The biggest problem startup founders face today is not ideas - it's execution chaos. And the silent killer is fragmented execution.

In fact, most tech and digital founders are quietly drowning in fragmentation.

You’re juggling:

15+ SaaS tools

A rotating cast of freelancers and agencies

Well-meaning advisors

Random AI prompts

A graveyard of half-finished plans and strategies

Yet there’s no single operating system connecting strategy, experiments, product, growth, fundraising and finance. Everything is ad-hoc. Every week you’re reinventing your own process. The result?

Slow learning → you don’t iterate to product/market fit fast enough

Burnt runway → you spend like a scale-up while still proving basics

Founder fatigue → you’re operating the machine and building it

Traditional accelerators give you a sprint, not a system. Generic AI tools give you outputs, not a joined-up venture. Agencies give you activity, not accountability. None of them actually run your venture building process end-to-end.

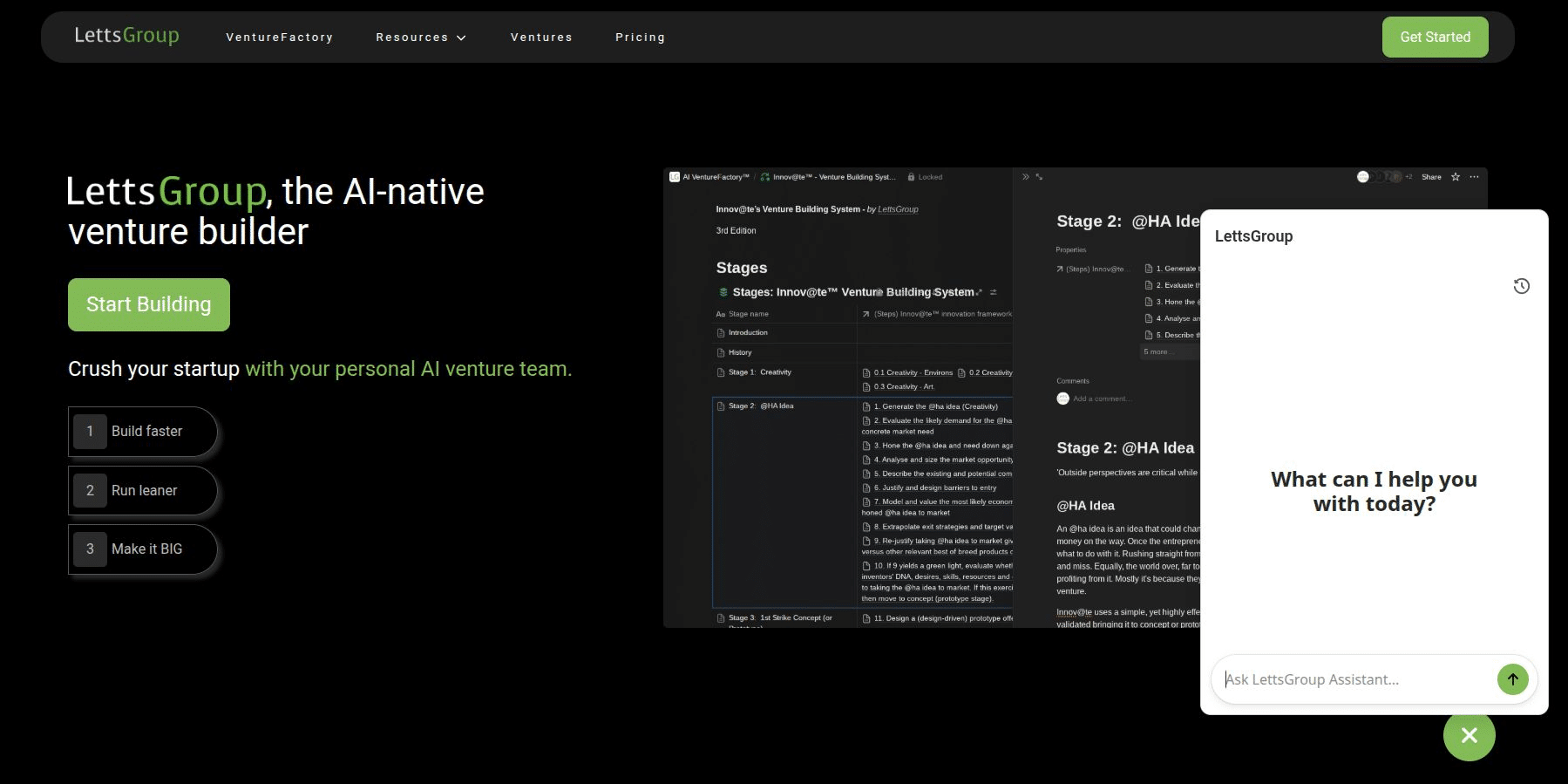

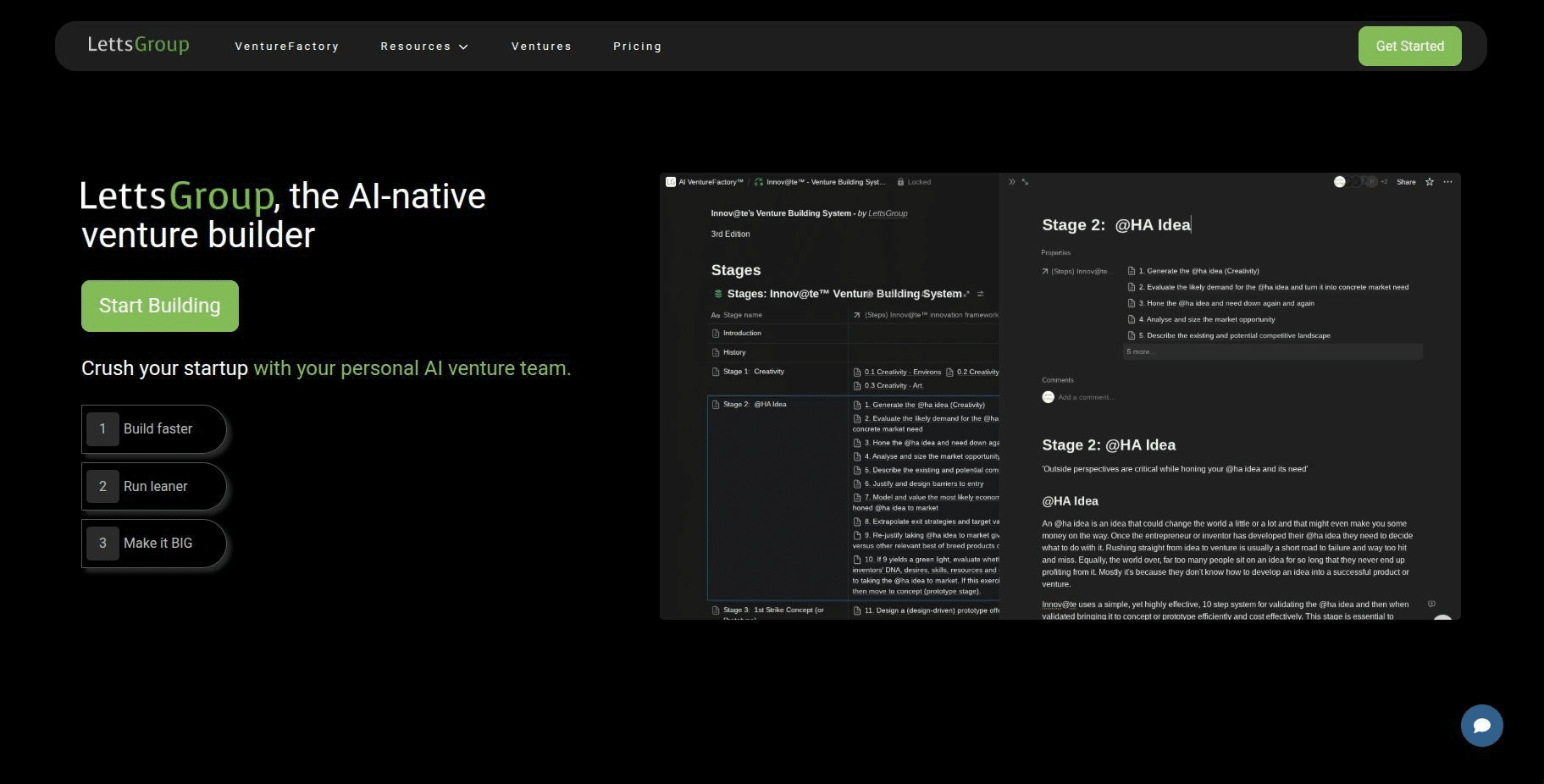

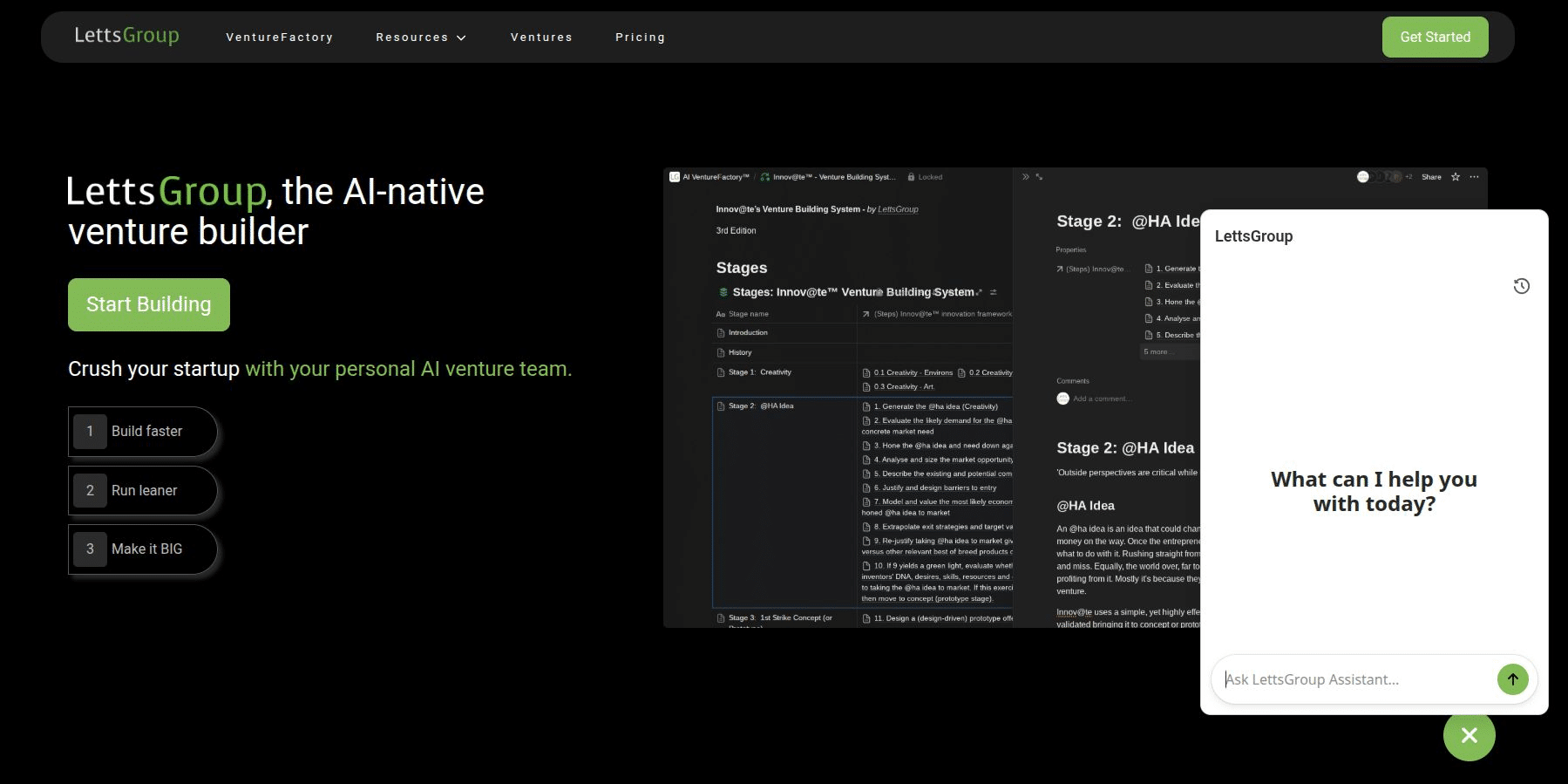

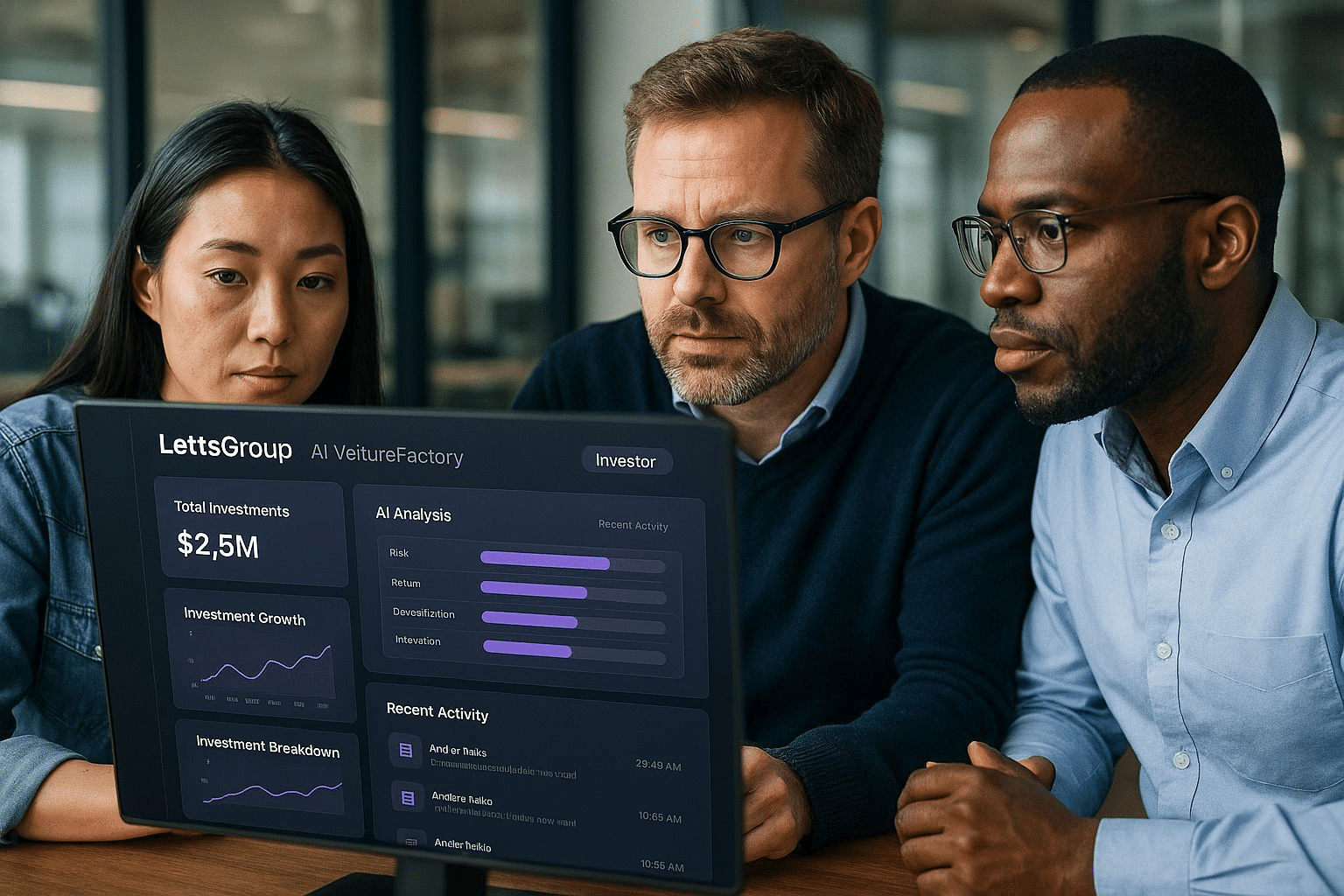

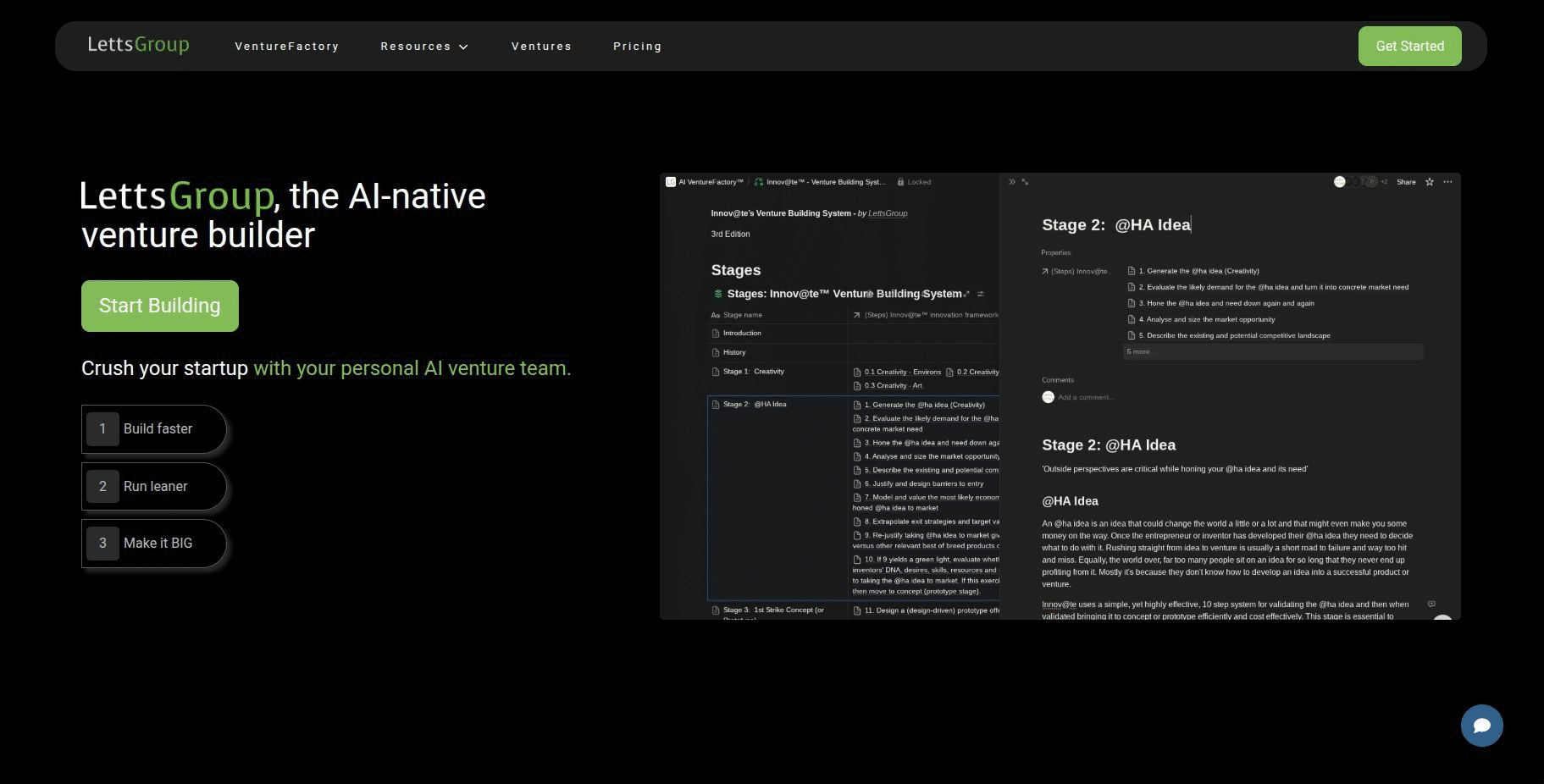

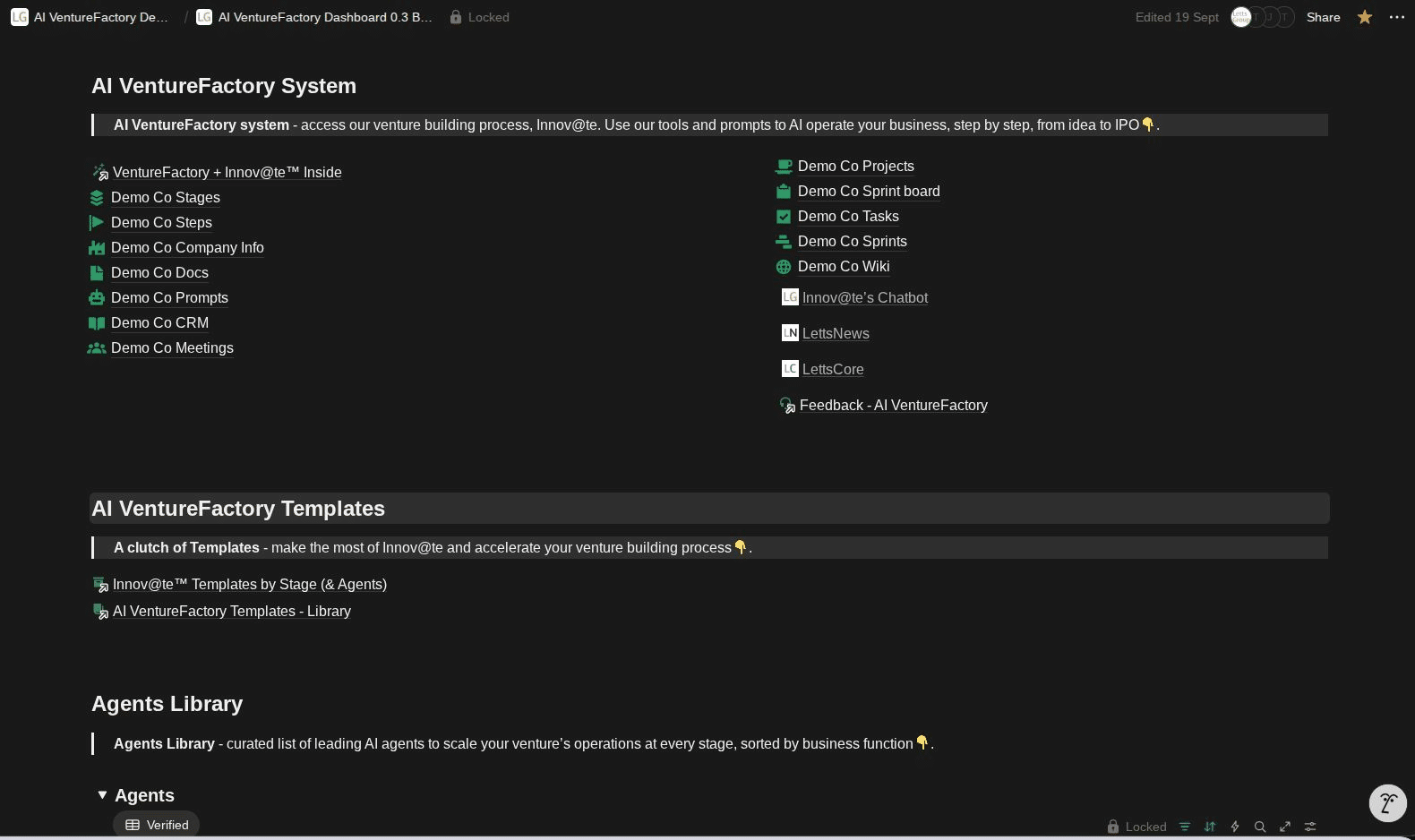

LettsGroup’s AI VentureFactory is an AI-native venture building platform that builds, scales and optimises your company at every stage – from idea to exit.

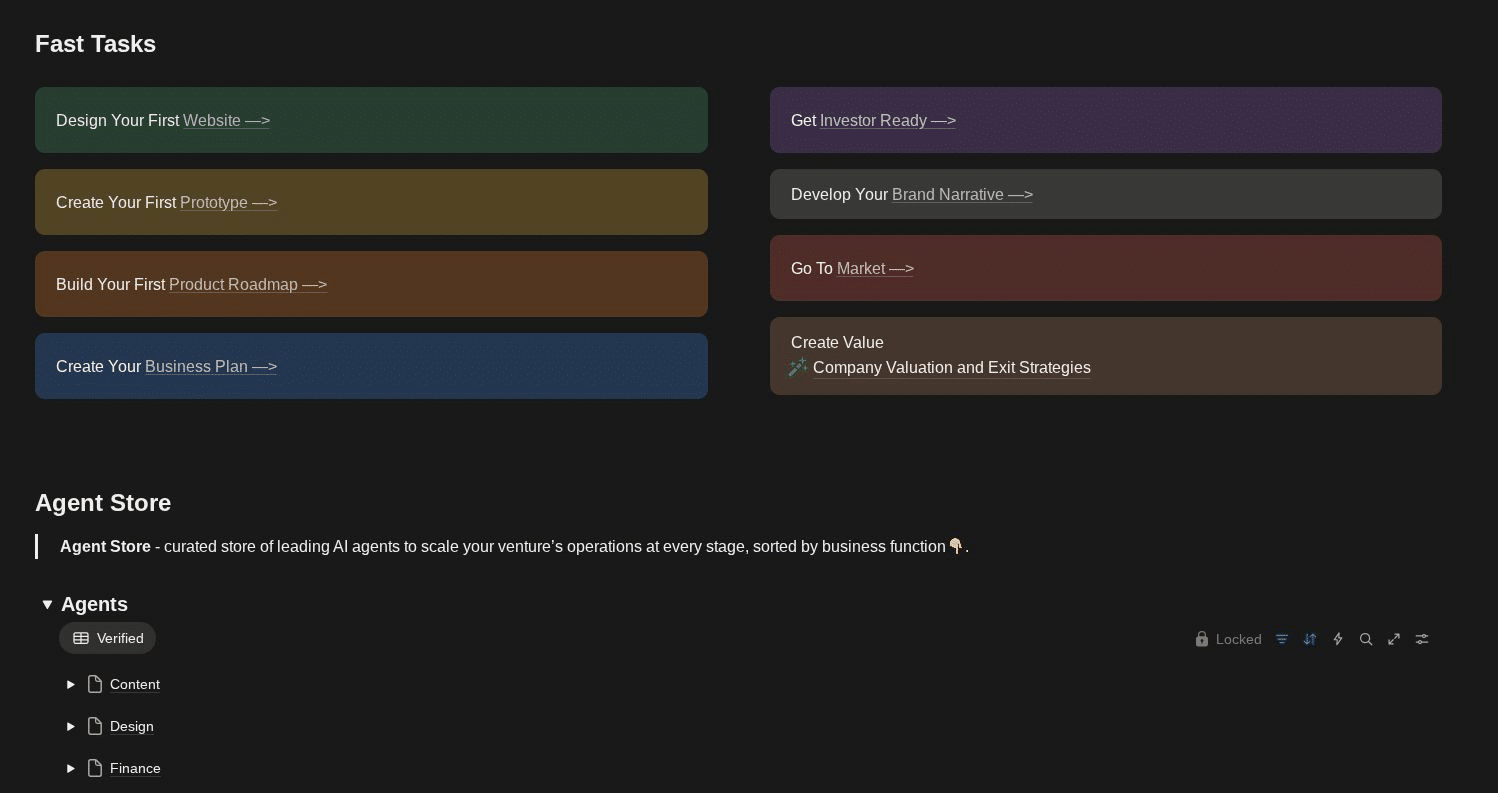

Instead of ten disconnected tools, you get a single AI-powered venture system with:

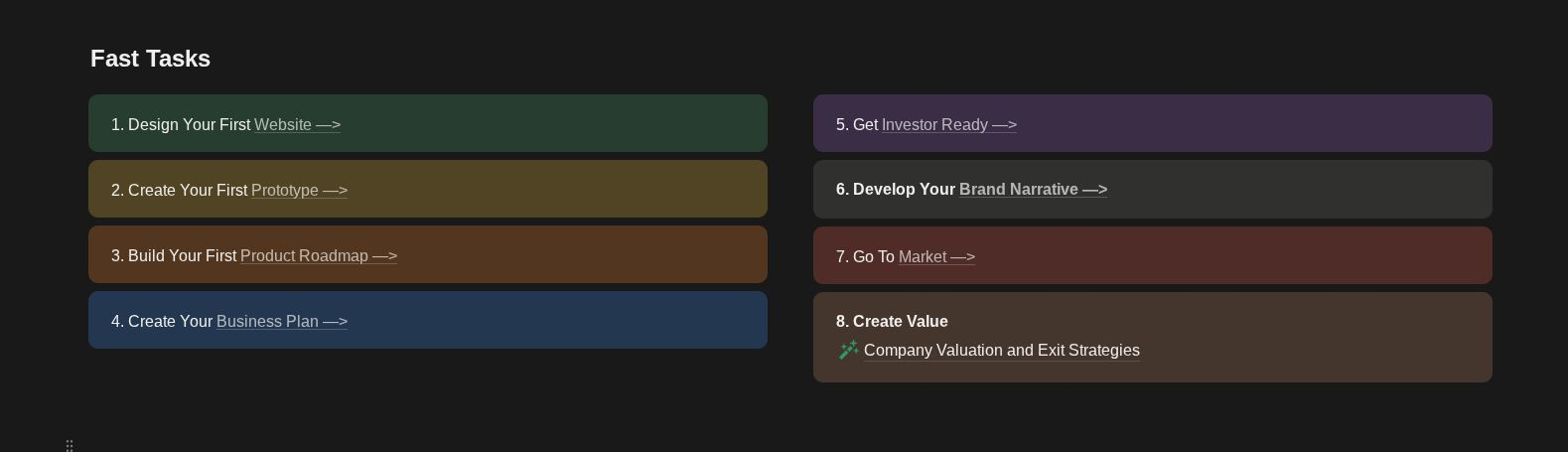

Innov@te™ Startup Agent – an intelligent co-pilot guiding you through 7 stages, 49 steps and hundreds of sub-steps, covering the full venture lifecycle from zero to exit.

Core Apps & AI agents – a suite of specialised apps and AI agents for marketing, product, operations, forecasting, fundraising prep and more – your “AI startup team in a box”.

Investor intelligence & readiness – tools for valuations, decks, models and due diligence workflows so you look like a serious company, not a hacked-together side project.

LettsGroup’s own venture building track record is built on this methodology – reducing the typical cost of building startups to seed stage by up to 90% and dramatically improving success rates versus industry norms.

And the kicker? Access starts at just £19 per month on the Startup Lite plan – including full use of the Innov@te™ startup agent and the core venture building system.

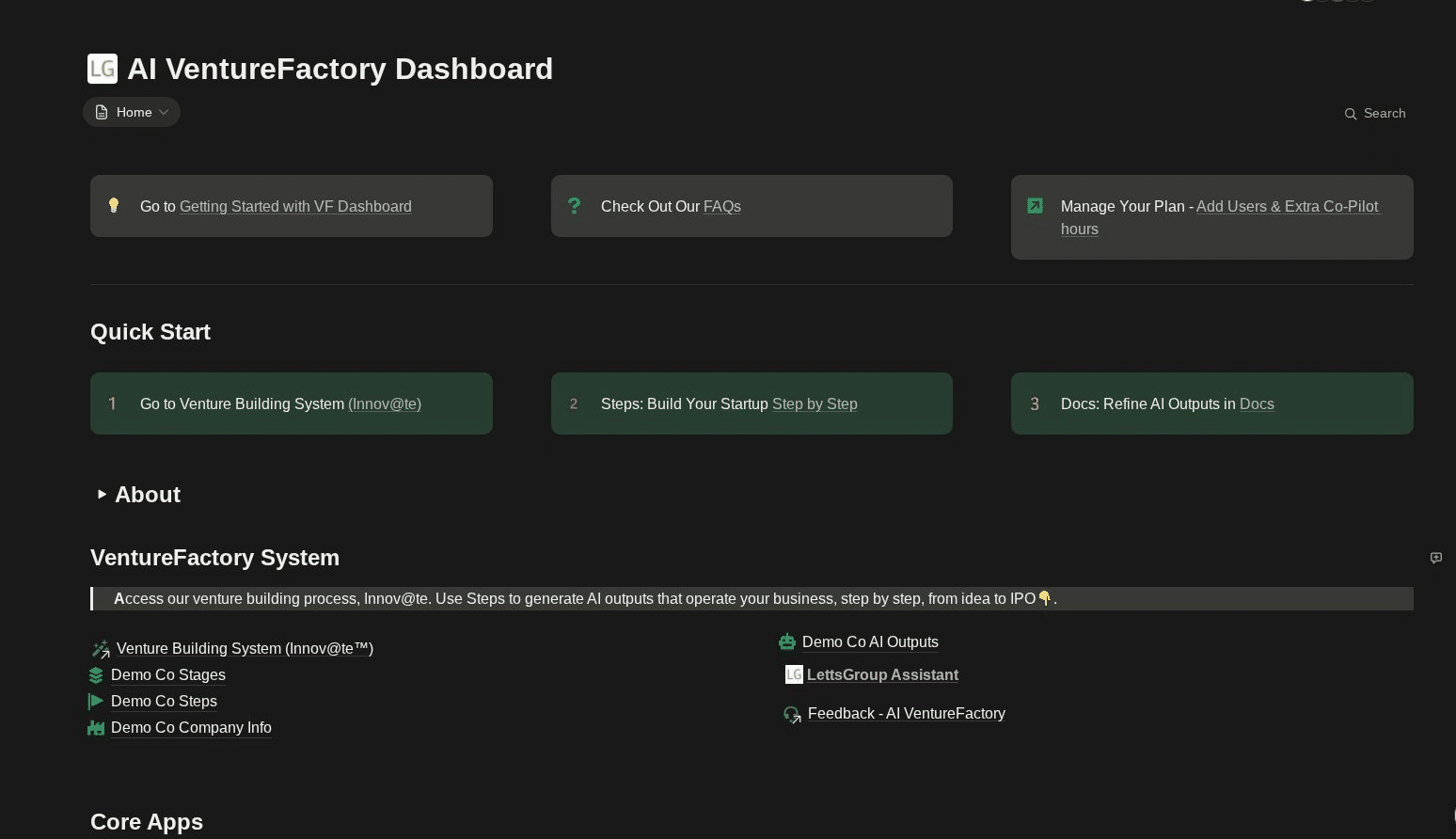

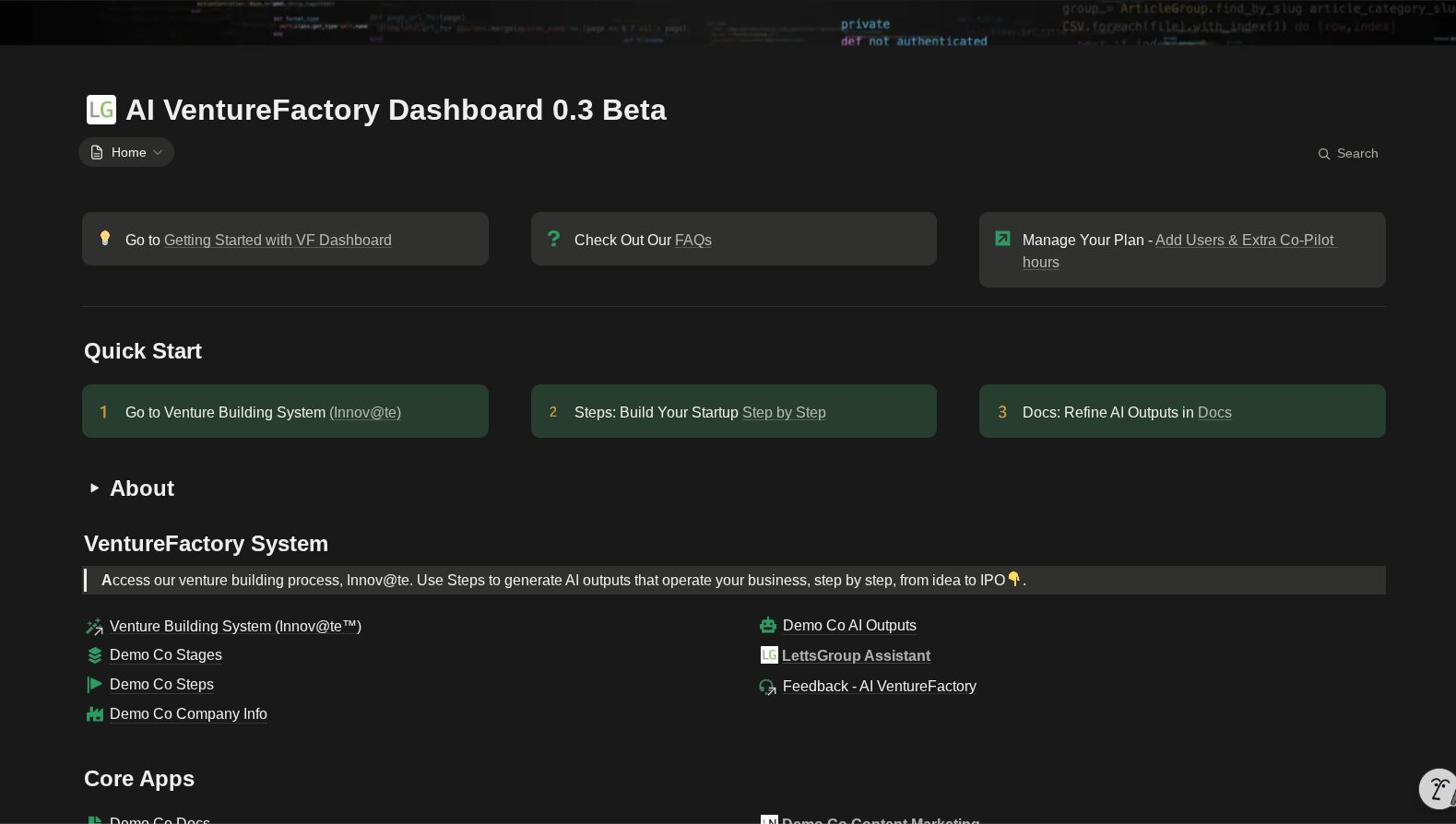

In practice, using the AI VentureFactory looks like this:

Day 1 – plug in, don’t spin up

You enter your company info and one-line description of your idea or offering.

The system adapts to your business model and builds a tailored venture blueprint in front of you.

Each week – one clear execution track

Innov@te™ tells you exactly which step to focus on next.

Carefully designed AI outputs, agents and tools generate product roadmaps, GTM plans, experiments, content, and financial models in minutes – not months.

Each funding moment – investor-grade in hours, not weeks

You spin up investor materials, forecasts and structured narratives using the same platform that’s been running your strategy and operations all along.

Instead of fragmented execution, you get compounding momentum : one system, one source of truth, one AI-augmented way of building.

For the price of a single SaaS seat or a couple of freelancer hours, you can:

Replace chaos with a proven, AI-powered venture methodology

Replace random tools with a joined-up venture operating system

Replace “hero founder mode” with a personal AI venture team backing you 24/7

If your biggest problem is fragmented execution – too many moving parts, not enough progress – then LettsGroup’s AI VentureFactory is likely the most leverage you can buy for £19 a month .

You don’t need more tools - you need a state of the art factory for your venture.

Head to Letts.Group and start building with the AI VentureFactory today.

LONDON, UK – LettsGroup (www.Letts.Group) is proud to announce the successful completion of its early beta phase and the official launch of the latest, most powerful version of the AI VentureFactory. This cutting-edge, AI-native platform is designed to revolutionise how early-stage tech and digital startups, as well as scale-ups, build, operate, and grow their businesses.

The AI VentureFactory represents a seismic shift in the venture ecosystem. By integrating advanced artificial intelligence directly into the venture building process, LettsGroup empowers founders to move from "Zero to IPO" with unprecedented speed and precision. The platform allows users to build faster, run leaner, and scale more effectively by automating complex tasks - from generating business plans and product roadmaps to executing go-to-market strategies, valuation models and financial forecasting.

With this full release, LettsGroup is also announcing its aggressive go-to-market pricing structure, designed to make elite venture-building tools accessible to everyone, from solopreneurs to scale-ups and corporate incubators.

Breaking down the barriers to entry for high-growth startups, LettsGroup has unveiled a tiered pricing model that starts at just £19 per month for the "Startup Lite" plan. This entry-level package includes full use of the Innov@te™ startup agent, a step-by-step AI venture building system, and essential tools for investor readiness.

"The AI VentureFactory is the first venture building platform that feels truly modern. It's powerful, flexible, and fast to build with," said Philip Letts, CEO & Founder of LettsGroup. "By moving out of beta and introducing our new pricing tiers, we are ensuring that every founder, regardless of their funding stage, has access to the same powerful AI tools used by the hottest startups."

Key Features of the AI VentureFactory Include:

Innov@te™ Startup Agent: An intelligent co-pilot that guides founders through every stage of the venture lifecycle.

Comprehensive Automation: Capabilities to handle marketing models, brand strategies, and operational tasks in minutes rather than months.

Core Apps: providing your scale-up infrastructure from day 1.

Flexible Tiers: Options ranging from the £19/month Startup Lite for solopreneurs to the Startup Ultra (£129/mo) for post-seed teams, and Enterprise solutions for corporate incubators.

Investor Intelligence: A dedicated plan for VCs, accelerators and advisors to perform due diligence and support portfolio companies at just £39/mo.

Founders and investors can explore the full range of features and subscription plans at https://letts.group/pricing/.

About LettsGroup

LettsGroup is a leading innovator in the digital economy, focused on building the next generation of technology ventures with its AI venture building platform. Through its flagship AI VentureFactory, LettsGroup combines your AI startup team with AI-native efficiency to help startups and scale-ups execute their strategies with precision.

For more information, visit https://letts.group/.

Thank you to everyone who joined LettsGroup and Brown Rudnick for "LettsTalk Tech" on 13 July. It was a fantastic event for entrepreneurs and investors. The next edition will be in April 2026.

LettsGroup is expanding its advisory board ahead of strategic developments in 2026. If you would like to join our investing advisory board please contact us at [email protected] .

Since early on, we understood that LettsGroup's AI VentureFactory and its core venture building process, Innov@te, deliver a sizable advantage to startups that use it. They build faster, run much leaner. It gives them a huge advantage in the market. With the AI VentureFactory now scaling, its users are demonstrating a new set of metrics for the tech and digital startup sector. Here are some of them:

First 6 private beta startups on the platform are now at or beyond Seed stage with new model economics having lowered cost to Seed by between 80 and 90%

Funding stages collapsing - faster cycles can inspire investors to ‘jump in earlier’.

From FTE to FTB (full time bots) - FTE count as a metric is dead. It’s about how much AI you use.

Team no bigger than 5 through scaling (beyond series A).

From idea to market launch in less than 12 months , less than £200k burn

Elapsed time for first business plan from 6 weeks to 6 minutes.

Time to first website less than 2 days

Draft forecasts in minutes

Equity analyst-grade reports for startups now a reality

Advertising agency grade brand narratives and organic marketing outputs enabled

Advanced product roadmaps in hours not weeks.

Plus much more…

Using LettsGroup's AI VentureFactory founders can now finance their startup to market launch - so professional investors participate later, which is a win-win, delivering greater founder control, with more data and proof points for investors when they are required.

This week the AI VentureFactory is starting to roll out its latest version with a new dashboard and numerous new breakthrough enhancements ahead of scaling further with larger numbers of startups and investors adopting the pioneering AI platform.

The LettsNews product team is building 3 new features that should make it the most innovative newsroom tech on the market by quite a distance.

*LettsNews is an AI VentureFactory core app.

Now that LettsCore is scaling nicely with thousands of users following its launch 3 months ago, its product team is starting work on more tech infrastructure for enterprises and app vendors including an advanced data analytics dashboard, bulk content uploading with AI support, and enhanced content sharing capabilities with tracking / usage /time bound sharing embedded.

LettsCore is on a solid path to become the new generation AI and Blockchain CMS for content-rich companies seeking to control and micro-monetise individual content assets at-scale better than they can today with traditional, more silo'd CMS platforms. We believe that LettsCore can become a vital new cog in the media landscape.

*LettsCore is an AI VentureFactory core app.

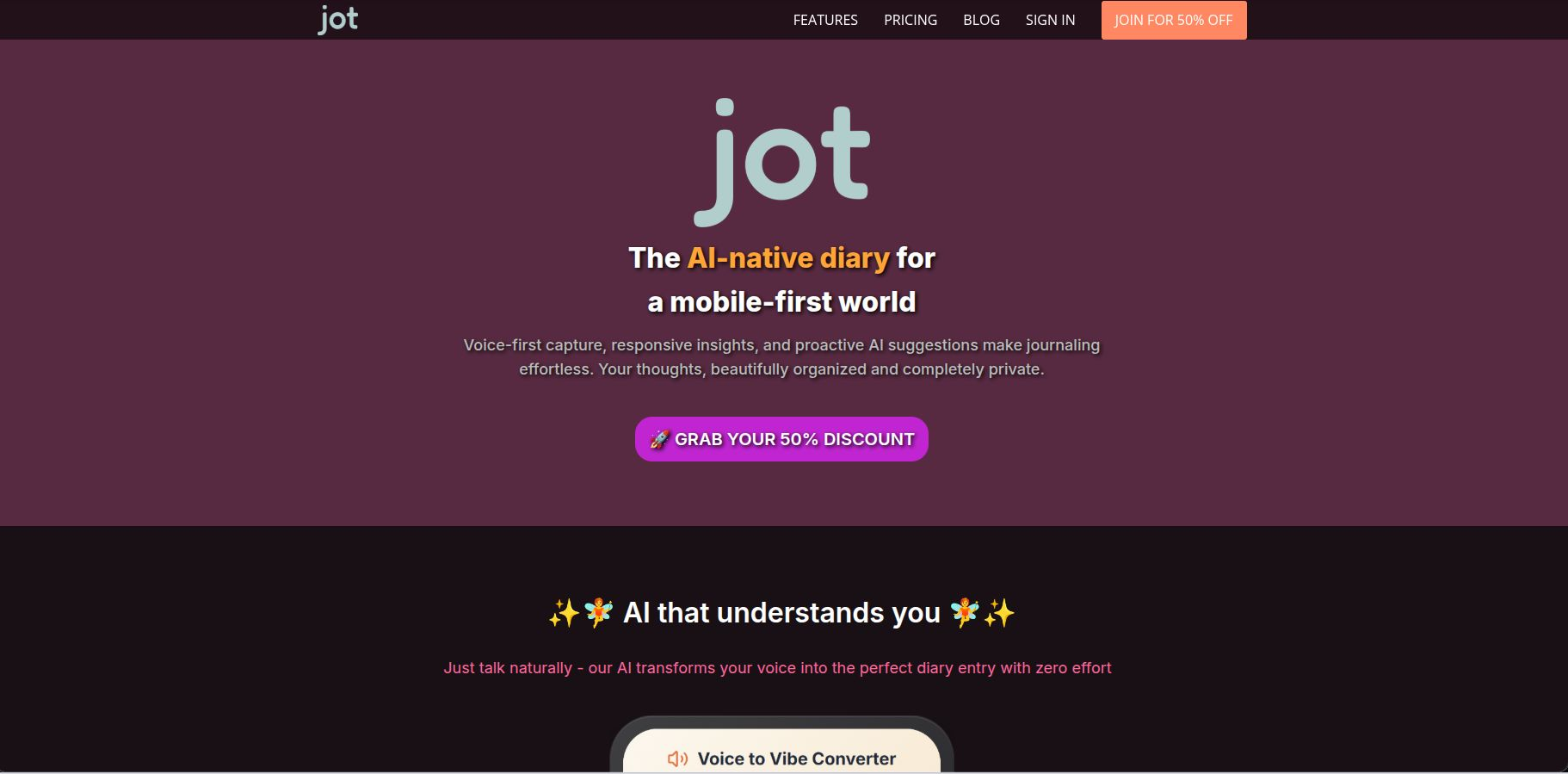

Jot , the AI-native diary, launched just 2 weeks ago and is adding paying customers at a clip thanks to its creative 'Lola and JotBot' campaign. It is also the fastest startup powered by the VentureFactory to date:

1. Idea to market launch in 5 months - started private beta just 6 weeks before launch

2. Do EVERYTHING with AI - the new style software startup approach?

3. Paying customers arriving through organic and viral marketing alone

4. Adding new product features every month

5. Available for a limited time on a special Black Friday deal - from just £19.99 for 12 months!

We all experience the frustration and fatigue from too many productivity tools - with a calendar, agenda, journal, notebook, address book, task manager and more sitting in isolated silos. Jot makes our lives easier by unifying them in one AI-native digital diary. Just add a diary entry and JotBot (AI) does the rest - creating calendar entries, appointments, tasks and more. The personal organiser you always dreamed of. Available on mobile, tablet and desktop.

*Jot is an AI VentureFactory core app.

As LettsArt powers towards 1,300 galleries, 4,500 art collectors and 6,000 artworks, and with the release of LettsArt's (AI) Assistant - the leading AI no-code platform for the art world can shift gears to its next phase of growth: data-powered, community-enabled and collector-driven with a slew of new features being released next year to support new generation, independent minded artists, gallerists and art collectors.

These include a significant new step into community engagement, advanced social features and inter-gallery comms. Beyond this, LettsArt will launch more premium features for higher tier plans, including auto-distribution to online digital art marketplaces.

VOICES will launch in early 2026 as the new town square for creators, writers and entrepreneurs. It will become the fully integrated social network of choice for VentureFactory core apps and startup customers that want to connect to it. The team is excited about the potential for VOICES as a next generation, Web3, filtered network and safe space for solopreneurs, entrepreneurs, innovators and creators. People with valuable voices.

*VOICES is an AI VentureFactory core app.

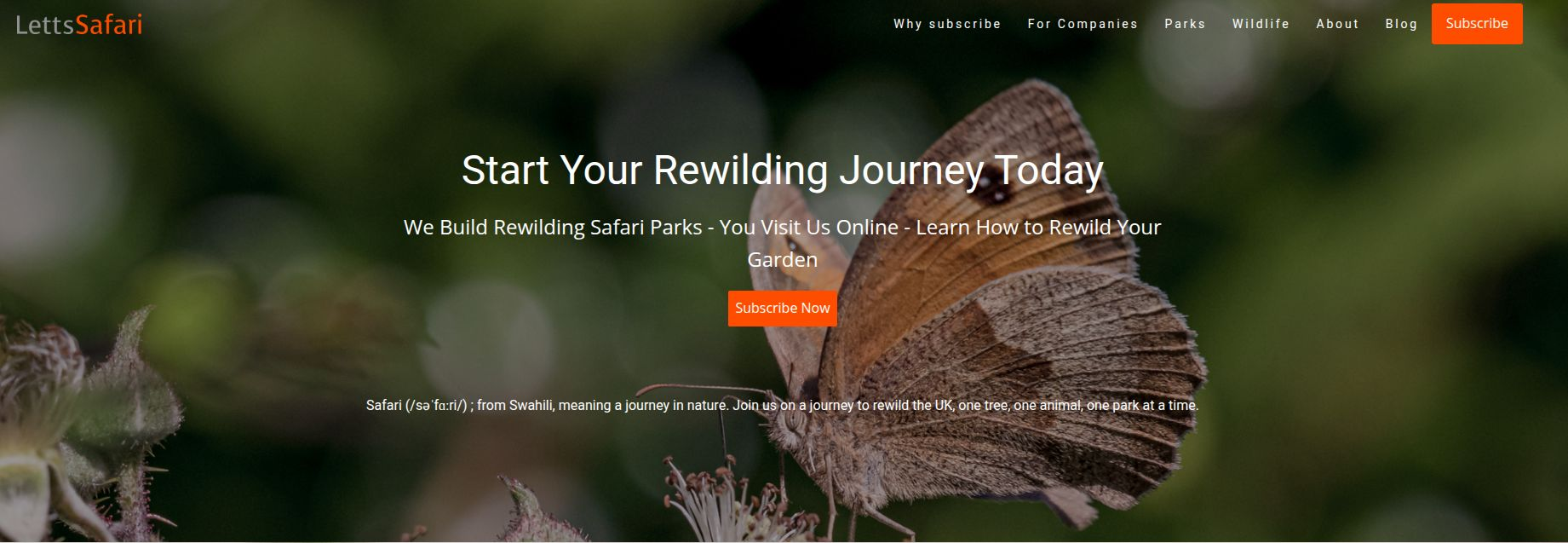

Membership of LettsSafari , the pioneering platform for smaller-scale rewilding, continues to be one of our most popular holiday gifts. After all who wouldn't want a bit of extra 'wild' in their lives. Becoming a member of LettsSafari is also the best way to start your rewilding journey. This experience will evolve further with its exciting new AI tool which is coming soon. Who would have thought of inventing your very own AI (Letts)Safari Guide!

LettsSafari is also soon launching its definitive guide to smaller-scale rewilding as a digital, coffee table style book - gifted to any paying member. Try it, gift it, wild it .

We highlight just a few startups in each monthly edition of LettsGroup's NewsFlash. To explore other companies using LettsGroup's AI VentureFactory go to LettsGroup/ventures.

Happy Thanksgiving!

The story of corporate venture building begins not in Silicon Valley, but in late 18th-century Britain with an entrepreneur named John Letts. In 1796, John launched what is recognised as the world's first corporate incubator, a revolutionary business model that would take two centuries to truly evolve into its modern form.

John Letts' original venture studio was ingeniously simple yet remarkably effective. His operation comprised a large storefront that sold products and prototypes directly to customers, with venture studio space in the back rooms where new prototypes were developed and products manufactured. Letts himself bridged these two worlds, moving between the retail front and the development back, selling products while simultaneously gathering crucial customer feedback to inform the next iteration of innovation.

This integrated approach proved extraordinarily productive. Within the first twenty years, John Letts' incubator launched an impressive array of products that we now take for granted: the commercial diary in 1812, journals, calendars, address books, and parliamentary ledgers. His methodology - combining direct customer interaction with rapid prototyping and product development - contained insights that remain valuable to this day. His ethos of making products with customers, not for customers was groundbreaking.

It would take approximately 200 years for the concept of Corporate Incubator 2.0 to emerge. The late 20th and early 21st centuries saw the rise of accelerators, venture studios, and operational venture capital as the latest iteration of organised venture building. However, despite their proliferation, most of these models have operated as what critics describe as "body shops" or "classroom models", lacking the full end-to-end methodology and integrated systems that characterised even the original John Letts model.

The fundamental problem has remained consistent across centuries: innovation delivery and financing have been too ad hoc. The traditional venture building approach has been artisanal, dependent on analogue processes and individual heroes rather than systematic methodology. The statistics are sobering, venture capitalists typically deliver one successful venture out of ten investments, while corporate venture success rates are even lower, hovering around one in fifteen or twenty.

This ad hoc approach to venture building and what entrepreneur Paul Graham termed "founder mode" has lacked the standard methodology and systematic approach that other industries have long employed to improve outcomes and reduce risk.

Philip Letts, a descendant of John Letts, has spent decades working to systematise and modernise his ancestor's insights. After building his first incubator in the Web1 era and his second in Web2, Philip founded LettsGroup's VentureFactory five years ago. His track record speaks to the power of systematic approaches - his first two incubators achieved a venture success rate of one in four, dramatically outperforming industry averages.

Now, with the AI VentureFactory, LettsGroup has created what they describe as the world's first AI-native venture building platform. This represents not just an incremental improvement but a fundamental reimagining of how startups can be built and scaled in an artificial intelligence-enabled world.

The AI VentureFactory's approach centres on scaling startups with technology rather than people. The platform delivers what LettsGroup calls "startup intelligence" - an AI agent combined with chat functionality and a personal AI startup team that handles the operational heavy lifting. This is complemented by over fifteen core applications providing scale-up infrastructure from day one, allowing founders to focus 80% or more of their time on product development and customer relationships while the VentureFactory handles the rest. Added to this they have recently launched a vetted, 3rd party Agent Store.

The vision extends beyond simple automation. LettsGroup positions the VentureFactory as evolving from a "sat nav" for startups to enabling truly "self-driving" companies. The platform is supported by experienced hybrid player-coach teams across LettsGroup who understand how to build and co-pilot startups through various growth stages, augmented by the VentureFactory's personal AI startup team.

This combination of human expertise and AI automation aims to make possible what they call the "one man/woman unicorn" - companies that can achieve massive scale without proportionally massive teams.

The power of the AI VentureFactory lies not just in its technology but in the proprietary venture building system that underpins it, a methodology proven over decades and multiple incubators. LettsGroup's venture building process has been developed and refined over fifteen years across more than twenty startups, taking tech and digital ventures from initial idea through to exit.

The current iteration of the system extends to seven stages, forty-nine steps, and hundreds of sub-steps, each AI-enabled. Critically, the system improves with the advancement of each venture through an integrated rating system, creating a virtuous cycle of continuous improvement.

The platform doesn't simply provide advice or guidance - it actively executes tasks . The VentureFactory builds products, creates websites, generates analyst notes, connects ventures to customers, and will soon facilitate investor connections. This active execution is what LettsGroup describes as "the magic" that sets it apart from traditional advisory or consulting models.

The economic impact of this approach has been dramatic. LettsGroup claims the AI VentureFactory reduces the cost of building startups by up to 90%. While the average cost of building tech startups to seed stage is approximately $2 million, the average cost of building the AI VentureFactory's first six tech startups to seed stage was less than $200,000.

The first six ventures powered by the platform have now reached seed stage, demonstrating new model economics across multiple metrics. Funding stages are collapsing with faster cycles encouraging earlier investment. The traditional metric of full-time employees (FTE) is being replaced by what LettsGroup calls FTB (full time bots), measuring how much AI a company employs rather than how many people.

Under this model, teams need not grow beyond five people even through scaling beyond Series A. Ventures can progress from idea to market launch in less than twelve months with less than $200,000 in capital burn. Business plans that once took six weeks now take six minutes. First websites launch in under two days. Draft forecasts generate in minutes. The platform can produce equity analyst-grade reports and advertising agency-quality brand narratives for startups - capabilities previously accessible only to well-funded, mature companies.

The fastest startup powered by the VentureFactory to date exemplifies these capabilities. Jot , an AI-powered digital diary that consolidates multiple productivity tools into a single platform, progressed from idea to market launch in just five months and began its private beta six weeks before that milestone. The venture operates with a team of five - none full-time - and has already begun acquiring paying customers.

Jot represents what LettsGroup believes may be the pure AI startup model, where virtually everything is accomplished through AI assistance, dramatically reducing the need for traditional full-time headcount during early growth stages.

Following a private beta period with internal ventures and core applications, the AI VentureFactory launched to market in July 2025. The platform now offers four subscription plans , starting at just £105 per month, catering to different customer segments: Startup Lite for new ventures, Startup Ultra for scale-ups beyond Seed stage, Enterprise for corporate incubators, and a newly launched Investor plan.

Since market launch, the platform has been adding one new customer per month, with plans to scale to one new startup per week by the end of 2026. External startups can now subscribe to access the platform, with some Startup Lite customers, after 6 months on the platform, can become eligible to pay cash-and-equity models where LettsGroup takes a stake in particularly promising ventures.

LettsGroup's vision extends beyond the current platform capabilities. Future development will expand the system's steps, AI outputs, and agent connectors to enable even deeper automation across the entire venture building lifecycle: Create, Build, Shape, Finance, Scale, and Exit. The company plans to connect the platform to pools of capital at each stage of the venture building lifecycle, creating an integrated ecosystem for venture formation and growth.

As Rob Wirszycz, Advisory Board lead, notes in the presentation materials, "The way startups are built and financed is changing thanks to AI, blockchain and crypto. LettsGroup is part of that change."

Two hundred years after John Letts opened the first corporate incubator, his descendant has created a platform that realises the full potential of that original integrated model, combining customer proximity with rapid development cycles, but now amplified by artificial intelligence to achieve scale and efficiency that would have seemed magical even a decade ago. In doing so, LettsGroup may be charting the course for how the next generation of ventures will be built, financed, and scaled.

If you're building a tech or digital startup - build smarter with LettsGroup's AI VentureFactory .

With Voice-First Capture , you simply talk for up to three minutes. Jot automatically converts your thoughts into a clean, structured entry, complete with tags and suggested hashtags, so you can capture more in less time.

Jot goes beyond transcription. Contextual Capture (opt-in) can use relevant life signals like recent locations and, soon, calendar cues to recommend what you might want to reflect on. Rather than staring at a blank page, you’ll see smart suggestions tied to your day.

Jot includes an adaptive AI that learns how you like to journal. It offers:

Personalised prompts and “micro-quests”

Summaries and mood insights

Smart tagging and organisation

JotBot for conversational follow-ups when you want a dialogue

From day one, privacy is fundamental. Jot is private by design with local encryption, zero-knowledge cloud backup, and optional app locks (biometric or passcode). Your entries are yours—full stop.

Frictionless capture: Journal hands-free, anywhere.

Timely prompts: Reflect on moments that matter, when they matter.

Clarity & momentum: Turn scattered thoughts into entries you’ll want to revisit.

Own your data: Strong privacy and security by default.

Jot is available now with simple, annual pricing that mirrors the tradition of a yearly diary. Jot Smart covers the essentials; Jot Max unlocks unlimited AI assists and deeper insights. For launch, enjoy a limited-time 50% discount with code JOTLAUNCH through November 30, 2025 .

Ready to make journaling effortless?

👉

Get started at

getjot.ai

Have questions or want to share feedback? We’d love to hear from you at [email protected] .

We are at the cusp of a transformation in how new ventures are created and scaled. The traditional image of startups – chaotic garages, massive burn rates, and long-shot odds – is giving way to a new paradigm: startups as engineered products of a systematic process, supercharged by artificial intelligence and automation. We distil some key insights and recommendations for new style venture building for both entrepreneurs and investors:

AI-Driven Venture Building is a Paradigm Shift: It’s not just incremental improvement but a fundamental change. By treating venture creation as a repeatable process and leveraging AI at every step, we can dramatically improve success rates and efficiency. New style venture building differs from traditional artisanal methods as assembly lines differ from craft workshops – the potential scale and consistency are vastly greater. Entrepreneurs should embrace this systematic mindset, and investors should recognise startups that do so as potentially lower-risk, higher-reward opportunities.

Traditional vs. New – Know the Difference: The old approach often meant each startup learning by itself, reinventing the wheel. The new approach means standing on the shoulders of accumulated knowledge encoded in platforms. Traditional was manual and people-heavy; new is automated and software-heavy. We should be conscious of when we’re falling into old patterns (“We need to hire lots of X to do Y”) versus asking “Is there a tool or process that can do this better?”. In practice: Founders, audit your operations for anything repetitive or standardisable – that’s a candidate for automation. Investors, ask startups not just what they will do, but how they will do it with technology – the how might be the difference between needing $5M or $50M to achieve the same result.

LettsGroup’s VentureFactory Example – a Glimpse of the Future: By implementing their venture building methodology and its AI-native platform , LettsGroup showed it’s possible to institutionalise innovation. Their claims of doubling startup success rates and dramatically reducing costs may seem bold, but they are backed by logic – address known failure points systematically and you will get better outcomes. The takeaway is that methodology matters . Startups should adopt a structured framework (whether the VentureFactory's Innov@te methodology or others) to ensure they aren’t missing critical steps. Investors might encourage or require portfolio companies to follow such frameworks or even provide access to them. Even if you don’t use a formal venture factory, having a checklist of venture-building steps and actively managing against it can be invaluable.

Economics Favour the Lean and Automated: We saw how small teams can reach massive scale with automation – the high revenue-per-employee case studies. The economics of startups are shifting to favour those who invest in automation early. A rule of thumb for founders: before hiring for a function, exhaust the automation options. Use humans for creativity, strategy, and nuanced relationship-building; use AI/automation for process, analysis, and scale. This will not only save money but also often produce faster outcomes (machines operate at high speed and 24/7). For investors, the “burn rate” conversation changes – it’s not just cutting burn, but smart burn. A company spending $100k on cloud services to automate may be far more efficient than one spending $100k on salaries for the same output. So dig into how the startup plans to use your capital – on building tools and scalable systems or on brute-force execution.

Scaling Challenges Can be Anticipated and Engineered Away: One of the most actionable insights is that startups fail in scaling often due to lack of planning for it. But now we know how to plan – build operational platforms in parallel with product development. Founders: don’t wait for a crisis to implement proper infrastructure and process. Use “growth hacks” but also build “growth infrastructure.” Implement at least rudimentary systems for customer management, deployment, analytics, CRM, content management, business planning etc., early – these will carry you through growth spurts. It’s the concept of building the aeroplane while flying, but given the new tools, you can at least have blueprints ready from the start. For investors: when doing due diligence, assess whether the startup has thought about scale beyond just acquiring customers – do they have an architecture that won’t crumble? If they’re using a venture building platform or methodology, that’s a positive signal of foresight.

The Right Tools Make a Difference: The landscape of startup tools and AI is rich. We identified categories from AI coding assistants to automated marketing and beyond. Founders should continuously scout for tools that can give them leverage. Adopting the right CRM or analytics platform or devops tool can save dozens of hires worth of effort later. However, integrate them well – disconnected tools can cause chaos; integration and automation between tools yield the real productivity gains. Both entrepreneurs and investors should view a well-curated, integrated tech stack as a sign of a mature, scale-ready startup. It’s akin to having good machinery in a factory – you can produce reliably. Don’t skimp on foundational tools due to cost; the ROI is usually high.

Leadership Must Evolve (But Don’t Kill the Founder Spirit): We saw the tension between Founder Mode and Manager Mode . The recommendation is clear: in early stages, favour Founder Mode , and let creative, flexible leadership drive innovation. As you grow, gradually layer in Manager Mode via processes or selectively hired managers, but do so carefully and in areas that need it. Founders should remain at the helm if possible, supported by systems (and people) that provide structure without suffocating creativity. Investors who back founder-led companies should help founders get resources to handle management tasks – maybe an ops advisor or connecting them to platform services – rather than reflexively pushing for a “professional CEO” too soon. Conversely, if a founder is resistant to any process even when the company is faltering under chaos, investors should counsel them on the need for some Manager Mode or bring in help in a limited scope (e.g., a fractional CFO to tidy finances rather than a whole new C-suite that displaces the founder). In AI-first startups, leverage the AI as a pseudo-manager for routine oversight, letting founders focus on vision.

Case Studies Prove It’s Possible – Emulate and Learn: The examples of WhatsApp, BuiltWith, etc., should serve as inspiration and playbooks. Founders: study how those companies operated. For instance, WhatsApp’s mantra was to do one thing exceptionally well (messaging) and not get distracted – which, combined with efficient tech, let 50 people serve half a billion users. Think about what is the “one thing” your startup must excel in, and apply extreme automation and focus there. If you’re an enterprise SaaS startup, maybe your one thing is a certain type of data processing – automate that fully. If you’re a marketplace, maybe it’s matching supply and demand – leverage AI to optimise that without manual brokers. Use AI case studies like the one-person marketing team to inform how you structure your team: perhaps you don’t need a full marketing department until much later if you use those techniques. Investors: when you see a startup taking such approaches, reward them, because they might do a lot with modest capital. Also, encourage sharing of best practices among your portfolio – each success story can teach others (e.g., one portfolio company’s success with an AI sales assistant might be implemented at another, raising overall performance).

Venture Capital Itself Must Adapt: For investors reading this, the message is that the old VC model is being disrupted from within. If startups need less money and prefer platforms, you should consider how to provide a platform or partner with those who do. Building out operational teams, AI tools, or even creating your own venture studio capabilities may be critical. Consider offering portfolio services not as an informal “extra” but as a formal product (e.g., your fund gives every startup access to an AI toolkit or platforms like LettsGroup's AI VentureFactory). Embrace data in your own decision-making – maybe use AI to triage deals – but more importantly, embrace the shift to human capital and tech enablement over just capital provision . The future might see venture firms that win deals not by highest valuation offered, but by having the best platform of support. If you can help a startup succeed systematically, that’s worth more than a few extra million dollars thrown at them. LPs (the investors in VC funds) will also start to expect that VCs leverage tech to improve their outcomes – after all, if success rates can double, funds can yield better returns with fewer write-offs.

Empower Entrepreneurs Globally: A wonderful implication of the new style is that it lowers barriers. As venture building becomes more of a learned skill and service, entrepreneurs from anywhere can tap into it. This means more diverse problems get tackled and more communities benefit from innovation. Founders and investors alike should look beyond traditional hotspots. If you have a great idea in a region without a big startup scene, consider joining a venture platform or online accelerator that can provide structure and remote support. Investors, consider investing in or creating platform-based incubators in emerging markets to capture untapped talent. The tools and methods discussed don’t require being in Silicon Valley; they mostly require internet access and some training. We might see a world where a founder in Africa, plugged into an AI venture factory, builds a company that competes globally – indeed that’s already starting to happen.

Balance Structure with Innovation: A cautionary note – while we promote structure, we should guard against over-standardisation. Sometimes great innovation comes from breaking rules or taking an unconventional path. Venture methodologies must allow for pivots and creative strategies that weren’t in the original plan. As an entrepreneur, don’t become slavishly dependent on a playbook if evidence suggests a different approach is needed; use the playbook as a guide, not a prison. As an investor or platform operator, remain open to adapting the system when a unique opportunity or challenge arises that doesn’t fit the mould. The future should be flexible . Think of the venture factory like agile manufacturing – able to retool quickly for new designs if needed.

In conclusion, the convergence of AI and venture building is enabling a new era where startups are built smarter, cheaper, and faster . The key takeaways for entrepreneurs are to leverage automation early and often, follow a structured process without losing your innovative edge, and be prepared to scale not just your product but your whole company intelligently. For investors, the key takeaways are to support startups with more than just cash – offer platforms, demand efficiency, and adapt your model to these new realities.

The prize is huge: an ecosystem where far more ventures succeed, capital is used more effectively, and innovation can flourish without being bottled up by operational hurdles or lack of know-how. We could see an explosion of viable startups tackling every niche, including pressing global challenges (climate, health, education) that were previously under-invested because they didn’t fit the high-burn model. When venture building is as optimised as, say, modern manufacturing, we might consistently create companies that both generate profits and solve real problems at scale.

To borrow the manufacturing analogy one last time: the industrial revolution transformed production and prosperity. We may be at the dawn of an innovation revolution in venture building – one that could unleash a wave of entrepreneurship akin to an assembly line of world-changing ideas made real. Those who embrace these new methods early will be at the forefront of that wave, much as early industrialists leaped ahead by adopting new machines. In the world of startups, that means more founders achieving their vision and more investors seeing returns, with fewer casualties along the way.

As this guide has shown, the pieces of this puzzle – from LettsGroup’s venture factory to AI case studies – are already falling into place. The future of venture building is being written now, in code and algorithms as much as in pitch decks and term sheets. Entrepreneurs and investors should seize this moment : adopt the new style of venture building, and be part of creating the future rather than competing with it. The companies – and venture firms – that internalise these lessons will likely be the leaders of the next decade.

In the end, successful venture building – old style or new – still hinges on creating real value: a product or service that customers want and a business model that sustains it. AI and automation don’t change that fundamental truth; they simply equip us with better tools to reach that goal. So, equip yourself with those tools, combine them with vision and grit (that unique human spark), and go build the future. The assembly lines of innovation are starting up – don’t be left handcrafting in the age of industrialised venture. Embrace the AI-driven, automation-enabled approach, and you just might build the next big success story with unprecedented speed and efficiency.

If you're a tech or digital startup founder, build faster, run leaner and make it BIG with LettsGroup's AI VentureFactory .

Join LettsGroup and Brown Rudnick for "LettsTalk Tech" in central London on Thursday, 13 November 4pm -7pm. If you'd like to come and join a select group of tech investors and entrepreneurs contact any member of the LettsGroup team. There are just a few places remaining.

Now that LettsGroup's AI VentureFactory powers a broad, growing cohort of tech and digital startups, the data that supports user KPI's is becoming quite meaningful. For example, the time to company positioning, messaging and market opportunity analysis shrinks from months to less than 2 days. The elapsed time for the first tailored business plan collapses from 6 weeks to 6 minutes. The time to design, architect and build an early stage company website is 2 days, not two months or more. Draft forecasts are produced in minutes, product roadmaps in little more - and equity analyst-grade reports for early stage startups is now a reality. As a result high quality investor decks can be produced from scratch in just hours.

There are hundreds more such data points - and tailored AI outputs from LettsGroup's VentureFactory - across venture building, product development, marketing, finance, operations, planning, research and more that will soon deliver a new standard for cross-industry startup KPIs and future modelling. All of this ensures that VentureFactory users, including startups, scale-ups and investors can gain an unfair advantage with faster venture build-rates and higher performance at much lower cost-to-build.

Just 2 months post market launch, LettsCore boasts over 1,500 users and a number of early corporate customers on-board including a leading app vendor. This new AI and Blockchain content / media management system is one of LettsGroup's core apps delivering Web3 content management, verification and monetisation at-scale. Its token-based, usage-driven pricing and fully distributed architecture provide unparalleled pay-as-you-go value with extremely high performance. The product team is working flat out supporting its fast growing user base while at the same time adding new features.

Unlike traditional CMS' LettsCore's platform goes well beyond just storing, managing and retrieving content by making content assets truly 'intelligent', and its platform a plug and play developer environment with APIs designed for customers to enable previously unobtainable features and capabilities. Auto distribution, social sharing, content-to-content interaction, auto-plug into AI tools, granular micro-monetisation and more are baked in. These capabilities are increasingly important in the chaotic, AI era.

LettsNews AI-powered newsroom tech for independent journalists, writers and marketers is adding a slew of new features to further empower its growing user base. This month the team released the ability to auto-add video and audio embeds from a host of leading platforms including YouTube, Vimeo, TikTok, Instagram and Spotify. This widens the array of Content Items added or uploaded in its newsroom tech, alongside AI generated, text, image, video and audio.

Towards the end of the month LettsNews will add a new scheduling system to forward publish news stories and auto social media sharing. The team has also started building its end-to-end AI 'News Agent' - which will be like having your own extensive AI story building tool and AI news team all wrapped into one powerful AI agent. Its chatbot style news story builder and the way it generates reusable Content Items and powerful, fact-checked news stories could prove to be quite ground-breaking. LettsNews is now also available as a VentureFactory core app.

LettsArt's growth has accelerated with the roll-out of LettsArt 2.5. The AI, no-code art platform now boasts 1,250 art galleries powered by its tech, adding around 50 new gallery customers per month. Its users adopt the platform to sell art better online and monetise social media followers more efficiently. It now hosts over 5,250 artworks and boasts over 4,000 art collectors. It has just launched its second generation 'AI Assistant' alongside a host of new AI features to make the complex process of building, curating and operating a fully-featured online art gallery simple and available to any independent artist, gallerist and art dealer - with literally zero tech skills required.

Paying subscribers are converting nicely as well now, adding recurring revenues to its existing transaction-based fees. We increasingly believe that LettsArt could, over time, become the platform of choice for the burgeoning art industry.

The hyper-startup Jot , is one of the fastest startups to go from idea to full market launch in the history of the AI VentureFactory. The company reinventing the diary with AI is on track to go live in November just in time for the year end busy season. Look out for the launch offer when it hits the digital shelves in the next couple of weeks. We'll keep you posted and put you in front of the queue for this hot new 100% AI-native, reverse-retro consumer offering.

A new social network and feed will be launched in early 2026. VOICES is an innovative Web3, private social network which will initially become available to LettsGroup's AI VentureFactory users and its core app users. It will be tightly integrated with LettsGroup's VentureFactory platform and core apps for a truly seamless experience. Coming in early 2026.

LettsSafari has completed phase 1 of its journey - proving its smaller-scale rewilding system and building out its all-digital platform. The next step to full commercial scaling is launching national rewilding safari parks as major attractions in the west . They will be fully open to the public, starting in England.

The team is now starting to explore conversations with investors and landholders about building its first national LettsSafari park, with a unique, highly scalable day visit centre showcasing the full magic of smaller-scale rewilding in a truly immersive, natural environment, alongside a 500+ acre rewilding safari park and safari village designed specifically for the western world. The combination is not only unique, but optimises the financial profile while building a next generation, sustainable theme park business.

LettsSafari's pioneering techniques, two-decade experience, online platform, growing brand and numerous on the ground implementations make it uniquely suited to deliver this exciting new Africa-meets-the-West, Eden Project scale play.

We highlight just a few startups in each monthly edition of LettsGroup's NewsFlash. To explore other companies using LettsGroup's AI VentureFactory go to LettsGroup/ventures.

Fast forward a few years: what might the venture ecosystem look like if AI-driven venture building becomes the norm? One compelling vision is that venture capital evolves from a financial industry into a platform-enabled industry utilising platforms like LettsGroup's AI VentureFactory . Further, instead of just funds competing to invest in startups, we could see integrated venture platforms that combine funding, tools, and talent in a single unified system. In effect, venture building could itself operate like a software platform – with startups as “users” who plug in to get everything they need to build a company.

LettsGroup hints at this future. It suggests a model where the process of venture creation and the provision of capital are fused in some way - something more akin to a venture factory that has attached capital pools . Entrepreneurs might engage with this platform not by pitching in a one-off transaction, but by entering into a program or ecosystem.

Imagine a platform where an entrepreneur with an idea signs up, and the platform (through AI) helps refine the idea, provides the initial funding as credit, supplies all necessary software infrastructure (perhaps cloud credits, AI tools, etc.), helps build the startup with AI outputs for each step in the venture building process, matches the entrepreneur with mentors or team members from a network, and basically shepherds the venture from inception to growth.

Such a platform might take some equity as a blended form of payment, some might even consider a revenue share. It’s like AWS + Y Combinator + an AI advisor/team + a VC fund all rolled into one, available on-demand. This could drastically lower barriers to entry globally, as access to venture building expertise and capital would no longer be limited by personal networks or geography – anyone plugged into the platform could benefit.

From the perspective of venture capital firms, those that successfully transform to utilising platforms like LettsGroup's AI VentureFactory (which has just added a new 'Investor Dashboard') will likely have a competitive edge. For example, a founder might prefer to work with a firm that offers a proven venture-building platform with, say, a 2x higher success rate, over more traditional VC style approaches that just give money but no support. This could lead to a consolidation where a few top venture platforms attract the best founders, akin to how a few cloud computing platforms dominate their space. It’s possible we see the rise of a “Startup Operating System” provided by a private company (or consortium) that many startups use, analogous to how many businesses use cloud services today.

Another aspect of the future could be contract venture building for others . LettsGroup speculated that mature venture factories could become contract manufacturers for venture ideas from large corporations or funds, similar to Foxconn building products for Apple. Taking that further, venture capital itself could outsource some of its venture creation to such contract venture factories. For instance, a pension fund that wants exposure to tech startups could simply commission a venture factory to build and scale a set number of companies in certain domains, rather than picking existing startups to invest in. This flips the venture model: instead of investing in entrepreneurs who come to you, you as an investor decide what you want (perhaps via market analysis) and then build it with the help of a venture platform. This approach might especially appeal to corporate venture arms or large pools of capital seeking predictable innovation for their needs. It’s somewhat analogous to how the semiconductor industry evolved – initially, integrated companies did everything, but later you had fabless companies that design chips and contract foundries that manufacture them. We could see “fabless” VCs (who have ideas and capital) and “foundry” venture factories (who build the ventures).

Such a platform-driven ecosystem could also globalise venture building beyond the major hubs like Silicon Valley. If the platform is accessible anywhere, talent from around the world could create startups using it, tapping local knowledge with global support. This might unlock innovation in regions that historically lacked access to venture expertise or capital. We might see specialised venture platforms focusing on different regions or sectors, all connected in networks.

The role of people in AI venture building platforms will also evolve. We will still need visionary entrepreneurs – AI can assist, but it doesn’t replace human creativity and leadership (at least not for the foreseeable future). We will also need experienced mentors and industry experts to guide startups (though AI might handle a chunk of the advice, human judgement remains key for nuanced decisions). However, these people might be engaged in a more flexible way. The LettsGroup model mentions an “expanding network of experienced venture leaders who each contribute to multiple ventures” in their ecosystem. This hints at a gig-economy or fractional involvement model: an expert could be overseeing strategy for 3 ventures at once via the platform tools, something that’s feasible if those ventures run systematically. The platform orchestrates contributions so that expertise is shared efficiently. This collective model leverages scarce talent (like seasoned startup execs) across many companies without each startup needing to hire them full-time.

The power dynamics in such a future platform-centric ecosystem likely shifts more in favour of founders (or founding teams) and the platform operators, and a bit away from traditional VCs. If entrepreneurs have direct access to what they need, the competitive advantage of having venture connections declines. However, platform operators (which might be evolved VC firms or new entities) become extremely influential. They might even fund companies off their own balance sheet or via new mechanisms like tokens if blockchain is involved.

We may also see blurring of public and private markets . If venture creation becomes more repeatable, investors like private equity or even public market investors might want in at earlier stages through these platforms. Conversely, some startups might never need to go public if they achieve profitability quickly with a lean model – or they might get acquired by the platform itself if it makes sense.

From the founder’s perspective, the future might involve choosing which venture platform to join similar to how one chooses which accelerator or incubator to join today – but with bigger consequences. Joining a platform could commit you to certain approaches (which can be good if they work). It might also come with standardised terms (maybe less negotiation of custom equity deals since platform deals could be cookie-cutter). Ideally, if multiple platforms exist, competition among them will keep terms fair and service quality high.

It’s also plausible that big tech companies become part of this story. For instance, Amazon or Microsoft could partner with leading venture building platforms to enhance their startup programs to embrace more full-fledged venture platforms (they already give cloud credits and some support; they could in theory expand into providing funding and offering systematic guidance via LettsGroup's AI VentureFactory for example, especially if it drives usage of their ecosystem).

On the flip side, there are risks and challenges in this future. Will such heavy systematisation limit creativity? It’s important that venture platforms don’t become overly formulaic, lest they churn out cookie-cutter companies that lack true innovation. Platforms must allow flexibility and pivots – presumably the AI will learn to incorporate creative divergences when needed. LettsGroup talks about the critical; importance of AI-driven infrastructure and operations to free up time for creativity and enhance success.

Another challenge is mentorship and intuition – can AI fully replicate the mentorship a human VC or experienced entrepreneur provides? Likely not 100%, but it can augment it. The human element will remain, but possibly scaled via AI (e.g., one great mentor can impart knowledge via an AI that many startups benefit from).

In summary, the future of venture building as a platform could mean:

Ultimately, these changes aim to do what technology and process improvements always do: increase efficiency and output. In this case, the output is successful ventures, and efficiency means using less capital and time to get there. If pioneering firms like LettsGroup and Steel Perlot are indicators, we are moving toward a world where creating a startup is not a shot in the dark but a guided endeavour. Tomorrow's entrepreneur might say “I built my company on Platform X,” much like today one might say “I built my app on AWS.” And tomorrow’s investor might be as much a venture building platform user or partner as a stock picker.

As LettsGroup’s analysis puts it, this would be a fundamental restructuring of the power dynamics – shifting more control and value to innovative founders and the platforms that enable them, rather than traditional capital gatekeepers. The hope is that this democratises innovation and reduces wasted potential (all those failed startups that could have succeeded with better support). In the ideal future, venture building becomes accessible, data-driven, and successful on a scale never before seen – a true global innovation factory.

The next section of our guide to New Style Venture Building is 'Final Thoughts & Takeaways' - coming soon.

If you're a tech or digital startup founder, build faster, run leaner and make it BIG with LettsGroup's AI VentureFactory .

As startups grow, their leadership needs often evolve. Early on, what a company needs from its leaders (usually the founders) is very different from what it needs once it has hundreds of employees or steady, predictable revenue. These two phases require distinct mindsets, often referred to as “Founder Mode” versus “Manager Mode.” In the context of AI-driven, automation-first startups, understanding these modes – and knowing when to shift gears – is crucial. The injection of AI and efficient processes can actually extend the runway of Founder Mode, but eventually elements of Manager Mode must come in for stability. Let’s break down these leadership modes and how they apply in modern venture building.

Founder Mode is characterised by scrappiness, creativity, and an embrace of chaos. In Founder Mode, leaders are like inventors and explorers. They thrive with incomplete information and urgent deadlines, willing to make quick decisions and big bets. They wear many hats – one minute coding or designing, the next minute pitching to a customer or fixing a broken process. Paul Graham of Y Combinator likens it to an obsessive focus on building and iterating quickly, almost like living in a constant hackathon. Brian Chesky of Airbnb exemplified this with his relentless focus on perfecting the product experience in the early days – a very hands-on, detail-oriented approach driven by passion.

Common traits of Founder Mode leaders include:

Manager Mode , on the other hand, is characterised by establishing structure, repeatable processes, and efficiency. A Manager Mode leader is akin to a corporate executive: focused on optimising, organising, and minimising risk. This is ideal once a company has found a formula that works and needs to scale it reliably or maintain it. In Manager Mode, you create departments, define roles clearly, implement policies, and rely on data and procedures to drive incremental improvement.

Traits of Manager Mode leaders include:

Both modes are important, but timing is everything. In a high-growth startup early on, too much Manager Mode can be deadly. If you install a rigid manager when the company still needs to be pivoting and experimenting, you can smother the innovation. As one commentary noted, bringing a corporate manager into a startup too soon is like “asking a librarian to DJ at a rave” – a mismatch that can end in disaster for both parties. Corporate managers might impose 12-step approval processes and demand extensive data for every decision, which just doesn’t work when a startup needs to move fast and iterate with limited info. For example, a manager might say “we can’t launch this feature until it passes all these internal reviews,” whereas a founder mode approach might be “let’s get a prototype in front of users next week and see what happens.” In early stages, speed and agility beat perfection and procedure. Overemphasis on Manager Mode early can indeed suffocate the startup’s spirit – “innovation suffocation” as it’s been called – because startups thrive on creative chaos and risk-taking to find what works.

Conversely, in a mature company, pure Founder Mode can become problematic. If a company has hundreds of employees and significant revenue, you can’t have everyone constantly pivoting or ignoring process – it would be mayhem. A founder who continues to micromanage every detail and bypass all structure at scale can cause confusion, burnout, and strategic whiplash. At some stage, process and structure are necessary to not “crash the plane.” As one quip goes, you don’t want the accounting books to look like a teenager’s messy bedroom – eventually, someone has to bring order.

The tricky part for startups is navigating the transition or balance between these modes . Ideally, a startup uses Founder Mode in the beginning to find its footing, and gradually incorporates Manager Mode elements as it scales. But the leaders must be self-aware enough to either adapt or bring in help at the right time. Many founders are great at the early stage but either struggle or lose interest in running a later-stage organisation. On the other hand, bringing in “adult supervision” (manager CEOs) too early can kill the company. So there’s a timing dance.

In AI-driven startups, this dynamic has some interesting twists:

A good strategy is for founders to surround themselves with complementary leadership as the company grows. That could mean hiring a COO or other executives who bring Manager Mode skills while the founder remains the visionary. However, it’s critical that those hires understand startup culture and don’t enforce big-company rules prematurely. LettsGroup humorously describes what goes wrong when you drop a corporate manager into a startup: they build a “corporate cage” for a company of five, they turn the culture from “move fast and break things” to “move cautiously and file a report about it,” and they take so long analysing risk that competitors outpace the company. To avoid this, any managers brought in must adapt to a startup’s needs – perhaps a “Manager Mode 2.0” that is informed by entrepreneurial thinking.

Likewise, founders must eventually embrace some managerial responsibilities. A wise founder will gradually institute necessary process in areas like finance (you can’t ignore accounting forever), HR (especially as you hire more people, you need policies for fairness and legal reasons), and product QA (as users scale, quality issues become more serious). The key is doing it pragmatically: implementing just enough structure to solve current pains, but not so much to constrain innovation. LettsGroup noted, for instance, that Manager Mode absolutely has its place once a startup hits a more stable, mature phase – no founder actually wants zero processes when they have, say, 100 employees; at that point, chaos can do real damage. It’s about the right dosage at the right time.

In founder-friendly venture building environments (like the venture factory), there is recognition that the founder’s original qualities – passion, drive, willingness to fail fast – are precious and should be preserved as long as possible. So rather than replacing founders, the aim is to coach them and supplement them . For example, a venture factory might provide leadership training or mentors to help a founder develop managerial skills when needed, or conversely, teach a corporate-type co-founder how to stay flexible and innovative. LettsGroup’s research into key traits of successful founders vs. managers and how they interconnect suggests that awareness of these differences is itself valuable. A startup team that understands who is playing founder vs manager roles, and respects each other’s contributions, can achieve a healthy balance.

In an AI-automated startup, some traditional managerial tasks (like status reporting, task assignment) might be handled by the system, leaving managers to focus more on coaching, culture, and decision-making . In that sense, Manager Mode might shift from micromanaging process to setting high-level guardrails and maintaining efficiency. The motto could be “don’t suppress the chaos entirely, just channel it constructively.” As one analysis put it, in early stages you need a “chaos pilot, not a process prophet”. Over time, you slowly introduce more process prophets in supporting roles once the rocket is already flying.

To put it succinctly, Founder Mode is for search, Manager Mode is for execution. A startup begins in search mode – searching for product-market fit, a viable model. Once found, it transitions to execution mode – scaling that model. Founder Mode leadership excels at search; Manager Mode excels at execution. The tricky part is that scaling isn’t a binary switch; it’s a gradient. So there’s a period where both mindsets are needed: the company is executing what’s working and still searching in other areas (new features, new markets). During that period, having a leadership team that covers both bases is ideal – perhaps the CEO remains very founder-like, while a COO or VP Operations is more manager-like, and they work in tandem.

In conclusion, startups should cherish Founder Mode in the beginning – it’s where the bold vision and rapid progress come from – and avoid premature bureaucratisation. As they grow, they should carefully weave in Manager Mode elements – often through processes, tools, or selected hires – to ensure stability and efficiency. The most successful companies often have founders who evolved into effective large-scale leaders (think Bill Gates, who started as a hardcore coder and eventually managed a giant company, or Mark Zuckerberg who had to balance move-fast culture with running a global corporation). Not every founder will become a great late-stage CEO, but those who do often drive exceptional outcomes. For those who don’t, the best scenario is that they partner with or yield to someone who can manage without killing the founder spirit of the company.

As the LettsGroup piece humorously concludes: neither Founder Mode nor Manager Mode is inherently superior – they’re just “catastrophically wrong when misapplied”. The art of leadership in an AI-driven startup is to apply the right mode at the right time. With AI and venture platforms smoothing some transitions, founders may be able to lead further and more effectively than in the past, supported by systems that compensate for their managerial weaknesses. And when the time comes to hand over to more Manager Mode leadership, it should be done in a way that doesn’t lose the innovation DNA of the startup. Remember, you “can’t cat-proof a Frisbee” – you can’t make an inherently risky, revolutionary venture completely risk-free or it would lose its essence. The goal is to manage the risks, not eliminate them. Founder Mode provides the courage to take risks; Manager Mode provides the prudence to mitigate them. Balancing the two is who dares, wins.

The next section of our guide to 'New Style Venture Building' is 'Case Studies of AI-Driven Ventures' - coming soon.

If you're a tech or digital startup founder, build faster and run leaner with LettsGroup's AI VentureFactory .

If startups can do more with less capital thanks to AI and automation, what does this mean for the venture capital (VC) industry that funds them? The implications are profound. Traditionally, venture capital’s role has been to provide the significant funding needed for startups to scale (hiring, marketing, etc.) in exchange for equity. But in an environment where a startup might only need a few hundred thousand dollars – or no outside capital at all – to reach profitability or substantial revenue, the value proposition of traditional VC is challenged .

In an AI-enabled venture ecosystem, human and intellectual capital trump pure financial capital . That is, the best ideas and teams might not need as much money, but they might need other support (like AI resources, infrastructure, or networks). Venture capital firms, therefore, may have to evolve from being primarily money suppliers to being true value-add partners. Already, a few VCs try to differentiate by offering “platform” services (like recruiting help, PR, or strategic advice). But the new style venture building suggests a shift beyond that: VCs might need to white-label or even build actual venture-building platforms and AI tools to the startups that they back.

One likely outcome is the rise of “operational venture capital” models and venture studios run by investors . We have seen early steps of this with firms like a16z (Andreessen Horowitz) building large internal teams to help startups, or Project A in Europe which has functional experts on staff to deploy to portfolio companies. LettsGroup itself positions as a “new category of venture builder” that builds and sometimes even backs ventures through their AI VentureFactory, aiming for systematically better outcomes . And LettsGroup's new VentureFactory dashboard for VCs enables them to come to the table not just with a check, but with a platform like its AI VentureFactory that the startup can plug into for instant scale capability. Essentially, the VC firm itself could act more like a venture factory or incubator for its portfolio.

Another implication is on the financial side: smaller rounds and potentially leaner valuations in early stages. If a startup can get further on its own or with less money, it may delay raising or raise less. This could mean fewer equity dilutions for founders and a harder time for VCs to deploy large funds. Some VCs might respond by focusing on quality over quantity and earlier stage deals – investing in more startups with smaller tickets, hoping that higher success rates (even if exits are smaller on average) will yield good returns. The old model of needing a few unicorns to pay for all the duds might shift if there simply are fewer duds (because venture building is more predictable). In such a scenario, VC portfolio strategy could become a bit more like private equity – targeting solid businesses and helping them grow efficiently – rather than a high-risk lottery.

However, one could also argue that easier scalability will create bigger successes too, not just moderate ones. A startup that grows super efficiently might capture markets faster and end up a huge win with minimal capital. That’s great for founders, but for VCs it raises the question: how to ensure you’re part of that journey if your money wasn’t needed early on? This is where disintermediation risk comes in. If founders don’t need as much VC money, they might skip it or use alternative financing (like revenue-based financing, crowdsourcing, corporate investors, or grants). Moreover, AI itself could connect founders directly with capital sources. One analysis predicts that AI agents will link entrepreneurs to investors directly, potentially bypassing traditional VC firms . We can imagine AI-driven platforms (perhaps blockchain-based or marketplaces) where startups get matched with interested investors (angel, family office, etc.) without going through the classic VC gatekeepers. If that becomes common, the power of big VC funds could diminish, unless they partake in those platforms.

VCs are aware of these shifts. In fact, some forward-looking venture firms are already experimenting with automation internally – for example, using AI to screen business plans or perform due diligence faster. But those are incremental improvements to their operations. The larger disruption is if the venture firms themselves must change their model . The LettsGroup vision hints that “the venture capital firm of tomorrow will function as an AI system with an associated network of entrepreneurs.” In practice, this could look like a VC that has built or white-labelled its own AI venture factory (like a LettsGroup for external ventures) where it can spin up companies almost on demand, assigning great entrepreneurs to lead them, with all the back-end provided. Such a firm might not evaluate deals in the traditional sense; rather, it co-creates ventures, providing both the idea or platform and the funding. This blurs the line between investor and builder. It’s almost a venture builder-VC hybrid .

Another scenario is venture capital as a platform service that external startups subscribe to. LettsGroup literally states they are on a mission to build and enable “venture capital-as-a-platform”. They have kicked this off by providing their VentureFactory platform to other investors and corporate incubators or investors. In the future, a startup might pay for access to a VC’s platform (including capital, but also tools and guidance) rather than just taking a check. The VC would monetize not only through equity but possibly through subscription or profit-sharing models. This changes the revenue model of venture investing from purely equity returns to a mix of equity and service revenue. It could also democratise access – a startup that doesn’t get a term sheet might still be able to pay to use the VC’s platform/tools to improve and eventually earn investment.

For traditional venture capitalists, these changes pose a challenge: how do you stay relevant when capital is commoditised? The likely answer is they must move up the value chain – offer things that money alone can’t. This might include:

We might also see a shift in power towards founders . If one of the aims of AI venture building is to empower entrepreneurs (and indeed some argue the AI-enabled future should “ultimately empower entrepreneurs more effectively than simply enriching venture capitalists”), then founders with good track records or strong ideas will have more options. They could choose to go it alone longer, or demand better terms from investors. The balance of negotiation could tilt slightly towards founders who have an AI-boosted operation and are less desperate for cash. This might result in friendlier deal terms, less onerous preferences, etc., as VCs compete to get into good deals. We’re already seeing super large funds and many new funds chasing a finite set of great startups; if those startups need less funding, the dynamic intensifies.

Interestingly, some new venture entities like Steel Perlot (backed by Eric Schmidt) are positioning themselves in line with these trends. Steel Perlot aims to “identify, invest in, and develop multi-generational platforms” and sometimes builds companies directly, only supporting those they think can reach global scale. This is a more interventionist model of venture investing , focusing on systemic change in target industries and blending capital with deep involvement. It aligns with the idea that VCs will pick specific domains to specialise in with technology (Steel Perlot presumably leverages AI expertise from its backers) and ensure their ventures in those domains benefit from that infrastructure.

We also see corporates entering the venture building space (corporate venture studios or incubators) which could become competitors or partners to VCs in funding innovation. If corporations build new companies internally using venture factory methods (like Mach49’s work with large firms), they might spin them out or fund them in ways that bypass traditional VC rounds. VCs might then find fewer high-quality independent startups, as some are birthed and grown inside corporate ecosystems or by venture platforms.

To adapt, venture capital might look more like “innovation capital” integrated with incubation . For example, a fund might say: “We invest $500k and also enroll you in a venture building platform which will handle X, Y, Z for your company.” The success metric might shift from just financial returns to also the success rate of portfolio (bragging about how 60-70% of their startups hit profitability, for example, rather than 90% failing). If investors can claim that their involvement doubles a startup’s chance of success, that’s a powerful selling point to founders deciding whose term sheet to accept.

There’s also the possibility that VC as we know it fragments into new forms:

Finally, the economics for VCs might shift. If startups require less money overall, funds might either shrink in size or find new ways to deploy capital (maybe investing in more startups or returning money to LPs sooner). The high management fees of mega-funds might be harder to justify if one can’t invest that money well due to more efficient startups. Conversely, if venture factories dramatically increase the number of viable startups, there could actually be more companies to invest in (just each needs less), potentially broadening the market for early-stage investing.

In summary, the implications for venture capital include:

As one Letts Journal article concluded, “tomorrow’s entrepreneurs may integrate with venture factory platforms rather than traditional legal structures that offer limited value beyond capital” , shifting greater control and value creation to founders and innovative builders. Venture capital firms, to remain central, will likely transform into these very platforms or align with them. We are likely to witness a convergence of roles: investors becoming builders and builders becoming investors – all facilitated by AI and systematic processes. The venture capital industry has always been about taking calculated risks on innovation; now it may have to innovate its own model to keep up with the entrepreneurs who increasingly can flourish without it.

The next section of our guide to New Style Venture Building is 'Founder Mode vs. Manager Mode Leadership' - coming soon.

If you are a founder or investor, sign up to LettsGroup's AI VentureFactory today.