Innovation is one of those much hyped, painfully over-used words. Its right up there with disruptive and visionary. How does the saying go if I had a dollar for every disruptive, visionary innovation I’ve been shown I’d be a rich man. And, if that’s not bad enough, ‘innovation’ is further expanded by stratified terms like incubator and accelerator - words that are bandied about equally, almost without meaning, by poachers and gamekeepers - entrepreneurs and investors. Statistically, venture building is a veritable crap shoot with extremely low success rates. Far too many organisations fail. Perhaps it’s time for a different approach.

Apparently 90% of new startups fail. And 75% of venture-backed startups fail - proving that money is not the answer to everything and that venture capital firms have no magic wand/bullet/rocket - whatever they say. Further, less than half of businesses get to their 5th birthday. The highest failure rate occurs in the information industry proving that they don’t use their own products enough - assuming they’re worth using in the first place. Check Facebook.

There are a few organisations that are trying to move venture building from the small, one-off artisanal workshop, that it is today, to a more ambitious model, based on the creation of a ‘venture factory’. Venture factory pioneers believe they can consistently deliver higher quality, repeat innovation and higher success rates when it comes to venture building.

Before the full blown venture factory came along, we witnessed a virtual proxy called the ‘venture studio’, also known as a startup studio or a startup factory. This business model focused on systematically producing new companies. Unlike traditional incubators or accelerators, venture studios don't just support existing startups; they actively engage in creating new businesses. Some of the key characteristics of a venture studio include:

Venture studios can be efficient mechanisms for launching new companies because they can leverage shared resources, expertise, and processes across multiple startups. This approach should, in theory, increase the speed and reduce the costs of starting new businesses, though it does typically involve a trade-off in terms of equity and control for the entrepreneurs involved.

The venture factory goes beyond a venture studio by operating a full blown factory, tooled and optimised for its own branded ventures first - only subsequently thinking about becoming a contract manufacturer for 3rd party ventures (as well). Like starting up as Google and then ending up as, well, Google Ventures - only with a real factory this time!

The venture factory has a carefully designed virtual space, a manufacturing process and methodology, specialist assembly lines, factory workers, robots, tools, quality control systems, and, most likely, a warehouse and distribution network. All designed around building and shipping ‘ventures’.

For a venture factory to work it will likely need a number of core components:

Mach49, a growth incubator for large corporations (is that an oxymoron?) has a simple 4 step process which includes ideate, incubate, accelerate and scale. It recently published a book about it called ‘The Unicorn Within’, which is a nice read and great if you can get one. A unicorn that is.

LettsGroup takes a more detailed approach with its innovation and venture building methodology aptly named ‘Innov@te’. Their process has 7 key stages and 49 steps that provide the basis for a genuine, repeatable venture manufacturing system. Its 7 stages include:

This 65 page manufacturing style process manual is about as exciting as reading a Boeing flight safety manual. Both crash without them - it's just the stats are worse for venture failure than aeroplane disasters. Oh, wait…

The venture factory team at LettsGroup are working on turning Innov@te into a dynamic and structured manufacturing software system. Think of it like a traditional manufacturing production system for building innovative startups rather than physical products. Move aside Oracle, hello Innov@te VRP.

There are a number of different venture design approaches. Perhaps the best known is the Lean Startup methodology which is about putting a process and a methodology around the development of a product. It’s kind of like teaching your toddler to use an iPhone AND clean up after themselves.

The Lean Startup methodology believes that every startup is a grand experiment that attempts to answer a question. The question is not "Can this product be built?" Instead, the questions are "Should this product be built?" and "Can we build a sustainable business around this set of products and services?" They believe that this experiment is more than just theoretical inquiry; it is a first product.

It is about starting with a very narrow concept designed around solving a niche and specific customer problem. Entrepreneurs are meant to launch a minimum viable product (MVP) which is an initial straw man that a few somewhat geeky early adopters might help shape into a real live product after a bunch of data driven iterations - assuming that the hard charging, gun toting entrepreneur has the patience for all these iterations and data analysis.

Lean believes that “Startups exist not to make stuff, make money, or serve customers. They exist to learn how to build a sustainable business.”

Over at LettsGroup they designed their own ‘Size Zero Philosophy’ which seems to be a broader, more structured approach to thinking about a highly efficient and automated enterprise. Their manual helps to design a focused, sustainable and more cost controlled, scaled enterprise from a small startup. Or, embeds a lean, more agile design into a larger corporation. Their Size Zero philosophy runs in parallel with Innov@te, their venture manufacturing process. Combined they could prove to be a new Kanban or a ‘Just in Time’, flexible method for venture manufacturing. Try getting your head around that one!

Apparently a true venture factory operates an advanced software system from their venture building process or methodology. It sounds a bit like fashioning ‘the Theory of Constraints’ manufacturing optimisation system from a simple book ‘The Goal’ - which actually happened and was first written by Eliyahu M. Goldratt in 1984. Today it is in its 3rd edition.

In the same vein it looks like advanced venture factories will develop their unique process and methodology into a complex manufacturing system and a set of defined, standardised software tools that are used not just to build the venture but to operate and manage it sustainably over time. AI and automation will accelerate these systems and, as a result, the very concept of repeatable, sustainable innovation.

Venture factories will likely think beyond the venture’s initial product launch and devise extended processes and systems for the longer term development of the venture and universal, scaled distribution systems for the scaling of their ventures.

For example, LettsGroup has developed their own proprietary Web3 content management system providing highly scalable content based verification, micro-monetisation (which is micro-payments on steroids, fully embedded in the content!!) and syndication. This looks like it could become a veritable warehousing and distribution platform for information industry ventures. Meaning we don’t just build it but we can sell it as well!

It might end up that the advanced venture factory of tomorrow will initially get built and operated to manufacture branded ventures that are owned and created by the venture factory owner - as Ford developed the car assembly line for their own branded cars. But, once these venture factories mature and scale it is likely that contract factories will emerge to create, build and scale ventures for 3rd party customers like venture capital investors, funds and global corporations.

Like today the iPhone is manufactured for Apple by Foxconn in places like China, the Czech Republic and South Korea. Tomorrow venture factories from the likes of LettsGroup and others could manufacture new contract ventures for Amazon, Apple or Blackstone with the simple premise that ventures built by them will last longer and experience a success rate greater than 1 in 10. Perhaps successful, repeat innovation is not as far away as it seems.

This article first appeared at The Letts Journal.

A new breed of more involved venture capital is developing to help support start-ups and growth companies in a more structured and elaborate manner. Some call it ‘operational venture capital’ proving at the very least that venture investors should stay away from new naming conventions.

Where venture capital typically plays an important role is the period in a company’s life when it begins to commercialise its innovation. The vast majority of the money invested by venture capitalists goes into building the infrastructure required to grow the business - in expense investments (manufacturing, marketing, and sales) and the balance sheet (providing fixed assets and working capital).

Venture capital’s niche exists because of the structure and rules of capital markets. Someone with an idea or a new technology often has few other institutions to turn to. Usury laws limit the interest banks can charge on loans, and the risks inherent in start-ups usually justify higher rates than allowed by law. So bankers will only finance a new business to the extent that there are hard assets against which to secure the debt. And in today’s information-based economy many start-ups have few hard assets, while at the same time, few young entrepreneurs can afford to buy a house for the bankers to wrap their somewhat grubby paws around in the glorious name of ‘collateral’.

Venture Capital therefore fills the void between sources of funds for innovation (chiefly corporations, government bodies, and the entrepreneur’s friends and family) and traditional, lower-cost sources of capital available to ongoing, proven businesses. Filling that void successfully requires the venture capital industry to provide a sufficient return to attract private equity funds, attractive returns for its partners, and sufficient upside potential to entrepreneurs to attract high-quality ideas that will generate high returns. The challenge is to earn a consistently superior return on investments in inherently risky business ventures. A challenge that you could argue is a little oxymoronic. But, then again, entrepreneurs do it every day of their life so who’s counting.

The original idea that the entrepreneur is the modern-day cowboy, roaming new industrial frontiers much the same way that earlier Americans explored the west is a vision that is starting to wilt on the vine. At the entrepreneurs side stands the venture capitalist, a trail-savvy, Tonto-style sidekick ready to help the hero through all the tight spots - in exchange, of course, for a not small slug of the pie.

Yet today’s entrepreneurs look more like Harvard MBA’s and venture investors look increasingly like Wall Street bankers. Some think this will lead to more empty suits and fraudsters and Sam Bankman-Fried’s than romances made in money-making heaven.

Others argue that it's more than ever going to lead to quickie divorces rather than investor bromances. After all, venture money is not long-term money. The idea is to invest in a company’s balance sheet and infrastructure until it reaches a sufficient size and credibility so that it can be sold to a larger business or so that the institutional public-equity markets can step in and provide liquidity. In essence, the venture capitalist buys a stake in an entrepreneur’s idea, nurtures it for a short period of time, and then exits with the help of an investment banker faster than you can say “show me the money”.

The problem is that a number of quality entrepreneurs want more than just money as they march tirelessly and lonesomely through the venture building process, so they might not want an empty suit with a hack load of promises and a half open wallet. They might, in this increasingly ESG universe, want something a little deeper, a little more dare I say, ‘meaningful’.

“Remember, investors will offer entrepreneurs all sorts of things and likely deliver none of them. They only have to deliver one thing - a cheque!” The famous words of venture capital legend Bill Draper III rang deep with our editor.

It seems Bill Draper, probably the first venture capitalist, summed up the essence of the venture capital industry by stating that these investors were not, in fact, partners to the entrepreneur but merely private company, early stage fund managers. And like public company fund managers from Fidelity, BlackRock or Schroders they’re more analyst than operator. They are there to make money out of the entrepreneur and not there to ‘buddy up’ Tonto-style or ‘make a goddamned difference’ to the universe aka Steve Jobs.

Unfortunately some of the great entrepreneurs like to make a difference. Call it the Napoleon syndrome or the youngest child syndrome or simply if-I’m-gonna-give-up-my-life-my-sanity-and-my-money-there-had-better-be-some-deeper-meaning-to-it!

Either way, apparently there are a decent number of entrepreneurs that want more than just a number crunching, cash accounting, financial analyst for their venture partner - they want something a little deeper than that. They’re looking for their very own Jerry Maguire. And who wouldn’t want a small piece of Tom Cruise.

As a result a new breed of ‘operational venture capital’ companies have emerged. Firms like Project A, EQT Ventures and others including a16z and GV (formerly known as Google Ventures) in the US. They have a combination of investing specialists and operational consultants that widen the entrepreneurs team in areas such as HR, talent, data, sales and marketing.

These operational VC’s on top of their investment, give you access to their people - often only if it is needed. It’s more like a menu. You know, that sales pitch “if you want to work with us, you can”. Except, an investor that has a large stake in your company and likely a board seat is not necessarily the most passive partner in real life. Pure play VC’s would suggest that if you utilise their ‘no operational strings attached’ money you can go and hire the best specialist advisers in the open market - not just shoe-in the ones that they employ.

In the ‘operational venture’ model the philosophy is that if you genuinely think you’re investing in a groundbreaking company you will need to spend at least 90 percent of the time working for the benefit of the entrepreneur, not the other way around. It sounds easy enough, but it isn't. Unless, of course, you really are Tonto in real life.

It could be that this hybrid ‘operational VC’ approach does not go far enough to really make the difference. The Letts Journal’s mothership, LettsGroup, addresses this with its ‘branded venture group’ approach which combines a new style IP focused conglomerate with an operational venture outfit. They are not afraid to back their own ideas and staff their ventures until the product-to-market fit is more evident and it can attract quality outside capital. It’s like a private equity approach to earlier stage venture building.

The folks at LettsGroup believe that current technology investment models are broken; too much money is wasted on too few innovations reaching either maturity or delivering real impact. They believe that it’s time to change the model to a more predictable, repeatable process that ensures innovation happens faster, and delivers greater social impact. They have their own methodology, resources and technology. Kind of like a Kanban continuous improvement system but for innovation. A counter philosophy to the 1 in 10 high roller casino approach taken by traditional venture capital firms.

Whichever direction the venture capital market is headed the options for finding alternative capital for quality start-ups keep widening - even in these crappy markets. Indeed there are more angels, family offices, alternative debt models and funds than ever chasing the next best idea. And the desire to find and back the newest goldmine is as old and entrenched as the west coast dust fields.

Technology is only getting better at auto-matching pools of money with interesting start-ups. So much so that WALL-E could become your next VC! This means that professional venture investors might have to get better at offering more than just their money. If even McDonald’s can create a full-service, fully automated offering then surely venture capital outfits can up their game.

This article was originally published in the Letts Journal.

LettsGroup is a branded venture group, providing operational assistance to its ventures, including LettsArt, LettsSafari, LettsCore and many more.

Subscription-based services are changing the game for ecommerce, media, and streaming industries. LettsGroup is paving the way, adopting subscription services for an array of its own ventures.

The evolution of technology has affected human behaviour and shifted business operations and competition accordingly.

Subscription models have seen consistent growth and pickup by businesses as large as Unilever and Walmart as well as many startups and small businesses.

Over the last decade, the subscription ecommerce market has experienced meteoric growth. According to Forbes, there’s been 890% expansion since 2014. Currently, there are 18.5 million subscription box shoppers in the U.S. and 35% of these active shoppers subscribe to three or more services, with a median number of subscriptions per active subscriber being two.

According to Hitwise, the average demographic of this consumer is a younger millennial with a college degree that lives in a college town with an income above $100,000 (£75,000). They are also often an Amazon shopper, a regular reader of online news and more likely to buy online than in-store.

There are three broad types of ecommerce subscriptions:

Replenishment subscriptions (32% of subscriptions) - which allow consumers to automate the purchase of commodity items, such as razors or diapers.

Curation subscriptions (55% of subscriptions) - that attempt to surprise and delight by providing new items or highly personalised experiences in categories such as apparel, beauty, and food.

Access subscriptions (13% of subscriptions) - pay a monthly fee to obtain lower prices or members-only perks, primarily in the apparel and food categories.

The future looks bright for the recurring revenue leaders.

More relevantly, subscription-based media is a major game-changer. With news media diving head-first into the digital world, ad revenues and circulation have been in decline, and an endless series of cost cutting and transformation plans has led to the industry stabilising around paid subscriptions. LettsGroup’s own The Letts Journal has been at the forefront of subscription-based systems, solely reliant on digital circulation with paywalled systems for revenue as an ad-free service. And, based on demographics alone, the internet paywall is becoming a key part of the future of profitable digital content circulation.

While newspaper staff numbers keep falling and print circulation declines, digital media is growing. Based on publicly traded companies, in 2020, ad revenue for digital newspapers stood at 39%. Digital newspapers share of ad revenue has been steadily climbing, as in 2011 it had accounted for just 17% of ad dollars. The trends are similar across the western world. Digital, subscription-based media is here to stay.

The increasingly dominant subscription economy will get tested as we have headed into its first major economic downturn. The effects could be hard to predict, but while the upward trajectory is bound to continue, the likelihood is that short term pressures will dampen new sign ups. Ultimately the sector will probably consolidate around 2-3 leading players in each category. While this could be bad for consumers and content producers, there is an emerging category that could point to the future.

It seems that creators are taking the subscription economy into their own hands. A number of paywall based newsletter platforms have emerged for independent writers and media startups enabling them to charge subscriptions to niche audiences. Some, such as Bankless, have developed subscription audiences in the hundreds of thousands. LettsGroup’s website system for the art world, LettsArt, provides a subscription-based platform for the art world and is free for artists. Artists can easily buy and sell their pieces, in a way that fully enables them to take complete control of the process.

LettsGroup has also launched one of the first online eco-services platforms for the subscription economy called LettsSafari. Environmentally conscious subscribers pay so that trees get planted, wild animals released and new rewilding safari parks are created and supported.

Just as new platforms will drive the emerging creator economy, we can expect Web3, including crypto, NFT’s and the metaverse, to shape big media over the next decade alongside other key technology developments like AI - all of which are factors LettsGroup will account for in the development of incoming ventures. The drive to digital is likely to become pervasive and, if so, micro payments should finally take off. A few cents for a media snippet supported by ads could prove to be an attractive alternative to the limited number of subscriptions we might be willing to sustain.

This article was first published in the Letts Journal.

LettsGroup is a branded incubator group, which is active through @LettsGroup on twitter.

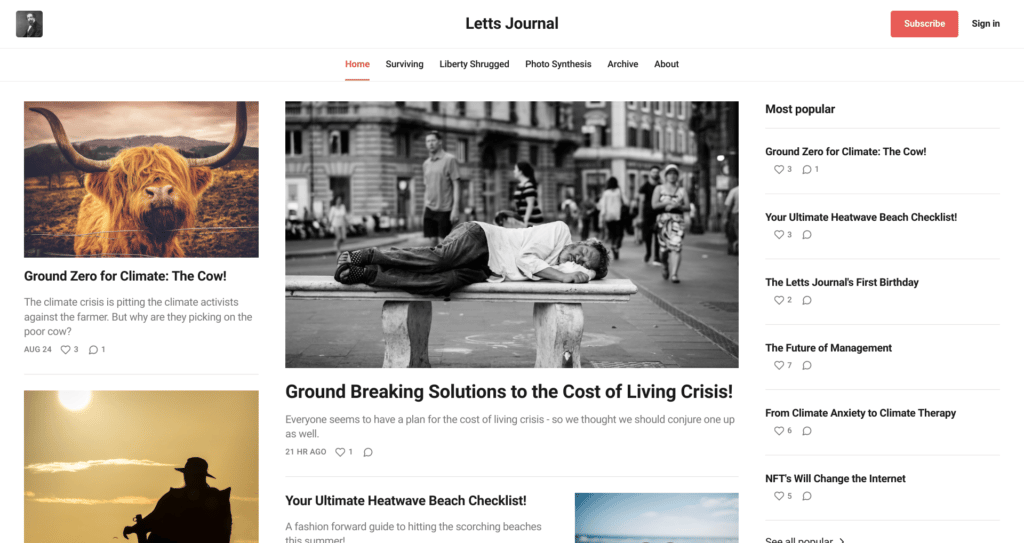

Letts Journal, created to deliver business media with a soul, is celebrating its first anniversary.

LettsGroup is excited to announce the anniversary of its business media venture, Letts Journal. A year ago today, Letts Journal was launched as a new style weekly publication that talks straight about business, climate, and life for progressive thinkers and innovative leaders. It is proud of its commitment to free media that is ad-free, clickbait free, and free to read.

Letts Journal has grown exponentially in the past twelve months, having developed a strong, supportive foundation of readers who have provided the venture with invaluable feedback and data. Some of the most well-loved features of Letts Journal include weekly updates straight to readers’ inboxes, along with the refreshing, insightful and humorous take on business news that makes the subject all-the-more engaging and accessible.

The media site’s three extra channels cover future trends, political satire, and photo-cartoons - putting the soul back into digital news. A year on, with the launch of its new website layout, the Letts Journal has stayed fresh and exciting. The new layout makes available handy digital tools - a hallmark of each LettsGroup venture.

True to the Letts Journal belief that information media should be accessible and attainable to all, the team have decided to keep all content free at all times - curbing the common monetary issues of paid digital subscription requirements that have been a well-cited downfall of multiple digital news and media sites. It's become especially relevant in the face of today's cost of living crisis.(Dare we say 'recession' …. Er, banana)

At Letts Journal, any paid subscriptions are voluntary to fulfill the LettsGroup values of access and sustainability. Voluntary subscriptions allow devoted readers to support Letts Journal’s expansion, but access to content remains untouched regardless of a paid or unpaid subscription. That is the Letts Journal promise.

This July, Letts Journal implemented other subscription options. Their standard free subscription is now supplemented with a voluntary monthly or annual subscription at just £3.50/pcm or £35 annually - completely at the subscriber’s discretion. Alternatively, one can gift or donate a subscription. But the standard is set and will remain that all content is free and accessible to paying and non-paying subscribers.

The Letts Journal further offers a Platinum membership for people or businesses that want more from the platform. Those supporters can get featured as a sponsor, and receive invitations to exclusive LettsGroup events.

Growth at Letts Journal is completely determined by its growth in subscribers - whether they are paying or non-paying, meaning that reading and sharing Letts Journal commentaries is encouraged and indeed vital to this independent platform and its writers’ evolution.

Subscribe to Letts Journal to experience the platform’s news commentary today, along with weekly updates straight to your inbox. Letts Journal is a publication of the branded incubator group, LettsGroup, which is active through @LettsGroup on twitter.