM analysis (Total Addressable Market, etc.) to show the market potential. Investors want to know your startup could eventually tap a large market if successful. Use credible sources or bottom-up logic to estimate this. Also prepare a competitive analysis : identify key competitors or alternative solutions your target customers use today. Be honest and show you understand the landscape. Highlight what differentiates you - e.g. a unique technology, business model or insight that others lack. If you have any early traction (like pilot users, LOIs, or even a waitlist or prototype usage), plan how to present these as validation. LettsGroup's AI VentureFactory provides AI outputs for all of the above tailored specifically to your business.

Pitch Deck: Arguably your most important tool, the pitch deck is a concise slideshow that tells your story in 10-15 slides. Ensure it covers the essential components investors expect: company overview, problem, solution, market opportunity, business model, traction/validation, go-to-market strategy, competition, team, financials, and the fundraising “ask” (how much you’re raising and what for). Each section should be brief and punchy:

Problem: What pain point are you solving? For whom exactly (early adopter)? Use a relatable narrative or data to make it concrete.

Solution: Your product/service and how it uniquely solves the problem. Include your UVP (Unique Value Proposition) – what sets you apart.

Market: How big and growing? Include market size estimates and any trends (e.g. AI boom in your sector). Show you know your niche and competitors.

Business Model: How you plan to make money (pricing, revenue model) and who pays. If B2B, outline your pricing; if B2C, perhaps your user growth to monetisation plan.

Traction: Any proof points so far – users, revenue, pilots, partnerships, or even product milestones (MVP done, etc.). Early adopters or letters of intent strengthen your case.

Team: Highlight the founders and key team or advisors. Why are you the team to bet on? Mention relevant experience or domain expertise.

Financials & Ask: Provide a snapshot of your financial projections or key metrics (e.g. Monthly Burn, revenue if any, growth KPIs) and state how much you are raising, in what instrument (equity or SAFE/note), and broadly what the funds will be used for (e.g. product development, key hires, marketing) over the next ~18 months.

Keep the design clean and visual - use charts or graphics where possible instead of dense text. Remember, investors may skim your deck in under 4 minutes total, so make those minutes count: clear, compelling, and focused on selling the vision.

Demo or Prototype: If you have a product demo, prototype, or MVP, have it ready. A quick demo (even within meetings) can be powerful. For digital startups, a live website or app preview builds credibility. No MVP yet? Consider at least a clickable mock-up or design prototype to visualise the idea. In the AI era, expectations even at pre-seed are higher and many investors want to see some working proof-of-concept or technical validation if possible.

Data Room Prep: Savvy founders prepare a basic data room early. This can be as basic as a folder (Google Drive, Dropbox, etc.) with key documents an investor might request for due diligence. For pre-seed, it might include your detailed financial model, a longer business plan or product roadmap, any existing customer testimonials or pilot results, incorporation documents, IP info (patents filed?), and team resumes. Having this ready to share on request shows professionalism. LettsGroup's AI VentureFactory's core apps include a new Equity and Investor Management system they have started rolling out.

Tools & Resources: To streamline preparation, leverage modern platforms. For example, LettsGroup’s AI-native venture building as software provides a structured 7-stage, 49-step roadmap (the Innov@te framework) covering everything from idea validation to planning to fundraising prep. It generates draft outputs for each step (like an early adopter customer profile, marketing plan, or even defining your first prototype and building you first website) and guide you through investor readiness systematically. Even outside that platform, identify your own stack: e.g. use Jot or Google Docs to develop and compile your plans, Canva or PowerPoint for your deck (many free pitch deck templates exist, including those by Sequoia or YC), and financial modelling templates (or software) for projections. Services like SeedLegals (UK) or Gust (US) offer templates for equity offerings, cap tables, and even automate parts of the fundraising paperwork, which is useful for first-timers.

The goal is to present like a pro even if you’re a newbie: well-organised, thorough, and oriented toward growth.

Over the next few weeks we will publish 8 other sections of our Guide to DIY Fundraising for Tech and Digital Startups at LettsGroup's blog including:

Part 2 - coming nerxt week: "Valuing Your Startup: Pre-Seed and Seed Valuation Basics".

Get the fundraising process right and raising money is possible - get it wrong, or follow too many shortcuts and you will regret it. As a startup founder, your most scarce resource is your time. Don't waste it fundraising the wrong way.

Join some of today's hottest startups building faster with LettsGroup's AI Venture Factory - go to Letts.Group .

AI has made building startups easier and winning harder .

Easier, because you can prototype in days what used to take months. Harder, because the barrier to entry has collapsed, copycats move faster, and the internet is now a 24/7 hype machine that will happily distract you into shipping nothing.

So what actually separates highly successful entrepreneurs in 2026?

When you strip away the noise, the best founders aren’t the ones with the fanciest tools. They’re the ones with the best operating traits — the internal wiring that turns chaos into momentum. That’s exactly the game LettsGroup is built for: founders as operators who need infrastructure, not vibes.

Here are the five traits that matter most, and why they’re perfectly suited to building tomorrow’s great AI-native startups.

Everyone loves the “rocketship” story. Nobody loves the 18-month slog where your CAC doubles, your MVP breaks, and your best engineer gets poached.

Psychologist Angela Duckworth defines grit as perseverance and passion for long-term goals — and shows it predicts real-world outcomes across demanding environments. That’s the founder advantage: staying in the game long enough for the compounding to kick in.

Even modern tech icons say the quiet part out loud. NVIDIA CEO Jensen Huang has repeatedly emphasised resilience as a critical ingredient for success.

In the AI era, grit matters more because the feedback loops are faster — and so are the failures. You’ll run more experiments, which means you’ll also absorb more punches. The founders who win don’t avoid the pain. They metabolise it.

AI can generate features. It can’t generate taste .

Steve Jobs put it bluntly: start with the customer experience and work backwards to the technology . That’s still the best product strategy on Earth, especially when “AI-first” temptations push teams to ship clever demos instead of meaningful outcomes.

Jeff Bezos makes the same point in a different language: customer obsession keeps you in “Day 1.”

The AI era rewards founders who are obsessed with:

a specific user pain

a specific workflow

a specific moment where the product feels like magic

Not “we added AI.” More like: we removed friction so aggressively it feels illegal.

AI multiplies options. Focus multiplies results.

Jobs again: focus is “saying no” to a hundred other good ideas. This trait is underrated because it’s not glamorous. But focus is what turns a scattered startup into a sharp one.

In practical terms, focus means:

one ICP you can describe without adjectives

one core metric you’d fight someone for

one wedge product you can actually dominate

In a world where you can spin up ten prototypes in a weekend, the winners are the founders who pick one and ship it relentlessly.

The AI era is an experimentation era. Your job isn’t to be right — it’s to get right faster than everyone else.

Bezos argues that high-velocity decision-making matters, and notes most decisions should be made with ~70% of the information you wish you had. That’s basically the modern startup doctrine: place smart bets, learn, iterate, repeat.

But “risk-taking” doesn’t mean chaos. It means:

reversible decisions (“two-way doors”)

tight experiments with clear pass/fail criteria

fast correction without ego

AI gives you leverage. This trait tells you how to use it without lighting your roadmap on fire.

Your startup is not just a product. It’s a nervous system.

Daniel Goleman’s work in Harvard Business Review argues emotional intelligence is the sine qua non of leadership. Translation: if you can’t manage yourself, you can’t scale a team — especially when things get weird (and they will).

In the AI era, EQ is a competitive advantage because teams are smaller, cycles are tighter, and the emotional load is heavier. Founders with emotional awareness:

hear hard feedback without spiralling

hire better (and keep them)

avoid co-founder cold wars

build cultures that don’t burn out

And yes, research reviews of entrepreneurial success factors consistently surface traits like persistence, innovativeness, and strong personal/behavioural capabilities. EQ is what makes those traits usable with other humans .

The most successful entrepreneurs aren’t superhuman. They’re consistent : gritty enough to last, obsessed enough to care, focused enough to finish, experimental enough to learn, and emotionally intelligent enough to lead.

Or, in Jobs’ words: “Stay hungry, stay foolish.”

In the AI era, those five traits don’t just build startups. They build startups that actually ship.

LettsGroup's AI VentureFactory powers some of the hottest new startups. Start building today at Letts.Group .

Startups don't need more inspiration. They need systems that work under pressure.

For decades, the startup world has operated on a simple premise: great ideas, talented founders, and enough capital will somehow combine into success. But the data tells a different story. Most startups fail not from lack of vision, but from poor execution. They drown in disconnected tools, conflicting advice, and the overwhelming chaos of building something from nothing.

The modern founder faces a paradox: unlimited access to resources, yet paralysed by fragmentation. They're told to move fast and break things, but given no system to do either effectively. They're sold productivity tools that don't talk to each other, frameworks that don't adapt to reality, and advice that lives separately from execution.

This is broken. And it's time for a new category.

Venture building as software isn't an accelerator offering mentorship and a demo day. It's not a venture studio building companies for you. And it's certainly not another project management tool claiming to solve everything.

It's the complete re-engineering of how ventures get built — transforming the entire process from idea validation to scale into a connected, intelligent system that founders actually use in the moment they need it, tying it all together. It's like your personal AI venture team optimised for each stage. It's an end to end operating system for startups like never seen before.

From ideation to building a prototype, developing your positioning and early strategies, validating the market, sizing the opportunity, creating your first website, attracting early customers, raising money, planning with perfection, marketing efficiently, forecasting and so on.

Think of it this way: software transformed how we communicate, how we work, how we learn. But somehow, the process of building a company, one of the most complex, high-stakes endeavours humans undertake, has remained stubbornly analogue, fragmented, and reliant on luck.

LettsGroup is changing that.

Startup building is a process, not magic. Behind every "overnight success" is a series of disciplined decisions, rapid experiments, and systematic learning. The winners aren't the luckiest, they're the ones who learned fastest and executed the cleanest.

Speed without discipline is chaos. Discipline without speed is death. Modern venture building requires both. You need velocity, but not recklessness. Structure, but not rigidity. The future belongs to founders who can move with precision at pace.

Execution beats ideas — every time. The world is full of brilliant ideas that died in PowerPoint. The differentiator isn't what you think; it's what you ship, test, learn, and iterate.

We reject the status quo: fragmented tools that create more work than they solve. Advice divorced from action. Vanity metrics disguised as progress. Hustle culture that burns out founders without building leverage. And the patronising approach of building "for" founders rather than "with" them.

The current system treats founders like children who need guidance. We treat them like operators who need infrastructure.

The future of startups belongs to smaller teams with clearer systems. Faster learning loops. Lower burn rates. Higher conviction. And the teams who win won't just have better ideas — they'll have better execution infrastructure.

They'll operate inside a system where learning is embedded into every action. Where AI accelerates meaningful work instead of generating noise. Where progress is measured in validated learning, not activity theatre. Where every tool, framework, and insight connects into one coherent operating system for venture building.

Not an accelerator. Not a studio. Not another tool collecting dust in your stack.

This is venture building as software — re-engineered for the speed, pressure, and possibility of what comes next. This is the infrastructure layer the startup world has been missing.

And this is just the beginning.

Build your startup faster and smarter with LettsGroup's AI VentureFactory . Get started today!

LettsGroup, the pioneering AI-native venture builder enjoyed a breakout year in 2025. This was the year we proved that startup founders and investors no longer need to accept the costly, chaotic grind of traditional venture building. Instead, with our AI VentureFactory platform and a suite of new core apps, LettsGroup delivered a smarter, faster path from idea to market. The result? A future-forward venture ecosystem where companies build faster, run leaner, and make it BIG – all while having more fun along the way.

2025 saw the full launch of LettsGroup’s AI VentureFactory, a milestone that revolutionised how startups are built. After an extensive internal beta, the platform opened to external founders in June, and its impact was immediate. This AI-native venture-building system slashes startup build costs by up to 90% through Seed stage and dramatically accelerates time-to-market. Early adopters confirmed what we knew from our own ventures: the VentureFactory’s integrated AI “startup team in a box” confers a huge advantage.

Startups on the platform are reaching milestones in record time, and the first six private beta ventures all hit Seed stage with 80–90% lower costs than industry norms. In fact, founders have gone “from idea to market launch in under 12 months for under £200k”, a cycle that used to take years and millions. Key processes that once took weeks or months – writing business plans, building websites, developing prototypes and forecasting – are now done in minutes or days. It’s as if the traditional full-time team has been augmented (or dare we say, partially replaced) by full-time bots, heralding a new startup operating model.

Central to this is Innov@te™, our intelligent startup agent that guides founders through 7 stages, 49 steps and hundreds of sub-steps from idea to exit, generating AI outputs at every step. Instead of juggling 15–20 disjointed tools, founders get one AI-powered venture system covering product development, marketing, operations, financial modelling, and investor readiness. It’s like having an on-demand CTO, CMO, and CFO, all powered by AI, building your startup alongside you. As our CEO Philip Letts quipped, “the AI VentureFactory is the first venture platform that feels truly modern – powerful, flexible, and fast”, moving companies from “zero to IPO” with unprecedented speed.

Crucially, we made this power accessible. Pricing plans start at just £19/month for a solopreneur-friendly Lite plan, ensuring every founder can leverage the same platform that built our own ventures. For growing startups and scale-ups, we rolled out Startup Ultra and Enterprise plans with features like multi-user support, advanced AI tools, and expert “Co-Pilot” coaching. We even introduced a new Investor/Advisor plan so VCs, accelerators, and mentors can plug into the system for due diligence and portfolio support. By democratising and unifying venture building tools that were once the privilege of well-funded teams, LettsGroup’s VentureFactory is leveling the playing field between a couple of folks in a garage and the best-funded Silicon Valley startups. No hype, just real, measurable outcomes: 90% lower build costs and substantially higher success rates for VentureFactory-powered startups.

Another critical part of 2025’s success story was the roll-out of core applications built to turbocharge ventures. These AI-enabled apps, all integrated with the VentureFactory, saw major launches and adoption this year, showcasing LettsGroup’s dynamic, multi-app approach.

Meet Jot, the AI-native diary and personal organiser that became one of 2025’s breakout stars. Jot set out to reimagine one of the oldest consumer products (the diary) for the AI era, and it’s succeeding with flair. After adopting the VentureFactory early on, Jot aimed to be one of the first startups built 100% with AI – and they delivered. The lean Jot team leveraged AI for everything from product development to marketing, collapsing their time-to-market. Jot went from idea to private beta in mere months, and all the way to public launch in just 5 months – a lightning pace that made it the fastest VentureFactory-built startup to date. Upon launching this November, Jot immediately started signing up free and paying customers from day one (helped by a creative “Lola and JotBot” viral marketing campaign).

So what does Jot do? In short, it’s the personal organiser you always dreamed of. Users simply jot down a diary entry, and JotBot, the app’s AI assistant, springs into action. JotBot automatically creates calendar events, tasks, and reminders from your entry, populating them into an integrated calendar and task manager – no more switching between separate journal, calendar, to-do, and contacts apps. By unifying journals and productivity tools, Jot saves time and keeps life organised in one place. Jot launched with an attractive freemium model and affordable subscription plans, so whether you journal a few times a week or keep a rigorous daily log, there’s a plan for you. (Pro tip: Jot’s Max plan runs under £5 a month for power diarists, and all plans were 20% off for the launch promo – an absolute steal for an AI life-assistant!). The momentum is real – Jot’s early success shows how a small startup with a big idea can use AI to punch above its weight, delight consumers, and monetise quickly.

Jot’s “Lola and JotBot” campaign added a fun, human touch to its AI-powered diary app. Jot is more than a cool product – it’s a proof-of-concept for our AI venture model. By doing “EVERYTHING with AI” (as the Jot team proudly says) and focusing on a massive market ripe for innovation, Jot exemplifies the founder-driven, AI-augmented approach LettsGroup champions. Founders and investors alike have taken notice that Jot’s user adoption is entirely organic – achieved with near-zero marketing spend, thanks to viral content and built-in network effects. Keep an eye on Jot as it scales in 2026; it’s not every day you see a centuries-old product (the diary) reborn as an AI app with both mass-market appeal and subscription revenue from the get-go.

Another 2025 highlight was the public beta launch of LettsCore, our groundbreaking AI and blockchain-powered Content Management System. After three years in R&D, LettsCore went live at the end of Q3 and is already performing nicely with thousands of users on board in just a few months. LettsCore addresses a pressing need for digital creators, media companies, and agencies: giving them total control over content ownership, monetisation, and distribution in a way legacy CMS platforms can’t. Every piece of content becomes an autonomous asset in LettsCore – stored with blockchain-backed security, enriched with AI for search and auto-tagging, and tokenized for micro-payments and NFT minting. In other words, LettsCore isn’t just another CMS; it’s a full-blown content operating system for the Web3 era.

This year, the LettsCore team hit key technical milestones: off-chain content storage integrated with Solana blockchain for transparency, AI tools for automated social media content generation, and robust subscription/micropayment infrastructure. By Q4, we saw enterprise interest solidify – our first enterprise client fully rolled out LettsCore, validating the product’s market fit. The story is building as LettsCore positions to capture an emerging market: content-rich businesses seeking decentralised, intelligent alternatives to old-school content management. With new enterprise features in development (advanced analytics, bulk content uploads with AI-generated descriptions and tags, and more.) and a clear first-mover advantage, LettsCore is poised to become a vital new cog in the media-tech landscape. It’s not often you see “blockchain” and “CMS” in the same sentence without an eyebrow raise, but LettsCore made believers out of skeptics in 2025, and we’re excited to scale it further in 2026.

Also in 2025, LettsGroup launched LettsNews, our AI-powered newsroom platform that boldly proclaims: “Newsroom tech for everyone.” In an era when the media is fragmented and independent journalists struggle for resources, LettsNews arrived as a game-changer. Public beta kicked off in late July, and by Q4 we had dozens of news creators and marketers onboard – with a strong percentage converting into paid subscribers for premium features. The appeal is clear: LettsNews gives freelance journalists, content marketers, and small media teams the kind of sophisticated publishing and distribution tools previously reserved for big newsrooms, but at a fraction of the cost. It’s a full-stack digital newsroom: users can capture stories in text, image, audio, or video (even on the go via mobile apps), leverage built-in AI for research and content generation, assemble complete stories in minutes, and auto-distribute them across sites and social channels. Tedious tasks like formatting articles, sourcing images, and scheduling social media posts are handled by smart automation. The result? Up to 10× faster content production and dramatically lower operating costs for independent news organisations and content marketers alike.

And we didn’t stop at launch. Throughout 2025, LettsNews kept innovating. The team introduced an intelligent social promotion system (even integrating Mastodon for decentralised reach), and began building the pièce de résistance: the NewsAgent. Slated for release in January 2026, LettsNews’s AI NewsAgent will function like an entire virtual newsroom team at your disposal – helping writers with everything from story ideation and research to assembling all the content assets (text, images, videos, audio) needed for a story, editing with inline AI assistance, and fact-checking before publishing. It’s an end-to-end generative news AI that could redefine content creation.

Also in the pipeline is the LettsNews Content Store, a marketplace for users to buy and sell news content (think Getty Images meets news), opening new revenue streams for our community. And for larger organisations, LettsNews is rolling out an “Organisation Plan” to let entire news teams run a fully functional, AI-optimised newsroom in-house. In short, LettsNews spent 2025 quietly gearing up to become a universal online news agency for the masses. As independent media continues to rise, we’re proud to be providing the tech backbone to support it.

Looking ahead, one of the most exciting developments is VOICES, a new social platform set to launch in Q1 2026. While not live in 2025, VOICES was brewing behind the scenes all year – and it represents LettsGroup’s forward-looking ethos at its best. VOICES is conceived as a “new town square” for creators, writers, entrepreneurs and innovators. Think of it as a filtered, Web3-friendly social network that values meaningful conversations over noise – a safe space for solopreneurs and thought leaders to share ideas and connect. What makes VOICES especially powerful is that it will be fully integrated with the VentureFactory ecosystem. Core app users and startup founders can seamlessly plug into VOICES to network, collaborate, and amplify their reach. In an online world plagued by toxicity and algorithmic chaos, VOICES will offer curation, community, and control. We’re incredibly excited about its potential to expand the LettsGroup platform into the social realm, creating a virtuous loop between our venture-building tools and a vibrant community of innovators. Stay tuned as VOICES goes live – early adopters of our 2025 products will feel right at home in this new social universe.

Beyond product launches and tech milestones, 2025 was the year LettsGroup cemented its influence in the startup space. Our VentureFactory platform didn’t just attract users – it attracted partners and a community. In the new year, we will start to forge cornerstone relationships with accelerators, VC firms, and other startup hubs to integrate the VentureFactory into their programs. We also launched the “LettsTalk Tech” event series in collaboration with industry partners, bringing together founders and investors to discuss the future of venture building. The overwhelmingly positive response to November's debut event showed that LettsGroup is not just participating in the conversation – we’re leading it.

Our customer base swelled throughout 2025, reflecting genuine product-market fit. We saw multiple new customers signing up daily for the VentureFactory and/or its core apps, creating early network effects that continue to accelerate growth. The expanding advisory board (with seasoned investors and tech leaders joining) is another testament to LettsGroup’s rising profile. These advisors are helping guide strategic moves as we scale, and their involvement signals strong confidence in our mission to re-imagine venture building and its relationship with venture capital (from “artisanal” to AI-driven, as we like to say).

Crucially, we’re also seeing success stories from our ventures and users that validate the LettsGroup approach. Jot’s rapid growth and paying customers are one example, but many other VentureFactory-powered startups are quietly building in stealth, set to make waves soon. The new startup metrics emerging from our platform are eye-opening: tiny teams (often no more than 5 people) achieving what traditionally took armies of developers and MBAs, and early-stage companies securing investor interest faster as our process collapses funding stages by delivering traction sooner. Founders are telling us that using the platform not only saved them money, but also made their startups fundable – by the time they approach VCs, they have solid products, market validation, and even due-diligence data auto-prepared by AI. That’s a win-win: founders retain more control (less dilution early on) and investors get startups that are de-risked and primed for growth.

From a business standpoint, LettsGroup’s own performance soared. Our software revenues doubled in 2025 (driven by surging subscriptions across our AI SaaS offerings) and our venture pipeline grew rapidly. From our beta launch in June 2025 we added roughly one new startup per month; by year’s end we’ve set in motion plans to scale that up to one new startup per week by end of 2026. It’s an ambitious goal – but if there’s one thing 2025 proved, it’s that the combination of passionate founders + AI automation is a formula for unprecedented scaling. The customer adoption momentum and the results our ventures achieved have given us the confidence to push the envelope even further.

Meanwhile, our wider core apps continued to thrive, adding to our influence. LettsArt, the AI no-code platform for artists and galleries, crossed a major milestone with over 1,300 online galleries and 5,000 collectors using the platform. It rolled out version 2.5 with new AI features and multi-user plans, and is now gearing up to launch LettsArt Market – an online art marketplace that will instantly become one of the largest of its kind, connecting emerging artists with collectors worldwide. And LettsSafari, our nature rewilding venture, quietly expanded its community and is preparing to open its first commercial rewilding safari parks in the UK, blending ecological impact with sustainable business. By year-end, LettsSafari even announced the upcoming AI-powered “Safari Guide” assistant to help people rewild their gardens and land, bringing conservation tech to anyone with a patch of green. These success stories from our branded ventures underscore the versatility of the VentureFactory model – from media and fintech to climate and art, our approach works across domains.

As we look to 2026, LettsGroup is poised for even greater things. The foundation laid in 2025, with product innovation, proven traction, and a growing community, positions us to scale venture building like never before. Our roadmap for next year is brimming with exciting developments: the VentureFactory will continue evolving with even smarter AI agents and features (we’re already on Dashboard version 0.3 and climbing, and as more startups and investors join, the platform’s capabilities and network effects will only grow. We plan to significantly ramp up our venture customer numbers: where we added a number of new startups in 2025, by the end of 2026 we aim to be adding one every single week. This step-change in scale isn’t wishful thinking – it’s the logical progression of our method. With automation handling the heavy lifting and a scalable “startup assembly line” in place, multiplying our throughput is just a matter of onboarding more founders and letting the AI fly.

On the product front, early 2026 will see the launch of major new tools that have their genesis in 2025’s work. We’ve talked about LettsNews' upcoming AI NewsAgent and content marketplace – these will come to fruition and further empower independent media. VOICES will go live, weaving a social layer through our ecosystem. LettsArt Market will open as a bustling hub for creative commerce and entrepreneurs, likely boosting LettsArt’s user growth even more. And across all our apps, expect continuous improvement: more AI magic, more user-friendly polish, and more integrations, driven by user feedback and our relentless drive to innovate.

Strategically, we’re also entering a growth and market expansion phase. Until now, a lot of our multi-product build phase was about proving the model; having done that, 2026 is about capturing market share. You’ll see LettsGroup starting to expand beyond the UK market, engaging new regions where startups are eager for an edge. We’ll be rolling out new marketing initiatives and perhaps yet more mini-apps and automation to cater to a broader audience of entrepreneurs (because every visionary with a great idea should be able to afford their own AI venture team!). Our expanding advisory board and partner network will be integral in this push, helping tailor our approach to different startup ecosystems globally.

All of this momentum also fuels our corporate trajectory. We haven’t been shy about our goal to take startups from zero to IPO, and that applies to LettsGroup itself as well. With our platform seeing strong revenue growth and a robust pipeline, we have our sights set on an IPO in the not-too-distant future. We envision LettsGroup becoming one of the defining tech companies that champion a new model of venture building – operational venture building + capital powered by AI, at scale. LettsGroup's trajectory is clear. As one investor put it, LettsGroup might just be building the “5-person unicorn” factory – and public markets love a good unicorn story.

In summary, 2025 was a transformative year for LettsGroup. We launched industry-shifting products, doubled down on our mission to make venture building smarter and faster, and saw our vision validated by the market. From key metrics (like 90% cost reductions and 10× speed-ups) to human stories (founders regaining focus, investors finding gems with our data), the impact has been tremendous. And through it all, we maintained the LettsGroup spirit: authoritative in our strategy, insightful in our thought leadership, dynamic in execution, future-forward in technology – and always enjoying the ride. To all our users, startup founders and investors who joined us this year: thank you. You’re part of something special – a new era where innovation thrives on intelligence and efficiency. Here’s to an even bigger 2026, as LettsGroup continues to accelerate venture building and help you, the visionaries, build the future faster than ever before. Onwards and upwards!

This article first appeared at the LettsGroup blog.

LettsGroup is ending the year on a high. Much of the group's multi-product build phase and pure investment phase has been completed with the full launch of its AI VentureFactory and core apps. The group is now tightly focused on its commercial growth phase, with multiple new customers signing up to its VentureFactory and/or core apps on a daily basis reflecting early network effects.

As a result, LettsGroup is expanding its advisory board ahead of strategic developments in 2026. If you are interested in joining our investing advisory board contact us at [email protected] .

The AI VentureFactory has completed its early beta and is now moving to full commercial launch. The team just released the latest, most powerful version of its startup agent, plus a bunch of new AI tools and core apps.

Instead of 15-20 disconnected tools, you get a single AI-powered venture system with:

Innov@te™ Startup Agent – an intelligent co-pilot guiding you through 7 stages, 49 steps and hundreds of sub-steps, covering the full venture lifecycle from idea to exit. With AI outputs at every single step to effortlessly propel startups forwards.

Core Apps & AI agents – a suite of specialised apps and AI agents for marketing, product, operations, forecasting, fundraising prep and more – your “AI startup team in a box”.

Investor intelligence & readiness – tools for valuations, decks, models and due diligence workflows so you look like a serious company, not a hacked-together side project.

LettsGroup’s own venture building track record is built on this methodology – reducing the typical cost of building startups to seed stage by up to 90% and dramatically improving success rates versus industry norms. Plans and pricing start at just £19 per month , making the VentureFactory probably the most powerful, yet cost effective venture building platform on the market.

Its subscription plans are built to match where startups are on their journey:

Startup Lite – £19/month for solopreneurs and new startups (1 user, full Innov@te™ startup agent, step-by-step AI venture-building system, GTM and investor tools, access to all VentureFactory apps, plus AI support and optional Co-Pilot expert hours).

Startup Ultra – £129/month for seed-funded and scaling teams, with 2 users, a Co-Pilot programme for CEO & CTO (monthly expert review), access to the AI Agent Store, and the LettsGroup venture network. Extra users at £29 per user / month.

Enterprise – £399/month per venture for larger scale-ups and corporate incubators, with 3 users, deeper Co-Pilot support, AI-automated core processes and advanced analytics. Extra users at £39 per user / month.

Most recently the team launched the new Investor / Advisor plan at £39 per user. See all VentureFactory plans at the Pricing page .

The LettsNews product team has been busy building its latest AI capability - the NewsAgent - which is an end to end AI agent for independent writers, journalists and content marketers. It enables users to build stories from scratch or amend existing, and auto-add other content assets, including images, video and audio from their LettsNews library or generate new ones. The NewsAgent helps you edit in as much detail as you like, with in-line AI and tools. It automatically generates content assets, orders and lists them, compiling them into stories that, once completed, can be fact-checked, shared with team members and edited with AI support prior to publishing. It is a fascinating new way to build quality news stories with what feels like a newsroom team with advanced tools supporting you.

The team has also been working on rounding out their auto-promote capabilities so its users can rapidly promote distributed stories to all the major social networks.

The team at LettsNews are determined to build the most easy to use, yet advanced AI-powered news story-building and distribution system available. With the wider LettsNews newsroom tech surrounding, it is a major step toward that goal - giving independent writers, PRs and journalists a system to rival any traditional enterprise newsroom software. Once the LettsNews (content) Store is added later in Q1 2026 it could position LettsNews as a universal, online news agency for the masses. You can try for free at LettsNews.com .

*LettsNews is an AI VentureFactory core app.

LettsCore is performing nicely with thousands of users, following its launch a few months ago. As a result, its product team has been working on adding product infrastructure for enterprises and app vendors including an advanced data and usage analytics dashboard. Following this, they will add bulk content uploading with AI support, and enhanced content sharing capabilities with tracking / usage / time bound social media sharing embedded.

LettsCore is in early beta and targeted at digital, SME media companies, agencies and creators looking for a content and media management system with an edge - blockchain, crypto-enabled and token-based pay-as-you-go, with the ability to deliver value, at higher performance with embedded, out of the box approaches to content monetisation, distribution and protection.

*LettsCore is an AI VentureFactory core app.

Jot , the AI-native diary and personal organiser, has completed its early beta at their usual high-octane pace. Today the team rolled out its AI calendar and task manager. Users simply write a diary entry and JotBot (its AI) kicks in, auto-creating calendar appointments and tasks that are instantly surfaced in its new calendar and task manager apps for users to view, edit and add new. Who needs multiple disconnected calendars, journals, diaries, tasks, organisers, note takers and address books when you have Jot.

As Jot goes from early beta to full launch they have today rolled out their full go-to-market pricing and subscription plans.

3 Subscription Plans:

1. Free - For people who journal 3 times a week. 12 diary entries a month, access to ALL features. 500MB storage.

2. Smart - For people who journal daily. £2.99 / month or £29 / year, 30 diary entries a month, more AI and access to ALL features. 2GB storage.

3. Max - For the most advanced diary keepers and journalers. £4.99 / month or £49 / year. 200 diary entries a month, unlimited AI, access to ALL features and 5GB storage.

There is a 20% launch discount on both paid plans until the end of January. Start for free at getjot.ai .

*Jot is an AI VentureFactory core app.

With LettsArt continuing to scale with 1,300 gallery users, and approaching 5,000 art collectors and 6,000 artworks, it has been working behind the scenes to monetise the platform further with the launch of the LettsArt Market - a next generation art marketplace for new-trend art collectors who want to go online and direct to the hottest new artists and gallerists. With LettsArt, not only can independent artists and gallerists build and operate their own branded AI no-code online art gallery to better show and manage their art, but art listed on sale in their gallery will also appear in the LettsArt Market, which, from the day it is launched, will be one of the largest, most advanced online art marketplaces. It uses search and AI for collectors to discover art easily, and the art available on sale will be categorised by genre and filtered by price range, medium and style.

Collectors will be able find some of the most exciting independent and emerging art, and buy at artist galleries and studios powered by LettsArt - leaning into the new trend for buyers to discover and collect art directly from the makers. The LettsArt Market will launch in January 2026.

*LettsArt is an AI VentureFactory core app.

VOICES is launching in early 2026 as a new, connected social platform for creators, writers and entrepreneurs - and a fully integrated social network for VentureFactory core apps and startup customers wanting to connect to it. The team is excited about the potential for VOICES as a next generation, Web3, filtered-network and safe space for solopreneurs, entrepreneurs, innovators and creators. People with valuable voices.

*VOICES is an AI VentureFactory core app.

LettsSafari is launching the world's first AI rewilding assistant in the new year. The LettsSafari Guide will be a dedicated, highly intelligent AI tool to help anyone understand about rewilding, nature restoration and wildlife conservation - answering questions, providing tips and techniques and guiding you quickly and easily through the rewilding process, supported by LettsSafari's wide-ranging insights and unique, pioneering approach to smaller-scale, mass market rewilding and nature restoration.

In Q1 2026 LettsSafari will also be launching its definitive guide to smaller-scale rewilding as a digital, coffee table type book - included free for any paying subscriber. Try it, gift it, wild it .

We highlight just a few startups in each monthly edition of LettsGroup's NewsFlash. To explore other companies powered by LettsGroup's AI VentureFactory go to LettsGroup/ventures.